Question: There can be more than 1 statement that is correct. A mutual fund manager is analyzing the performance of his/her portfolio (only one portfolio is

There can be more than 1 statement that is correct.

There can be more than 1 statement that is correct.

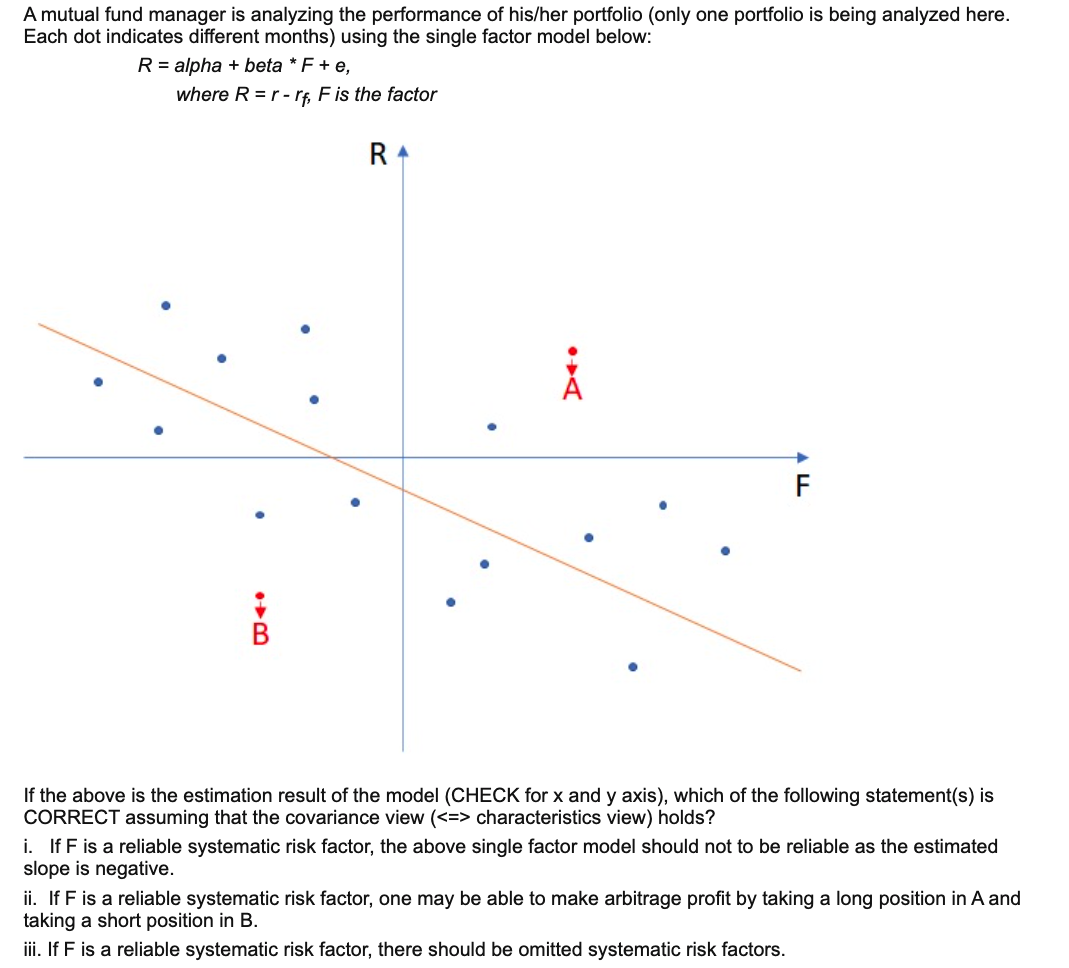

A mutual fund manager is analyzing the performance of his/her portfolio (only one portfolio is being analyzed here. Each dot indicates different months) using the single factor model below: R = alpha + beta * F + e, where R=r-rf, F is the factor RA i F i If the above is the estimation result of the model (CHECK for x and y axis), which of the following statement(s) is CORRECT assuming that the covariance view ( characteristics view) holds? i. If F is a reliable systematic risk factor, the above single factor model should not to be reliable as the estimated slope is negative. ii. If F is a reliable systematic risk factor, one may be able to make arbitrage profit by taking a long position in A and taking a short position in B. iii. If F is a reliable systematic risk factor, there should be omitted systematic risk factors. A mutual fund manager is analyzing the performance of his/her portfolio (only one portfolio is being analyzed here. Each dot indicates different months) using the single factor model below: R = alpha + beta * F + e, where R=r-rf, F is the factor RA i F i If the above is the estimation result of the model (CHECK for x and y axis), which of the following statement(s) is CORRECT assuming that the covariance view ( characteristics view) holds? i. If F is a reliable systematic risk factor, the above single factor model should not to be reliable as the estimated slope is negative. ii. If F is a reliable systematic risk factor, one may be able to make arbitrage profit by taking a long position in A and taking a short position in B. iii. If F is a reliable systematic risk factor, there should be omitted systematic risk factors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts