Question: there is 5 questions. help A company issues a 30-year zero-coupon bond. The bond matures for 1000 and has a price of 443. Determine the

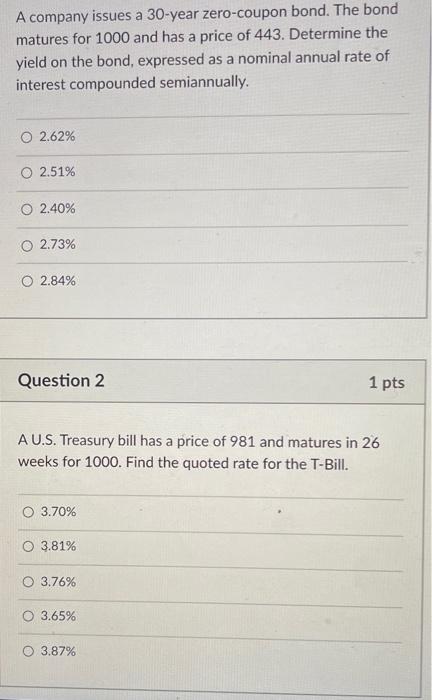

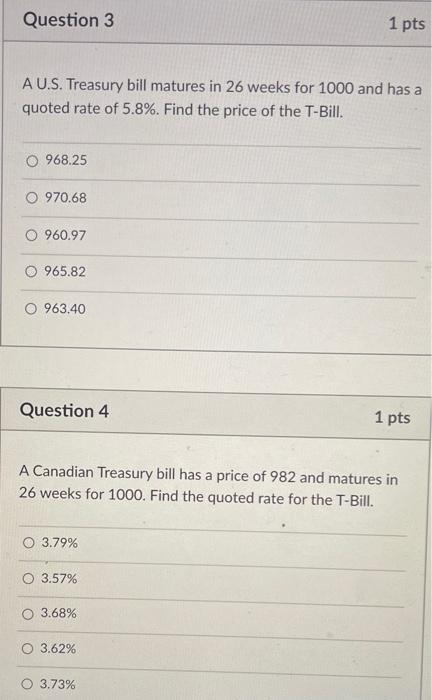

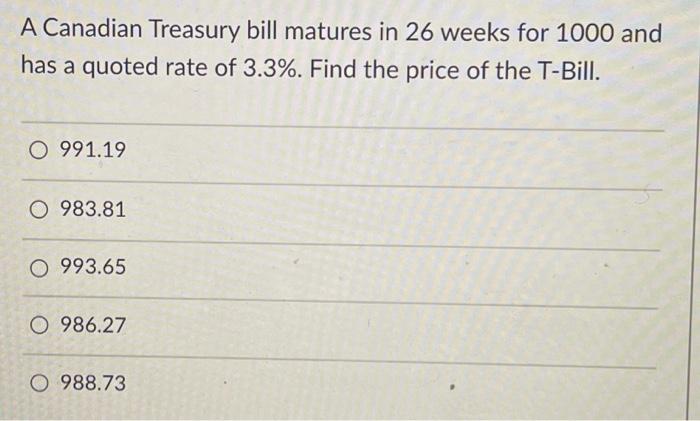

A company issues a 30-year zero-coupon bond. The bond matures for 1000 and has a price of 443. Determine the yield on the bond, expressed as a nominal annual rate of interest compounded semiannually. O 2.62% 0 2.51% O 2.40% O 2.73% O 2.84% Question 2 1 pts A U.S. Treasury bill has a price of 981 and matures in 26 weeks for 1000. Find the quoted rate for the T-Bill. 3.70% O 3.81% 3.76% 3.65% 3.87% Question 3 1 pts A U.S. Treasury bill matures in 26 weeks for 1000 and has a quoted rate of 5.8%. Find the price of the T-Bill. 968.25 O 970.68 0 960.97 965.82 O 963.40 Question 4 1 pts A Canadian Treasury bill has a price of 982 and matures in 26 weeks for 1000. Find the quoted rate for the T-Bill. 3.79% O 3.57% 3.68% O 3.62% 3.73% A Canadian Treasury bill matures in 26 weeks for 1000 and has a quoted rate of 3.3%. Find the price of the T-Bill. O 991.19 O 983.81 O 993.65 O 986.27 O 988.73

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts