Question: There is 7-3 & 7-4 information from my previous question. Firm value- note payable intrinsic common equity value $693,420-$100,000 = $593,420 or value available for

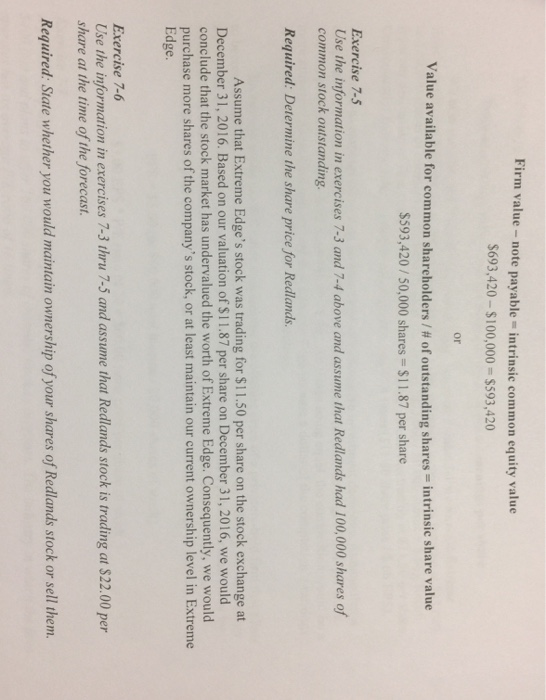

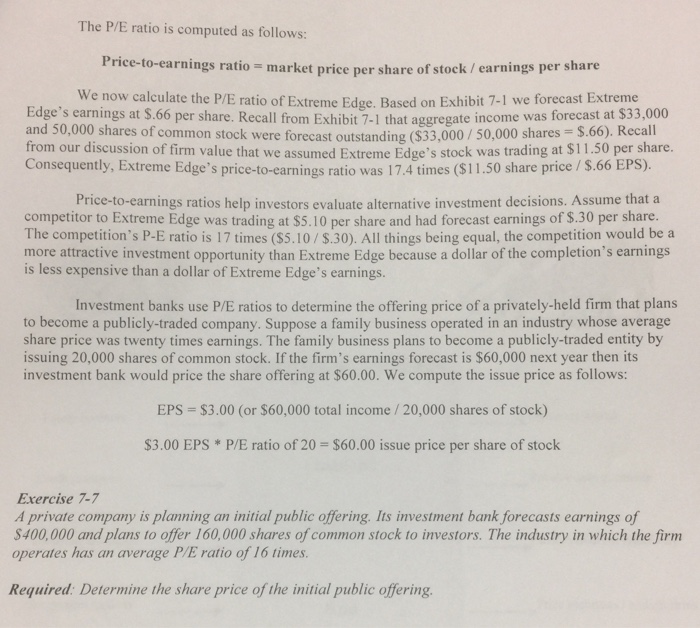

Firm value- note payable intrinsic common equity value $693,420-$100,000 = $593,420 or value available for common shareholders / # of outstanding shares intrinsic share value $593,420/50,000 shares $11.87 per share Exercise 7-5 Use the information in exercises 7-3 and 7-4 above and assume that Redlands had 100,000 shares of common stock outstanding. Required: Determine the share price for Redlands. Assume that Extreme Edge's stock was trading for $11.50 per share on the stock exchange at December 31, 2016. Based on our valuation of $11.87 per share on December 31, 2016, we would conclude that the stock market has undervalued the worth of Extreme Edge. Consequently, we would purchase more shares of the company's stock, or at least maintain our current ownership level in Extreme Edge Exercise 7- Use the information in exercises 7-3 thru 7-5 and assume that Redlands stock is trading at $22.00 per share at the time of the forecast Required: State whether you would maintain ownership of your shares of Redlands stock or sell them. The P/E ratio is computed as follows: Price-to-earnings ratio narket price per share of stock / earnings per share We now calculate the P/E ratio of Extreme Edge. Based on Exhibit 7-1 we forecast Extreme Edge's earnings at $.66 per share. Recall from Exhibit 7-1 that aggregate income was forecast at $33,000 nd 50,000 shares of common stock were forecast outstanding ($33,000/50,000 shares $.66). Recall from our discussion of firm value that we assumed Extreme Edge's stock was trading at $11.50 per share Consequently, Extreme Edge's price-to-earnings ratio was l 7.4 times ($11.50 share price/$.66 EPS) Price-to-earnings ratios help investors evaluate alternative investment decisions. Assume that a competitor to Extreme Edge was trading at $5.10 per share and had forecast earnings of $.30 per share The competition's P-E ratio is 17 times (S5.10/ S.30). All things being equal, the competition would be a more attractive investment opportunity than Extreme Edge because a dollar of the completion's earnings is less expensive than a dollar of Extreme Edge's earnings. Investment banks use P/E ratios to determine the offering price of a privately-held firm that plans to become a publicly-traded company. Suppose a family business operated in an industry whose average share price was twenty times earnings. The family business plans to become a publicly-traded entity by issuing 20,000 shares of common stock. If the firm's earnings forecast is $60,000 next year then its investment bank would price the share offering at $60.00. We compute the issue price as follows: EPS $3.00 (or $60,000 total income/20,000 shares of stock) $3.00 EPS * P/E ratio of 20 $60.00 issue price per share of stock Exercise 7-7 A private company is planning an initial public offering. Its investment bank forecasts earnings S400,000 and plans to offer 160,000 shares of common stock to investors. The industry in which the firm operates has an average P/E ratio of 16 times Required: Determine the share price of the initial public offering

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts