Question: There is a packaging operator that works 39 hours in a week. His salary is $14.74 per hour with a fringe benefit of 20%. During

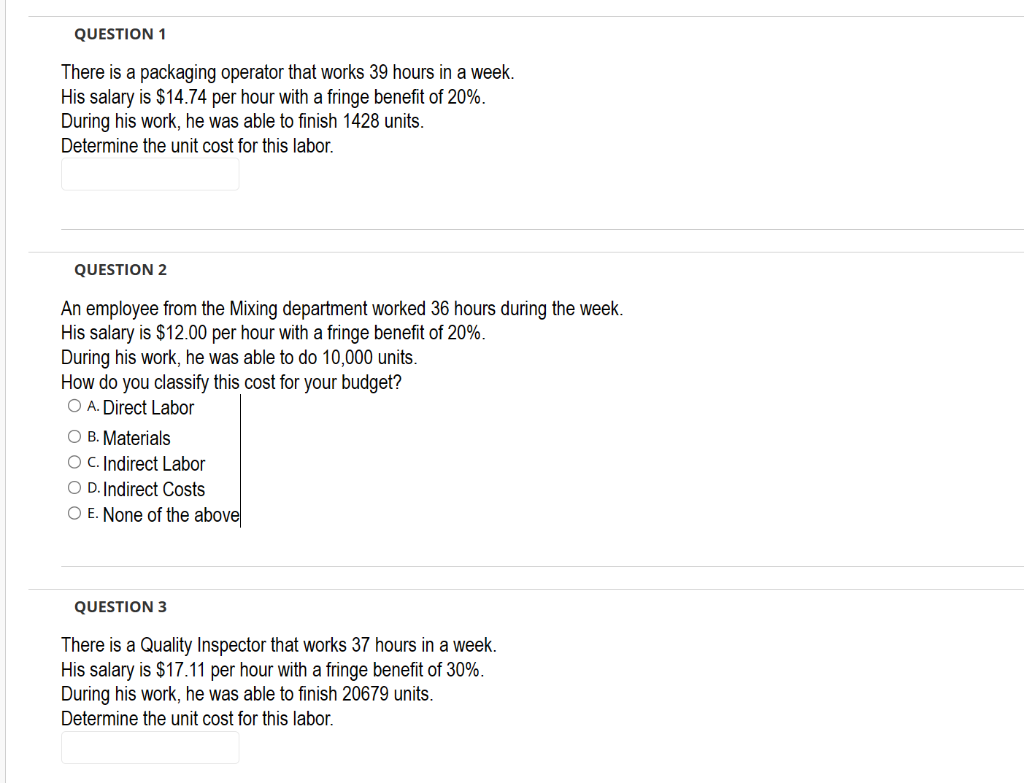

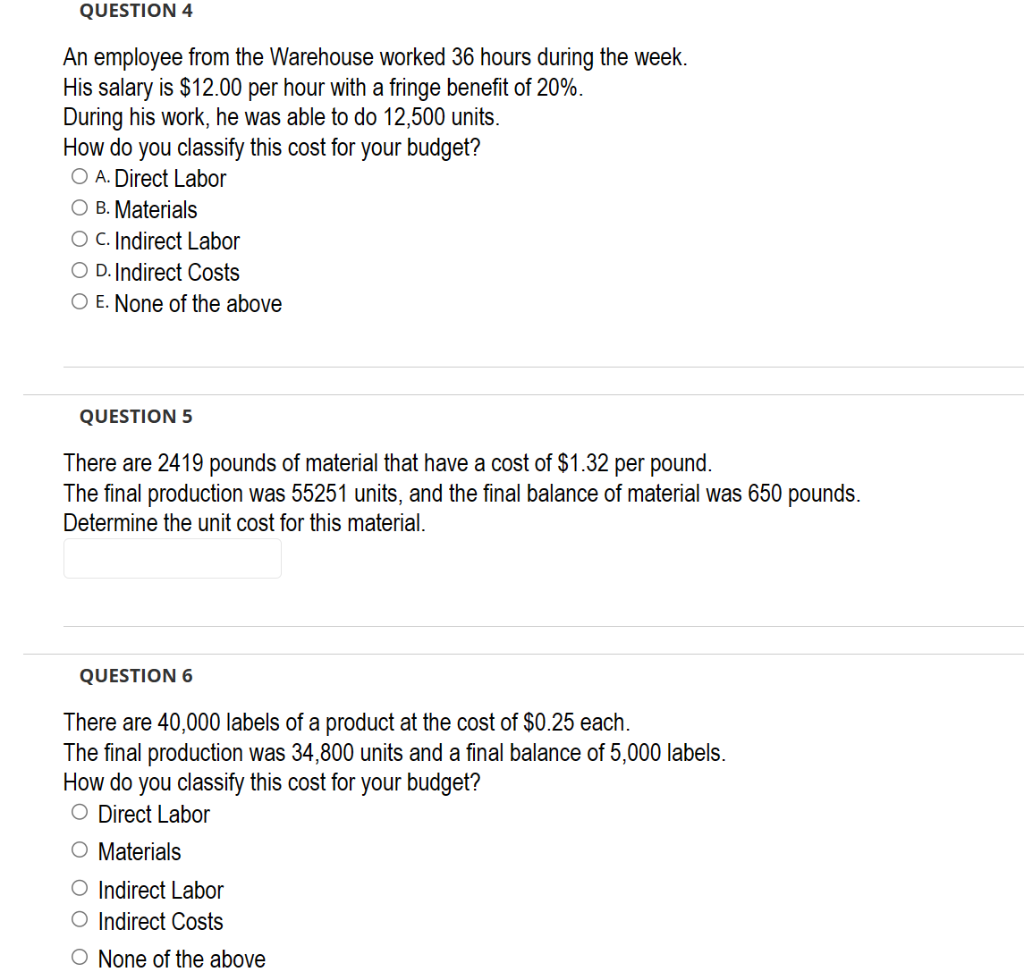

There is a packaging operator that works 39 hours in a week. His salary is $14.74 per hour with a fringe benefit of 20%. During his work, he was able to finish 1428 units. Determine the unit cost for this labor. QUESTION 2 An employee from the Mixing department worked 36 hours during the week. His salary is $12.00 per hour with a fringe benefit of 20%. During his work, he was able to do 10,000 units. How do you classify this cost for your budget? A. Direct Labor B. Materials C. Indirect Labor D. Indirect Costs E. None of the above QUESTION 3 There is a Quality Inspector that works 37 hours in a week. His salary is $17.11 per hour with a fringe benefit of 30%. During his work, he was able to finish 20679 units. Determine the unit cost for this labor. An employee from the Warehouse worked 36 hours during the week. His salary is $12.00 per hour with a fringe benefit of 20%. During his work, he was able to do 12,500 units. How do you classify this cost for your budget? A. Direct Labor B. Materials C. Indirect Labor D. Indirect Costs E. None of the above QUESTION 5 There are 2419 pounds of material that have a cost of $1.32 per pound. The final production was 55251 units, and the final balance of material was 650 pounds. Determine the unit cost for this material. QUESTION 6 There are 40,000 labels of a product at the cost of $0.25 each. The final production was 34,800 units and a final balance of 5,000 labels. How do you classify this cost for your budget? Direct Labor Materials Indirect Labor Indirect Costs None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts