Question: There is a proposal to do a project that will bring benefits equal to B = 30. The potential costs of the project are uncertain.

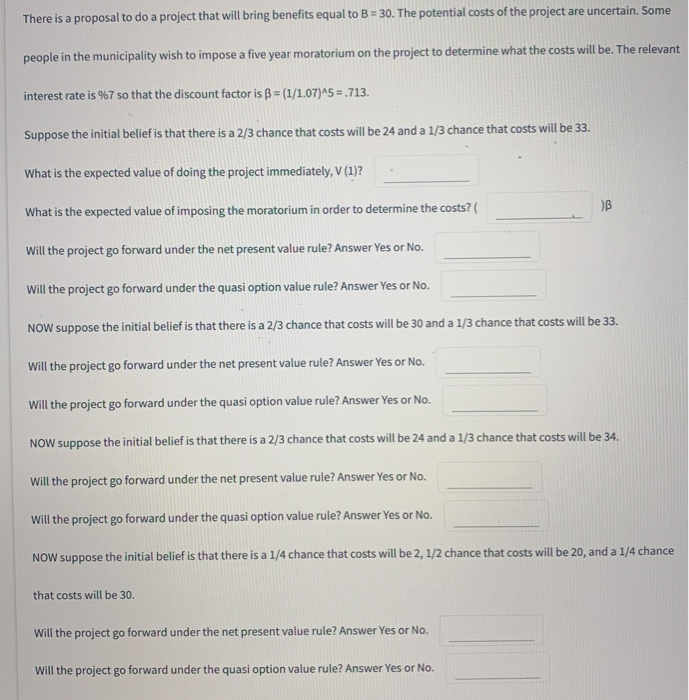

There is a proposal to do a project that will bring benefits equal to B = 30. The potential costs of the project are uncertain. Some people in the municipality wish to impose a five year moratorium on the project to determine what the costs will be. The relevant interest rate is %7 so that the discount factor is B = (1/1.07)^5 = 713. Suppose the initial belief is that there is a 2/3 chance that costs will be 24 and a 1/3 chance that costs will be 33. What is the expected value of doing the project immediately, V (1)? What is the expected value of imposing the moratorium in order to determine the costs?( Will the project go forward under the net present value rule? Answer Yes or No. Will the project go forward under the quasi option value rule? Answer Yes or No. NOW suppose the initial belief is that there is a 2/3 chance that costs will be 30 and a 1/3 chance that costs will be 33. Will the project go forward under the net present value rule? Answer Yes or No. Will the project go forward under the quasi option value rule? Answer Yes or No. NOW suppose the initial belief is that there is a 2/3 chance that costs will be 24 and a 1/3 chance that costs will be 34. Will the project go forward under the net present value rule? Answer Yes or No. Will the project go forward under the quasi option value rule? Answer Yes or No. NOW suppose the initial belief is that there is a 1/4 chance that costs will be 2, 1/2 chance that costs will be 20, and a 1/4 chance that costs will be 30. Will the project go forward under the net present value rule? Answer Yes or No. Will the project go forward under the quasi option value rule? Answer Yes or No. There is a proposal to do a project that will bring benefits equal to B = 30. The potential costs of the project are uncertain. Some people in the municipality wish to impose a five year moratorium on the project to determine what the costs will be. The relevant interest rate is %7 so that the discount factor is B = (1/1.07)^5 = 713. Suppose the initial belief is that there is a 2/3 chance that costs will be 24 and a 1/3 chance that costs will be 33. What is the expected value of doing the project immediately, V (1)? What is the expected value of imposing the moratorium in order to determine the costs?( Will the project go forward under the net present value rule? Answer Yes or No. Will the project go forward under the quasi option value rule? Answer Yes or No. NOW suppose the initial belief is that there is a 2/3 chance that costs will be 30 and a 1/3 chance that costs will be 33. Will the project go forward under the net present value rule? Answer Yes or No. Will the project go forward under the quasi option value rule? Answer Yes or No. NOW suppose the initial belief is that there is a 2/3 chance that costs will be 24 and a 1/3 chance that costs will be 34. Will the project go forward under the net present value rule? Answer Yes or No. Will the project go forward under the quasi option value rule? Answer Yes or No. NOW suppose the initial belief is that there is a 1/4 chance that costs will be 2, 1/2 chance that costs will be 20, and a 1/4 chance that costs will be 30. Will the project go forward under the net present value rule? Answer Yes or No. Will the project go forward under the quasi option value rule? Answer Yes or No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts