Question: There is a relationship between question 4 and 5. Please solve it all. Thank you. Q.4) Construct a three-step Binomial Tree Model for stock with

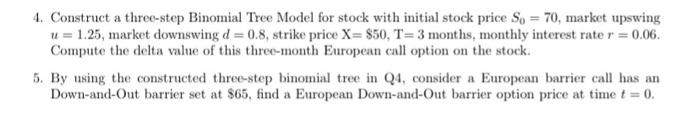

4. Construct a three-step Binomial Tree Model for stock with initial stock price S0=70, market upswing u=1.25, market downswing d=0.8, strike price X=$50,T=3 months, monthly interest rate r=0.06. Compute the delta value of this three-month European call option on the stock. 5. By using the constructed three-step binomial tree in Q4, consider a European barrier call has an Down-and-Out barrier set at $65, find a European Down-and-Out barrier option price at time t=0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts