Question: there is a solution on chegg which is wrong, please give a proper answer 3. Suppose that you form a portfolio by investing $1000 in

there is a solution on chegg which is wrong, please give a proper answer

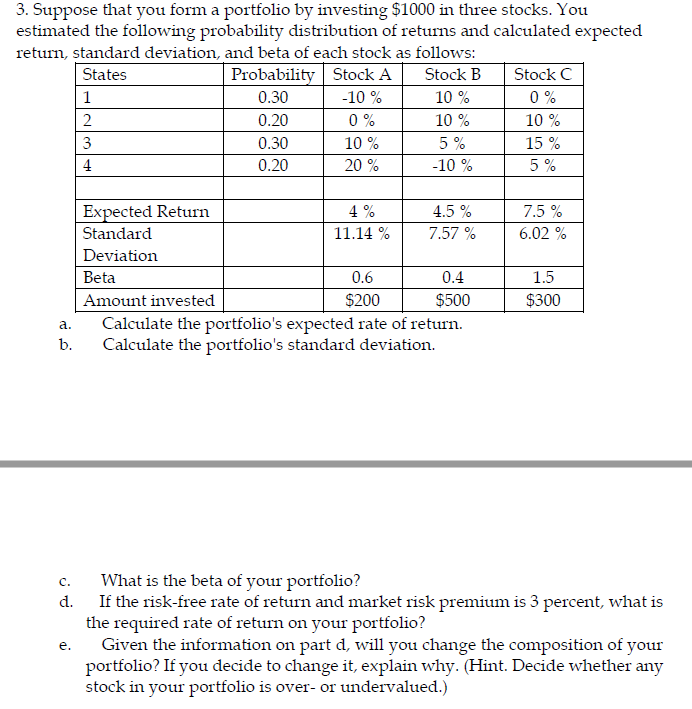

3. Suppose that you form a portfolio by investing $1000 in three stocks. You estimated the following probability distribution of returns and calculated expected return, standard deviation, and beta of each stock as follows: States Probability Stock A Stock B Stock C 1 0.30 -10% 10 % 0 % 2 0.20 0 % 10 % 10 % 3 0.30 10% 5% 15 % 4 0.20 20% -10% 5 % 7.5 % 6.02 % Expected Return 4 % 4.5 % Standard 11.14 % 7.57% Deviation 0.6 0.4 Amount invested $200 $500 Calculate the portfolio's expected rate of return. Calculate the portfolio's standard deviation. Beta 1.5 $300 a. b. What is the beta of your portfolio? d. If the risk-free rate of return and market risk premium is 3 percent, what is the required rate of return on your portfolio? e. Given the information on part d, will you change the composition of your portfolio? If you decide to change it, explain why. (Hint. Decide whether any stock in your portfolio is over- or undervalued.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts