Question: There is no additional info for the question PROBLEM 1. In anticipation of the new oPhone and Astronote, you decide to invest some of your

There is no additional info for the question

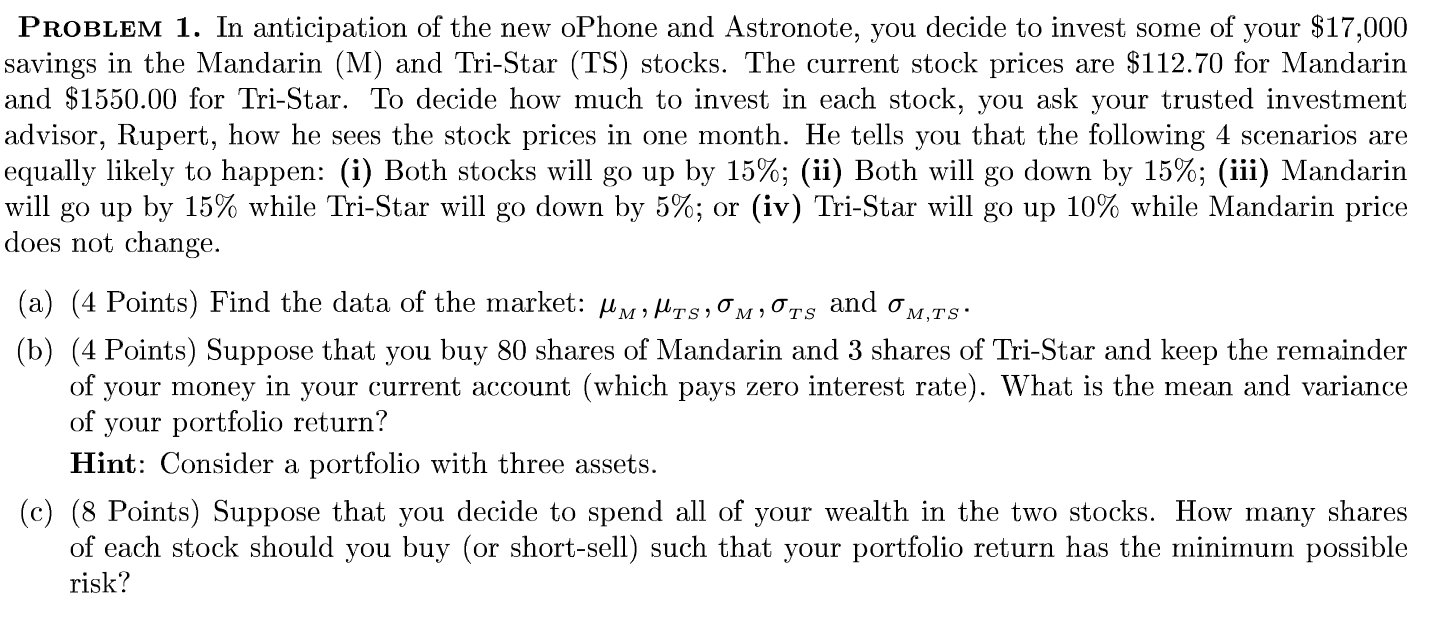

PROBLEM 1. In anticipation of the new oPhone and Astronote, you decide to invest some of your $17,000 savings in the Mandarin (M) and Tri-Star (TS) stocks. The current stock prices are $112.70 for Mandarin and $1550.00 for Tri-Star. To decide how much to invest in each stock, you ask your trusted investment advisor, Rupert, how he sees the stock prices in one month. He tells you that the following 4 scenarios are equally likely to happen: (i) Both stocks will go up by 15%; (ii) Both will go down by 15%; (iii) Mandarin will go up by 15% while Tri-Star will go down by 5%; or (iv) Tri-Star will go up 10% while Mandarin price does not change. (a) (4 Points) Find the data of the market: Ml mo fets (b) (4 Points) Suppose that you buy 80 shares of Mandarin and 3 shares of Tri-Star and keep the remainder of your money in your current account (which pays zero interest rate). What is the mean and variance of your portfolio return? Hint: Consider a portfolio with three assets. (c) (8 Points) Suppose that you decide to spend all of your wealth in the two stocks. How many shares of each stock should you buy (or short-sell) such that your portfolio return has the minimum possible risk? 0 and om,ts: M OTS PROBLEM 1. In anticipation of the new oPhone and Astronote, you decide to invest some of your $17,000 savings in the Mandarin (M) and Tri-Star (TS) stocks. The current stock prices are $112.70 for Mandarin and $1550.00 for Tri-Star. To decide how much to invest in each stock, you ask your trusted investment advisor, Rupert, how he sees the stock prices in one month. He tells you that the following 4 scenarios are equally likely to happen: (i) Both stocks will go up by 15%; (ii) Both will go down by 15%; (iii) Mandarin will go up by 15% while Tri-Star will go down by 5%; or (iv) Tri-Star will go up 10% while Mandarin price does not change. (a) (4 Points) Find the data of the market: Ml mo fets (b) (4 Points) Suppose that you buy 80 shares of Mandarin and 3 shares of Tri-Star and keep the remainder of your money in your current account (which pays zero interest rate). What is the mean and variance of your portfolio return? Hint: Consider a portfolio with three assets. (c) (8 Points) Suppose that you decide to spend all of your wealth in the two stocks. How many shares of each stock should you buy (or short-sell) such that your portfolio return has the minimum possible risk? 0 and om,ts: M OTS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts