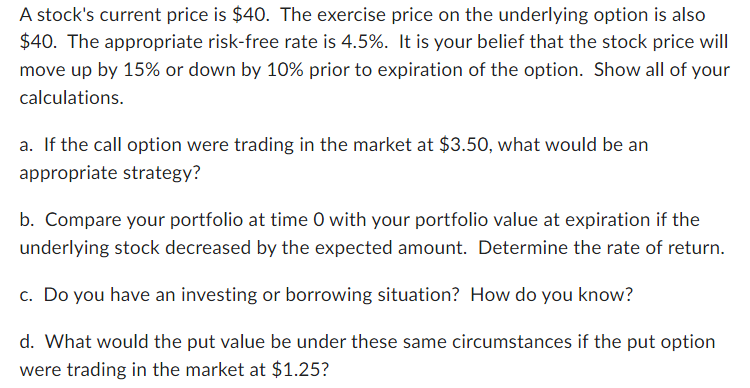

Question: There is no additional info provided. A stock's current price is $ 4 0 . The exercise price on the underlying option is also $

There is no additional info provided. A stock's current price is $ The exercise price on the underlying option is also

$ The appropriate riskfree rate is It is your belief that the stock price will

move up by or down by prior to expiration of the option. Show all of your

calculations.

a If the call option were trading in the market at $ what would be an

appropriate strategy?

b Compare your portfolio at time with your portfolio value at expiration if the

underlying stock decreased by the expected amount. Determine the rate of return.

c Do you have an investing or borrowing situation? How do you know?

d What would the put value be under these same circumstances if the put option

were trading in the market at $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock