Question: there is no additional information for this question. just check the picture that I attached 19 Cash operating cycle Question Kaplan The following financial information

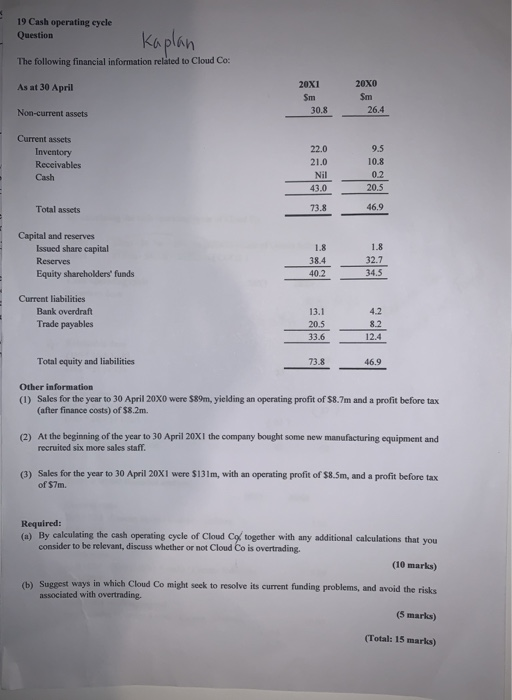

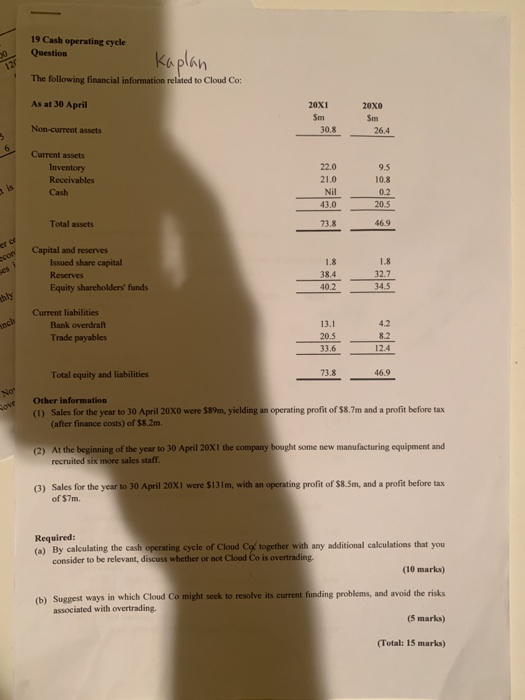

19 Cash operating cycle Question Kaplan The following financial information related to Cloud Co: As at 30 April 20X1 Sm 30.8 20x0 Sm 26.4 Non-current assets Current assets Inventory Receivables Cash 22.0 21.0 Nil 43.0 9.5 10.8 0.2 20.5 Total assets 73.8 46.9 Capital and reserves Issued share capital Reserves Equity shareholders' funds 1.8 38.4 40.2 1.8 32.7 34.5 Current liabilities Bank overdraft Trade payables 13.1 20.5 33.6 4.2 8.2 12.4 Total equity and liabilities 73.8 46.9 Other information (1) Sales for the year to 30 April 20X0 were $89m, yielding an operating profit of $8.7m and a profit before tax (after finance costs) of $8.2m. (2) At the beginning of the year to 30 April 20X I the company bought some new manufacturing equipment and recruited six more sales staff. (3) Sales for the year to 30 April 20X1 were $131m, with an operating profit of $8.5m, and a profit before tax of S7m. Required: (a) By calculating the cash operating cycle of Cloud Cytogether with any additional calculations that you consider to be relevant, discuss whether or not Cloud Co is overtrading. (10 marks) (b) Suggest ways in which Cloud Co might seek to resolve its current funding problems, and avoid the risks associated with overtreding. (5 marks) (Total: 15 marks) 19 Cash operating cycle Question 00 128 Kaplan The following financial information related to Cloud Co: As at 30 April 20x0 20x1 Sm 30.8 Non-current assets 26.4 6 Current assets Inventory Receivables Cash 22.0 21.0 Nil 9.5 10.8 0.2 20.5 43.0 Total assets 73.8 46.9 er of con Capital and reserves Issued share capital Reserves Equity shareholders' funds 1.8 38.4 40.2 1.8 32.7 34.5 thly anch Current liabilities Bank overdraft Trade payables 13.1 20.5 33.6 8.2 12.4 Total equity and liabilities 73.8 46.9 No Cove Other information (1) Sales for the year to 30 April 20X0 were $89m, yielding an operating profit of $8.7m and a profit before tax (after finance costs) of 58.2m. (2) At the beginning of the year to 30 April 20XI the company bought some new manufacturing equipment and recruited six more sales staff (3) Sales for the year to 30 April 20x1 were $131m, with an operating profit of $8.5m, and a profit before tax of $7m. Required: (a) By calculating the cash operating cycle of Cloud Co together with any additional calculations that you consider to be relevant, discuss whether or not Cloud Co is overtrading. (10 marks) (b) Suggest ways in which Cloud Co might seek to resolve its current funding problems, and avoid the risks associated with overtrading. (5 marks) (Total: 15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts