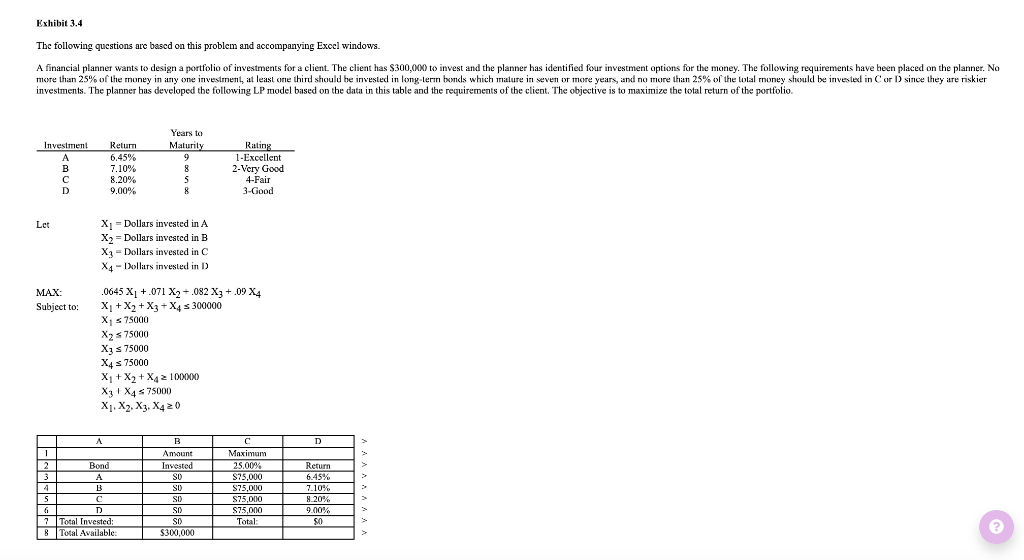

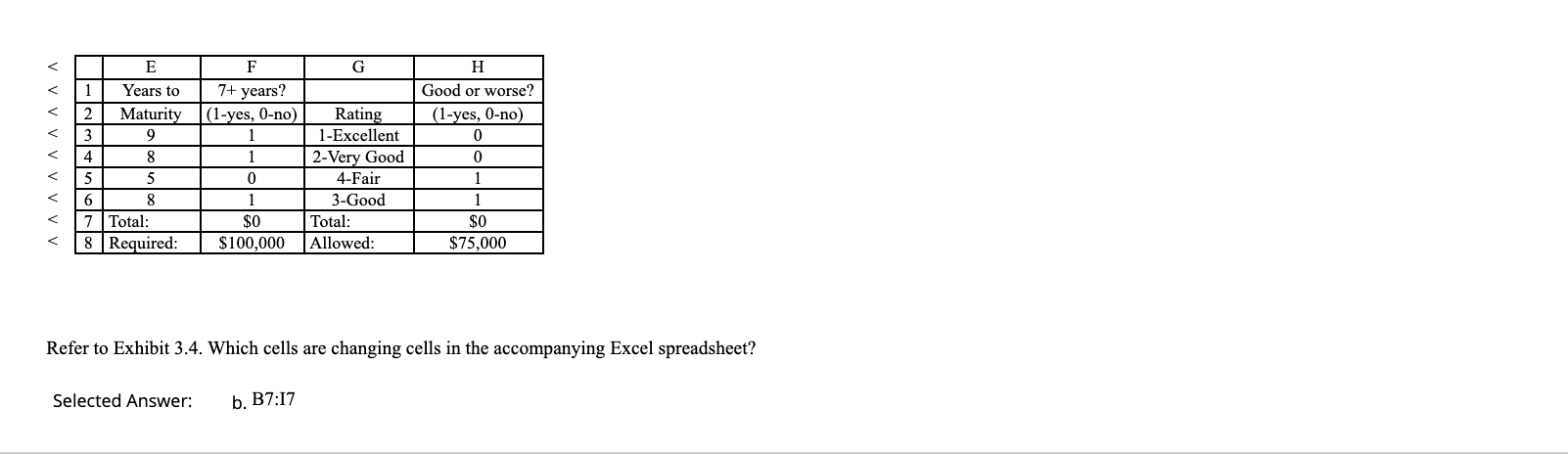

Question: THERE IS NO EXCEL SHEET OR ATTACHMENT PROVIDED FOR THIS QUESTION ALL OF THE INFORMATION IS GIVEN IS INCLUDED IN THE SCREENSHOT BELOW Exhibit 3.4

THERE IS NO EXCEL SHEET OR ATTACHMENT PROVIDED FOR THIS QUESTION

ALL OF THE INFORMATION IS GIVEN IS INCLUDED IN THE SCREENSHOT BELOW

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts