Question: there is no format for this question. We need to make it by ourselves PART 6: WORKSHEET 15 POINTS From the following data, make the

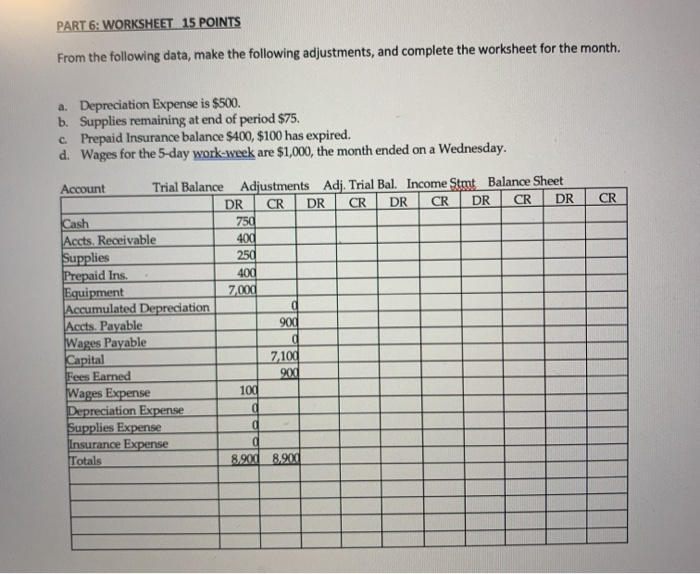

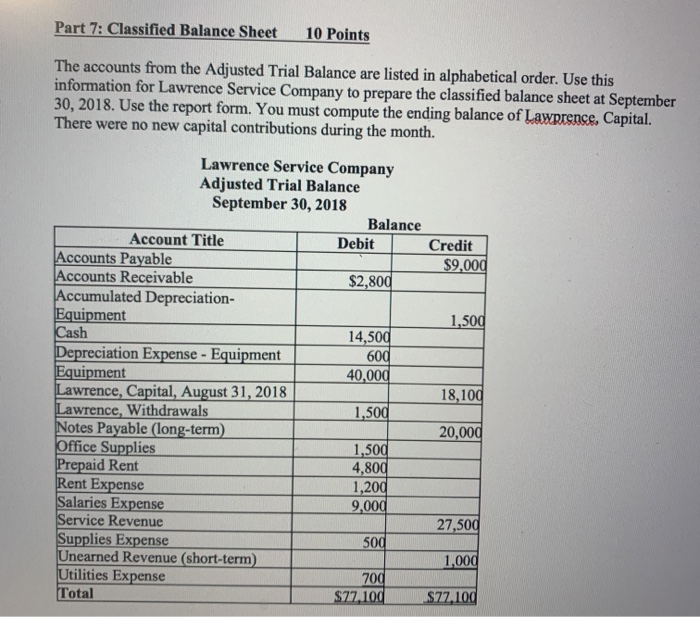

PART 6: WORKSHEET 15 POINTS From the following data, make the following adjustments, and complete the worksheet for the month. a. Depreciation Expense is $500. b. Supplies remaining at end of period $75. c. Prepaid Insurance balance $400, $100 has expired. d. Wages for the 5-day work-week are $1,000, the month ended on a Wednesday. CR Account Trial Balance Adjustments Adj. Trial Bal. Income Stmt Balance Sheet DR CR DR CR DR CR DR CR DR Cash 750 Accts, Receivable 400 Supplies 250 Prepaid Ins. 400 Equipment 7,000 Accumulated Depreciation d Accts. Payable 900 Wages Payable a Capital 7.100 Fees Earned 900 Wages Expense 100 Depreciation Expense Supplies Expense Insurance Expense Totals 8.900 8.900 Part 7: Classified Balance Sheet 10 Points The accounts from the Adjusted Trial Balance are listed in alphabetical order. Use this information for Lawrence Service Company to prepare the classified balance sheet at September 30, 2018. Use the report form. You must compute the ending balance of Lawrence, Capital. There were no new capital contributions during the month. Lawrence Service Company Adjusted Trial Balance September 30, 2018 Balance Account Title Debit Credit Accounts Payable $9,000 Accounts Receivable $2,800 Accumulated Depreciation- Equipment 1,500 Cash 14,500 Depreciation Expense - Equipment 600 Equipment 40,000 Lawrence, Capital, August 31, 2018 18,100 Lawrence, Withdrawals 1,500 Notes Payable (long-term 20,000 Office Supplies 1,500 Prepaid Rent 4,800 Rent Expense 1,200 Salaries Expense 9,000 Service Revenue 27,500 Supplies Expense 500 Unearned Revenue (short-term) 1,000 Utilities Expense 700 Total $77.100 S77.100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts