Question: there is no more additional info needed to solve this. If I have a 2xMoC/MoM and the deal is for 5 years, the IRR is

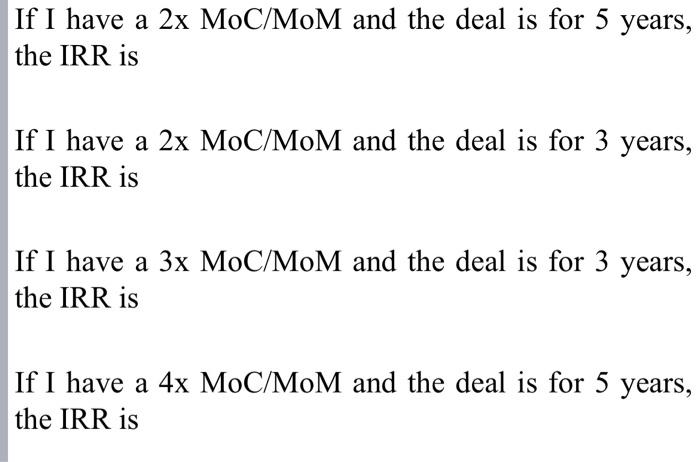

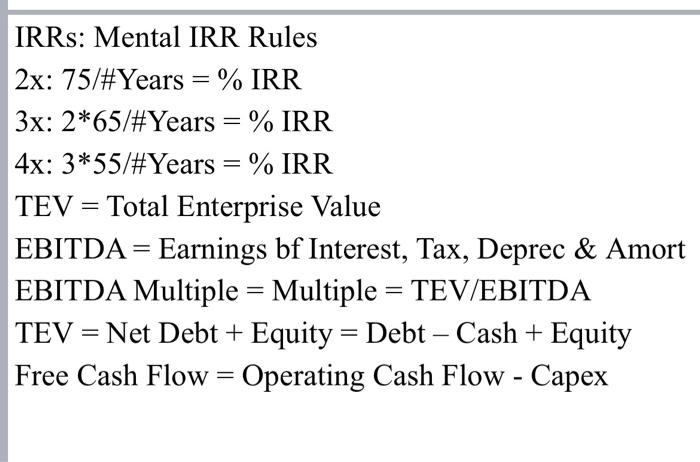

If I have a 2xMoC/MoM and the deal is for 5 years, the IRR is If I have a 2xMoC/MoM and the deal is for 3 years, the IRR is If I have a 3xMoC/MoM and the deal is for 3 years, the IRR is If I have a 4xMoC/MoM and the deal is for 5 years, the IRR is IRRs: Mental IRR Rules 2x: 75/\#Years =% IRR 3x:265/# Years =% IRR 4x:355 /\#Years =% IRR TEV= Total Enterprise Value EBITDA = Earnings bf Interest, Tax, Deprec \& Amort EBITDA Multiple = Multiple = TEV / EBITDA TEV= Net Debt + Equity = Debt - Cash + Equity Free Cash Flow = Operating Cash Flow - Capex IRRs: Mental IRR Rules 2x: 75/\#Years =% IRR 3x:265/# Years =% IRR 4x:355 /\#Years =% IRR TEV= Total Enterprise Value EBITDA = Earnings bf Interest, Tax, Deprec \& Amort EBITDA Multiple = Multiple = TEV / EBITDA TEV= Net Debt + Equity = Debt - Cash + Equity Free Cash Flow = Operating Cash Flow - Capex

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts