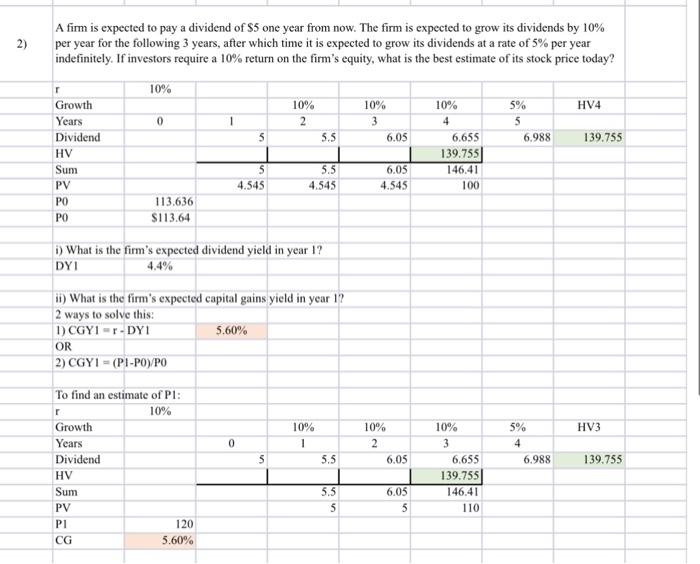

Question: There is no question in the picture, I will write it here. As you can see, the HV is in different years in this problem.

2) r A firm is expected to pay a dividend of $5 one year from now. The firm is expected to grow its dividends by 10% per year for the following 3 years, after which time it is expected to grow its dividends at a rate of 5% per year indefinitely. If investors require a 10% return on the firm's equity, what is the best estimate of its stock price today? 10% Growth 10% 10% 10% 5% HV4 Years 3 5 Dividend 5.5 6.05 6.655 6.988 139.755 HV 139.755 Sum 5 5.5 6.05 146.41 PV 4.545 4.545 4.545 PO 113.636 PO S113.64 0 2 4 5 100 ) What is the firm's expected dividend yield in year 1? DY 4.4% 1) What is the firm's expected capital gains yield in year 1? 2 ways to solve this: 1) CGYI-T-DY1 5.60% OR 2) CGYI = (P1-PO)/PO HV3 10% 1 0 10% 2 6.05 5% 4 6.988 5 5.5 139.755 To find an estimate of PI: r 10% Growth Years Dividend HV Sum PV PI 120 CG 5.60% 10% 3 6.655 139.7551 146.41 110 il ::: 5.5 5 6.05 5 2) r A firm is expected to pay a dividend of $5 one year from now. The firm is expected to grow its dividends by 10% per year for the following 3 years, after which time it is expected to grow its dividends at a rate of 5% per year indefinitely. If investors require a 10% return on the firm's equity, what is the best estimate of its stock price today? 10% Growth 10% 10% 10% 5% HV4 Years 3 5 Dividend 5.5 6.05 6.655 6.988 139.755 HV 139.755 Sum 5 5.5 6.05 146.41 PV 4.545 4.545 4.545 PO 113.636 PO S113.64 0 2 4 5 100 ) What is the firm's expected dividend yield in year 1? DY 4.4% 1) What is the firm's expected capital gains yield in year 1? 2 ways to solve this: 1) CGYI-T-DY1 5.60% OR 2) CGYI = (P1-PO)/PO HV3 10% 1 0 10% 2 6.05 5% 4 6.988 5 5.5 139.755 To find an estimate of PI: r 10% Growth Years Dividend HV Sum PV PI 120 CG 5.60% 10% 3 6.655 139.7551 146.41 110 il ::: 5.5 5 6.05 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts