Question: There is only 1 question. Using bank reconciliation to determine cash receipts stolen Alaska Impressions Co. records all cash receipts on the basis of its

There is only 1 question.

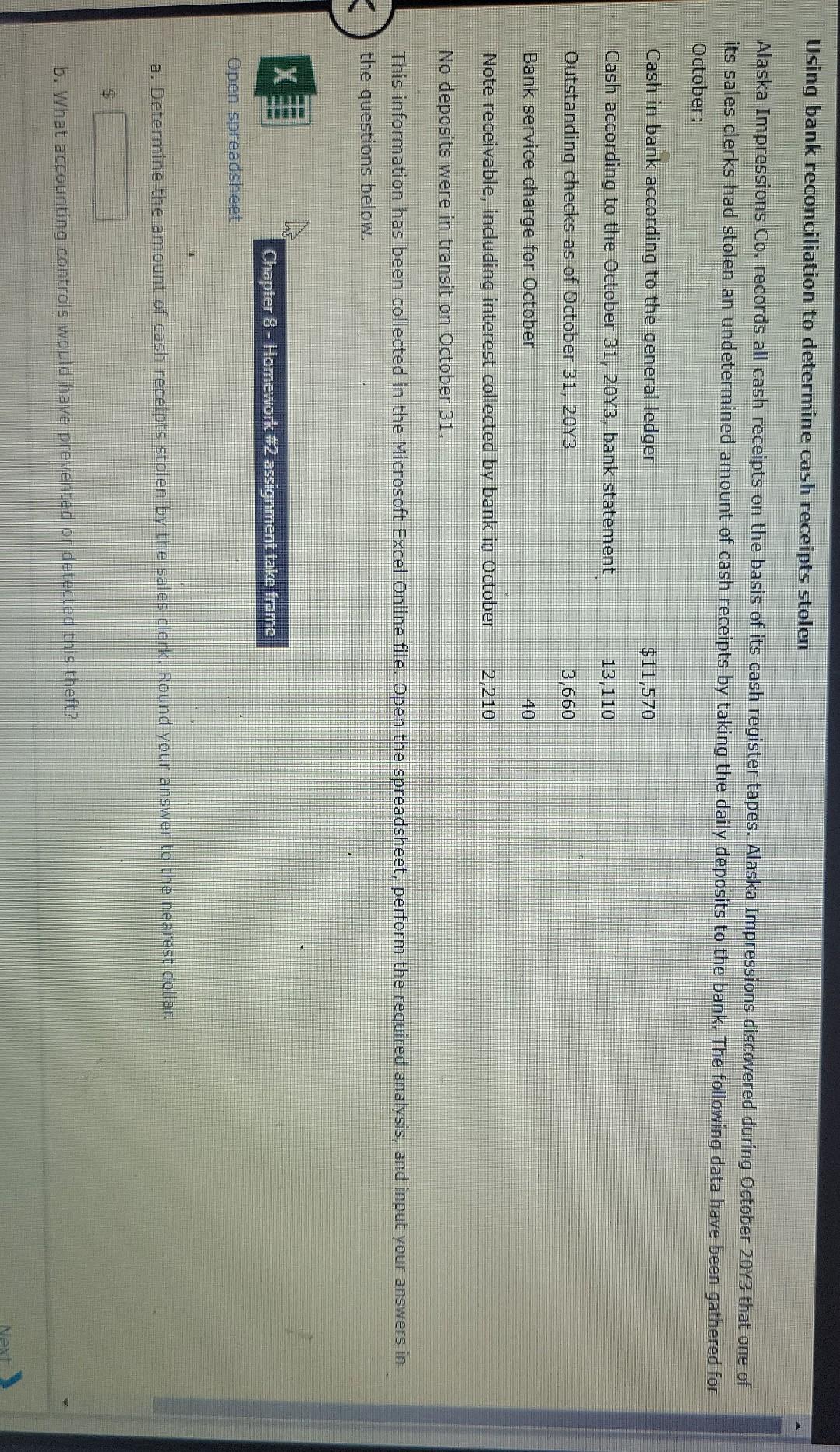

Using bank reconciliation to determine cash receipts stolen Alaska Impressions Co. records all cash receipts on the basis of its cash register tapes. Alaska Impressions discovered during October 2013 that one of its sales clerks had stolen an undetermined amount of cash receipts by taking the daily deposits to the bank. The following data have been gathered for October: Cash in bank according to the general ledger $11,570 Cash according to the October 31, 2043, bank statement 13,110 Outstanding checks as of October 31, 2073 3,660 Bank service charge for October 40 Note receivable, including interest collected by bank in October 2,210 No deposits were in transit on October 31. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. X Chapter 8 - Homework #2 assignment take frame Open spreadsheet a. Determine the amount of cash receipts stolen by the sales clerk. Round your answer to the nearest dollar. b. What accounting controls would have prevented or detected this theft? Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts