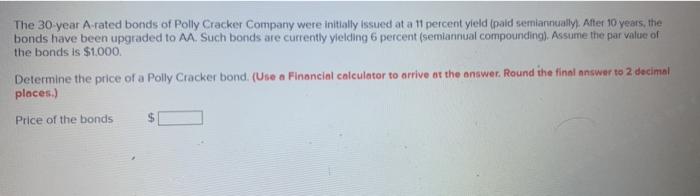

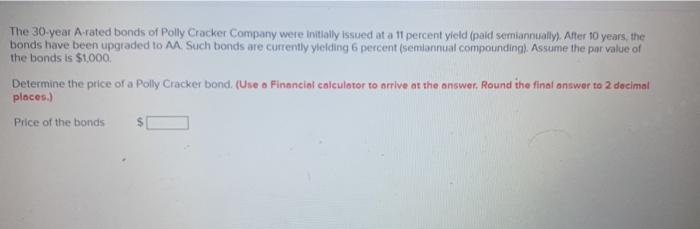

Question: there is only this statement The 30 year A-rated bonds of Polly Cracker Company were initially issued at a 11 percent yield (paid semiarmally. After

The 30 year A-rated bonds of Polly Cracker Company were initially issued at a 11 percent yield (paid semiarmally. After 10 years, the bonds have been upgraded to AA. Such bonds are currently yielding 6 percent (semiannual compounding). Assume the par value of the bonds is $1.000 Determine the price of a Polly Cracker bond. (Use a Financial calculator to arrive at the answer. Round ihe final answer to 2 decimal places.) Price of the bonds $1 The 30-year A-rated bonds of Polly Cracker Company were initially issued at a 11 percent yield (paid semiannually). After 10 years, the bonds have been upgraded to M Such bonds are currently yielding 6 percent (semiannual compounding). Assume the par value of the bonds is $1,000 Determine the price of a Polly Cracker bond. (Use a Financial calculator to arrive at the answer, Round the final answer to 2 decimal places.) Price of the bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts