Question: There is two parts for question 3 WileyPLUS Problem 10-3 In providing accounting services to small businesses, you encounter the following situations. . Grainger Corporation

There is two parts for question 3

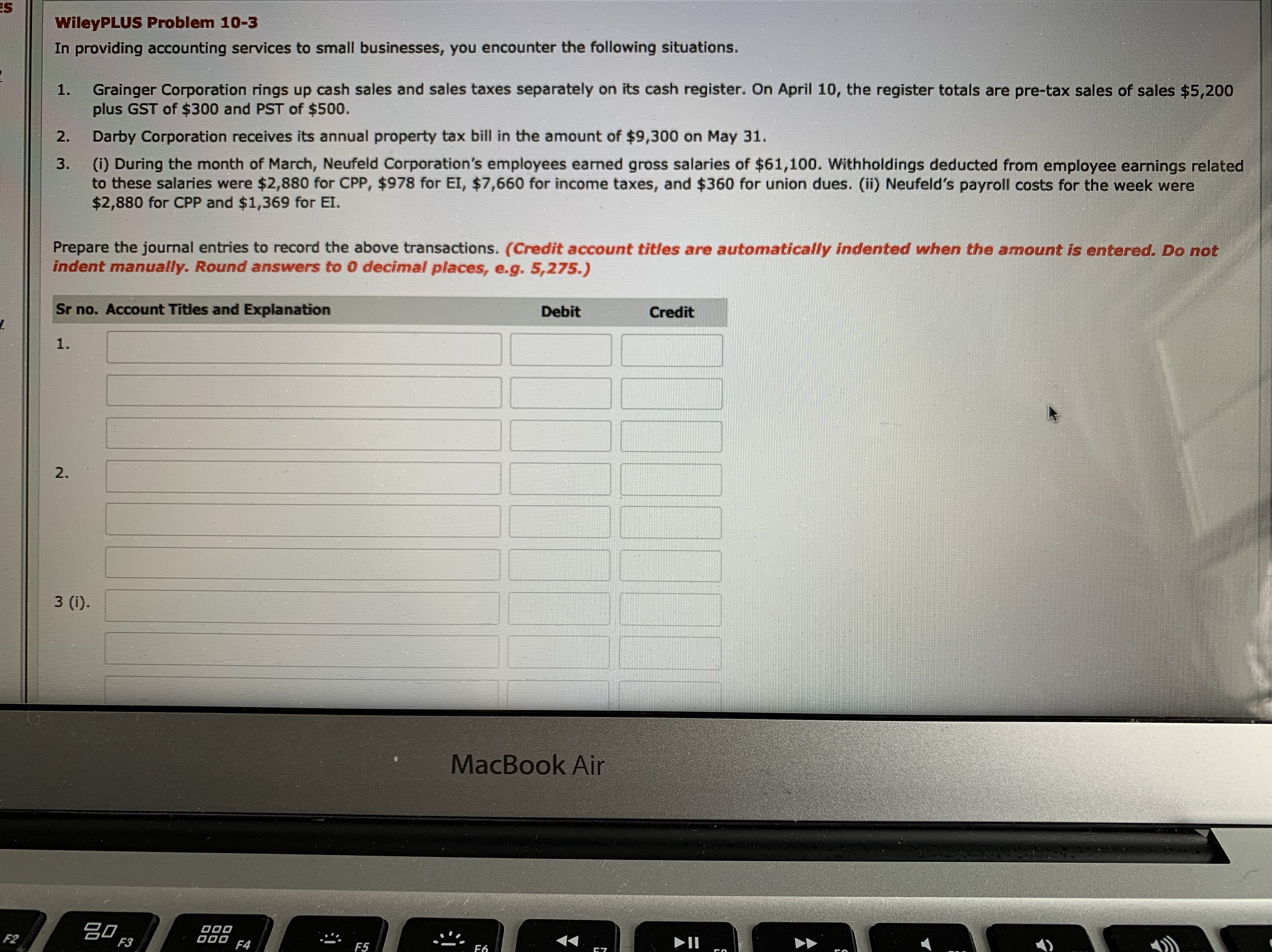

WileyPLUS Problem 10-3 In providing accounting services to small businesses, you encounter the following situations. . Grainger Corporation rings up cash sales and sales taxes separately on its cash register. On April 10, the register totals are pre-tax sales of sales $5,200 plus GST of $300 and PST of $500. 2. Darby Corporation receives its annual property tax bill in the amount of $9,300 on May 31. 3 . (i) During the month of March, Neufeld Corporation's employees earned gross salaries of $61,100. Withholdings deducted from employee earnings related to these salaries were $2,880 for CPP, $978 for EI, $7,660 for income taxes, and $360 for union dues. (ii) Neufeld's payroll costs for the week were $2,880 for CPP and $1,369 for EI. Prepare the journal entries to record the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 5,275.) Sr no. Account Titles and Explanation Debit Credit 1 2. 3 (i). MacBook Air F2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts