Question: There is wide market consensus that cap rates are expected to rise in the near future. Below are some expectations for cap rates, rental

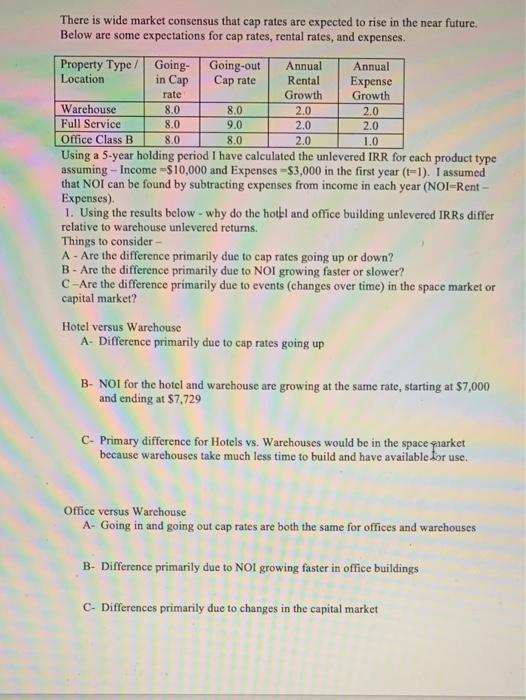

There is wide market consensus that cap rates are expected to rise in the near future. Below are some expectations for cap rates, rental rates, and expenses. Property Type/ Going- in Cap Going-out Cap rate Annual Annual Location Rental Growth Expense Growth rate Warehouse 8.0 8.0 2.0 2.0 2.0 Full Service Office Class B Using a 5-year holding period I have calculated the unlevered IRR for each product type assuming - Income -$10,000 and Expenses -$3,000 in the first year (t-1). I assumed that NOI can be found by subtracting expenses from income in each year (NOI-Rent - Expenses). 1. Using the results below - why do the hotel and office building unlevered IRRS differ relative to warehouse unlevered returns. 8.0 9.0 2.0 8.0 8.0 2.0 1.0 Things to consider- A - Are the difference primarily due to cap rates going up or down? B - Are the difference primarily due to NOI growing faster or slower? C-Are the difference primarily due to events (changes over time) in the space market or capital market? Hotel versus Warehouse A- Difference primarily due to cap rates going up B- NOI for the hotel and warehouse are growing at the same rate, starting at $7,000 and ending at $7,729 C- Primary difference for Hotels vs. Warehouses would be in the space qarket because warehouses take much less time to build and have available kor use. Office versus Warehouse A- Going in and going out cap rates are both the same for offices and warehouses B- Difference primarily due to NOI growing faster in office buildings C- Differences primarily due to changes in the capital market

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Answer i For Hotel verses Warehouse NOI increases at the same rate of 2 but the cap rate of Ho... View full answer

Get step-by-step solutions from verified subject matter experts