Question: there it is, sorry about that Dulari, a single, member of the military, was stationed at Camp Pendleton, California. On July 1, 2021, her army

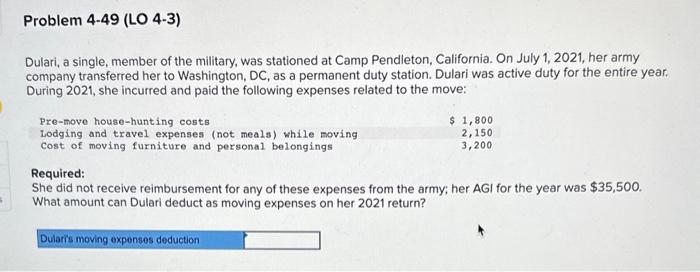

Dulari, a single, member of the military, was stationed at Camp Pendleton, California. On July 1, 2021, her army company transferred her to Washington, DC, as a permanent duty station. Dulari was active duty for the entire year. During 2021, she incurred and paid the following expenses related to the move: Pre-move house-hunting costs Lodging and travel expenses (not meals) while moving Cost of moving furniture and personal belongings Required: She did not receive reimbursement for any of these expenses from the army; her AGI for the year was $35,500. What amount can Dulari deduct as moving expenses on her 2021 return? Dulari, a single, member of the military, was stationed at Camp Pendleton, California. On July 1, 2021, her army company transferred her to Washington, DC, as a permanent duty station. Dulari was active duty for the entire year. During 2021, she incurred and paid the following expenses related to the move: Required: She did not receive reimbursement for any of these expenses from the army; her AGI for the year was $35,500. What amount can Dulari deduct as moving expenses on her 2021 return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts