Question: there numbered to create structure but all are one big question so please answer all. 1. Assume that you can either invest all of your

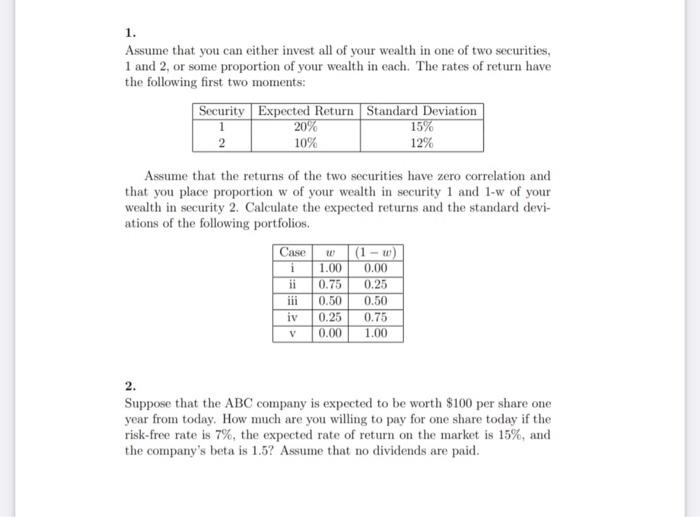

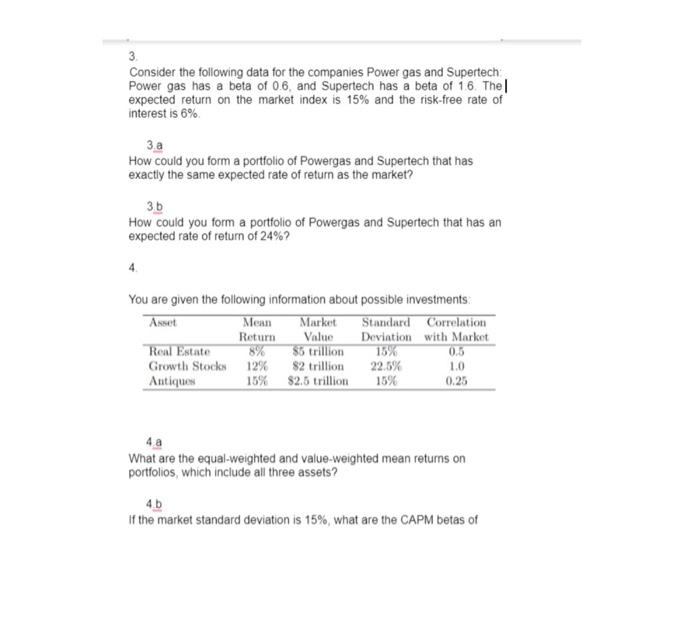

1. Assume that you can either invest all of your wealth in one of two securities, 1 and 2 or some proportion of your wealth in each. The rates of return have the following first two moments: Security Expected Return Standard Deviation 20% 15% 2 10% 12% Assume that the returns of the two securities have zero correlation and that you place proportion w of your wealth in security 1 and 1-w of your wealth in security 2. Calculate the expected returns and the standard devi- ations of the following portfolios. Case (1 - ) 1.00 0.00 ii 0.75 0.25 iii 0.50 0.50 0.25 0.75 0.00 1.00 10 i iv V 2. Suppose that the ABC company is expected to be worth $100 per share one year from today. How much are you willing to pay for one share today if the risk-free rate is 7%, the expected rate of return on the market is 15%, and the company's beta is 1.52 Assume that no dividends are paid. 3 Consider the following data for the companies Power gas and Supertech Power gas has a beta of 0.6, and Supertech has a beta of 16. The expected return on the market index is 15% and the risk-free rate of interest is 6% 3. a How could you form a portfolio of Powergas and Supertech that has exactly the same expected rate of return as the market? 3.b How could you form a portfolio of Powergas and Supertech that has an expected rate of return of 24%? You are given the following information about possible investments Asset Mean Market Standard Correlation Return Value Deviation with Market Real Estate $5 trillion 15% Growth Stock 12% 82 trillion Antiques 15% $2.5 trillion 15% 0.25 0.5 22.6% 10 4 a What are the equal-weighted and value-weighted mean returns on portfolios, which include all three assets? 4b if the market standard deviation is 15%, what are the CAPM betas of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts