Question: There's a mistake in Example 9.2 that needs to be corrected. We can agree with the example all the way until the last sentence of

There's a mistake in Example 9.2 that needs to be corrected. We can agree with the example all the way until the last sentence of "Step 3." 7.44%, sure, is the ongoing cost of the preferred stock, as mentioned in Step 2. But it's not also the cost of selling the preferred stock as implied by the final sentence. If you had to pay $1.375 in order to receive $58.50, then what is the corrected cost (in % terms) of selling the preferred stock?

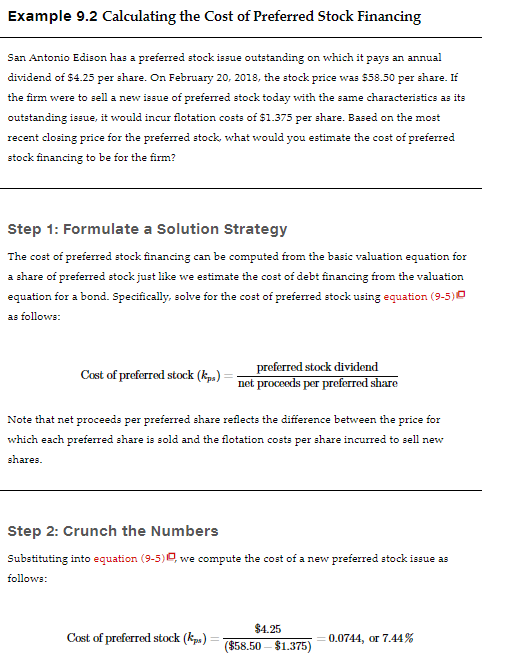

Example 9.2 Calculating the Cost of Preferred Stock Financing San Antonio Edison has a preferred stock issue outstanding on which it pays an annual dividend of $4.25 per share. On February 20, 2018, the stock price was $58.50 per share. If the firm were to sell a new issue of preferred stock today with the same characteristics as its outstanding issue, it would incur flotation costs of $1.375 per share. Based on the most recent closing price for the preferred stock, what would you estimate the cost of preferred stock financing to be for the firm? a Step 1: Formulate a Solution Strategy The cost of preferred stock financing can be computed from the basic valuation equation for a share of preferred stock just like we estimate the cost of debt financing from the valuation equation for a bond. Specifically, solve for the cost of preferred stock using equation (9-5) as follows: Cost of preferred stock (kpa) preferred stock dividend net proceeds per preferred share Note that net proceeds per preferred share reflects the difference between the price for which each preferred share is sold and the flotation costs per share incurred to sell new shares. Step 2: Crunch the Numbers Substituting into equation (9-5), we compute the cost of a new preferred stock issue as follows: Cost of preferred stock (kps) $4.25 $58.50 - $1.375) 0.0744, or 7.44% Example 9.2 Calculating the Cost of Preferred Stock Financing San Antonio Edison has a preferred stock issue outstanding on which it pays an annual dividend of $4.25 per share. On February 20, 2018, the stock price was $58.50 per share. If the firm were to sell a new issue of preferred stock today with the same characteristics as its outstanding issue, it would incur flotation costs of $1.375 per share. Based on the most recent closing price for the preferred stock, what would you estimate the cost of preferred stock financing to be for the firm? a Step 1: Formulate a Solution Strategy The cost of preferred stock financing can be computed from the basic valuation equation for a share of preferred stock just like we estimate the cost of debt financing from the valuation equation for a bond. Specifically, solve for the cost of preferred stock using equation (9-5) as follows: Cost of preferred stock (kpa) preferred stock dividend net proceeds per preferred share Note that net proceeds per preferred share reflects the difference between the price for which each preferred share is sold and the flotation costs per share incurred to sell new shares. Step 2: Crunch the Numbers Substituting into equation (9-5), we compute the cost of a new preferred stock issue as follows: Cost of preferred stock (kps) $4.25 $58.50 - $1.375) 0.0744, or 7.44%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts