Question: these are all practice questions i need some help on please!! 1. If a company sells equipment for more than what it is valued at

these are all practice questions i need some help on please!!

1.

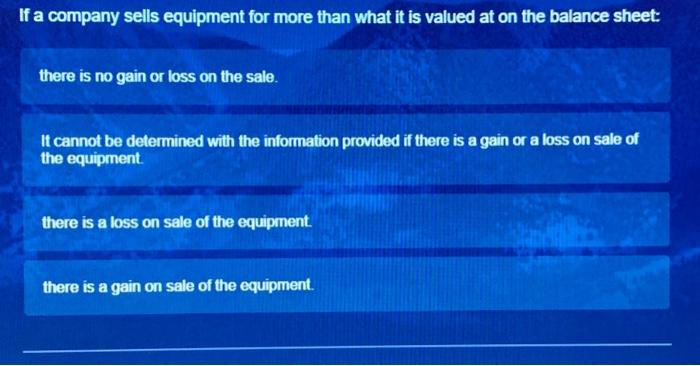

If a company sells equipment for more than what it is valued at on the balance sheet:

there is no gain or loss on the sale.

It cannot be determined with the information provided if there is a gain or a loss on sale of the equipment.

there is a loss on sale of the equipment.

there is a gain on sale of the equipment.

2.

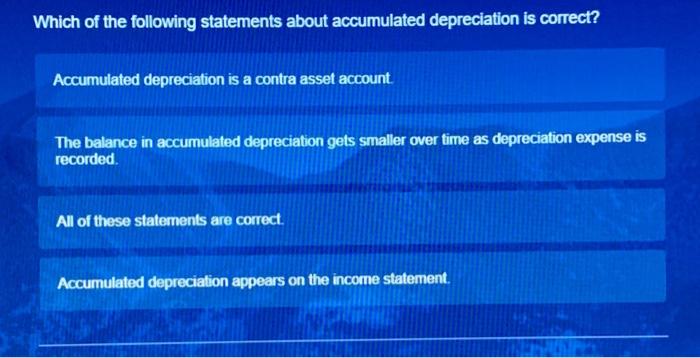

Which of the following statements about accumulated depreciation is correct?

Accumulated depreciation is a contra asset account.

The balance in accumulated depreciation gets smaller over time as depreciation expense is recorded.

All of these statements are correct.

Accumulated depreciation appears on the income statement.

3.

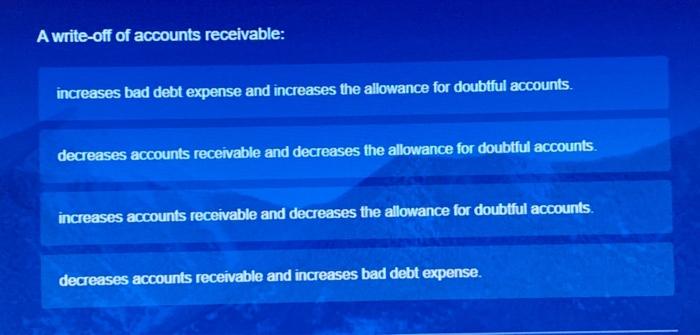

A write-off of accounts receivable:

increases bad debt expense and increases the allowance for doubtful accounts.

decreases accounts receivable and decreases the allowance for doubtful accounts.

increases accounts receivable and decreases the allowance for doubtful accounts.

decreases accounts receivable and increases bad debt expense.

4.

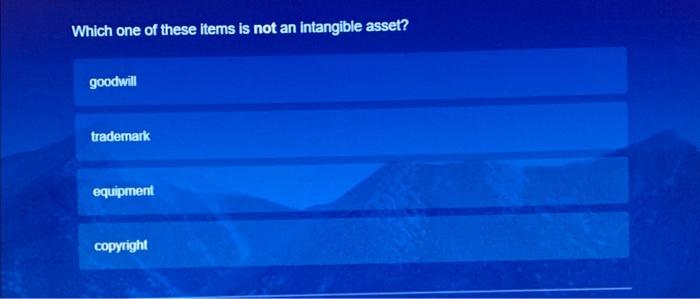

Which one of these items is not an intangible asset?

goodwill

trademark

equipment

copyright

5.

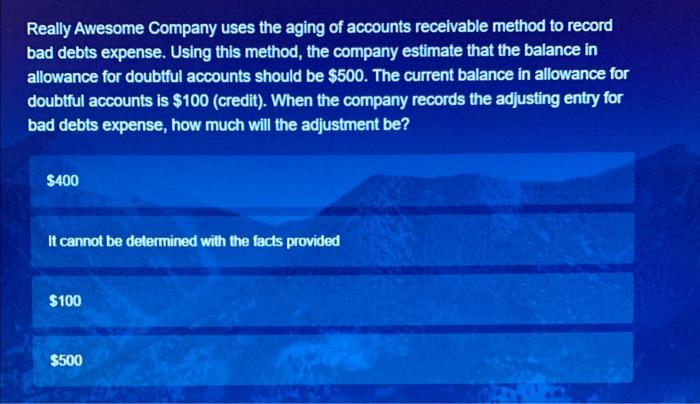

Really Awesome Company uses the aging of accounts receivable method to record bad debts expense. Using this method, the company estimate that the balance in allowance for doubtful accounts should be $500. The current balance in allowance for doubtful accounts is $100 (credit). When the company records the adjusting entry for bad debts expense, how much will the adjustment be?

$400

It cannot be determined with the facts provided

$100

$500

6.

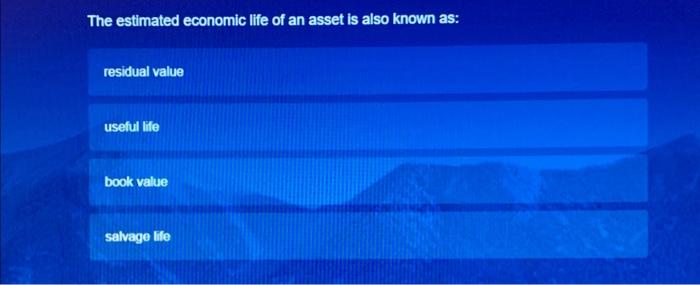

The estimated economic life of an asset is also known as:

residual value

useful life

book value

salvage life

7.

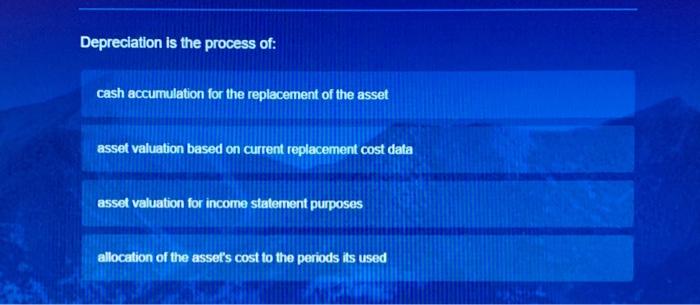

Depreciation is the process of:

cash accumulation for the replacement of the asset

asset valuation based on current replacement cost data

asset valuation for income statement purposes

allocation of the asset's cost to the periods its used

8.

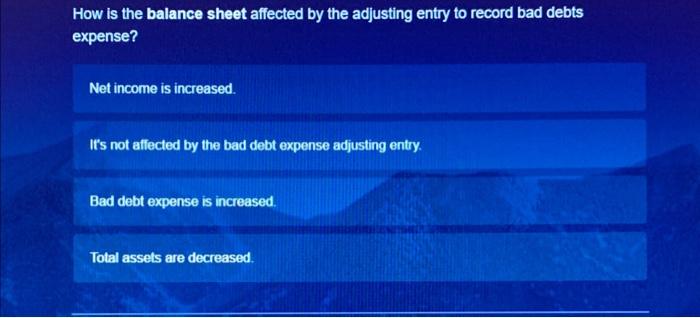

How is the balance sheet affected by the adjusting entry to record bad debts expense?

Net income is increased.

It's not affected by the bad debt expense adjusting entry.

Bad debt expense is increased.

Total assets are decreased.

9.

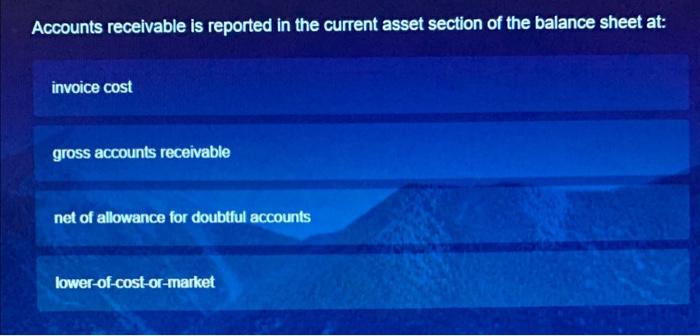

Accounts receivable is reported in the current asset section of the balance sheet at:

invoice cost

gross accounts receivable

net of allowance for doubtful accounts

lower-of-cost-or-market

10.

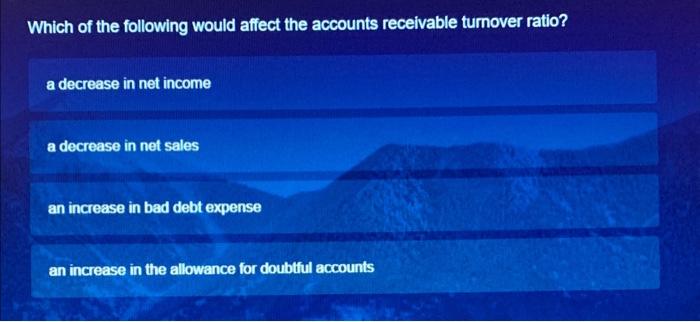

Which of the following would affect the accounts receivable turnover ratio?

a decrease in net income

a decrease in net sales

an increase in bad debt expense

an increase in the allowance for doubtful accounts

If a company sells equipment for more than what it is valued at on the balance sheet: there is no gain or loss on the sale. It cannot be determined with the information provided if there is a gain or a loss on sale of the equipment. there is a loss on sale of the equipment. Which of the following statements about accumulated depreciation is correct? Accumulated depreciation is a contra asset account. The balance in accumulated depreciation gets smaller over time as depreciation expense is recorded. All of these statements are correct. Accumulated depreciation appears on the income statement. A write-off of accounts receivable: increases bad debt expense and increases the allowance for doubtful accounts. decreases accounts receivable and decreases the allowance for doubtful accounts. Which one of these items is not an intangible asset? Really Awesome Company uses the aging of accounts receivable method to record bad debts expense. Using this method, the company estimate that the balance in allowance for doubtful accounts should be $500. The current balance in allowance for doubtful accounts is $100 (credit). When the company records the adjusting entry for bad debts expense, how much will the adjustment be? The estimated economic life of an asset is also known as: residual value useful lile book value salvage life Depreciation is the process of: cash accumulation for the replacement of the asset asset valuation based on current replacement cost dala asset valuation for income statement purposes allocation of the asset's cost to the periods its used How is the balance sheet affected by the adjusting entry to record bad debts expense? Net income is increased. It's not affected by the bad debt expense adjusting entry. Bad debt expense is increased. Total assets are decreased. Accounts receivable is reported in the current asset section of the balance sheet at: invoice cost gross accounts receivable net of allowance for doubtful accounts lower-of-cost-or-market Which of the following would affect the accounts receivable tumover ratio? a decrease in net income a decrease in net sales an increase in bad debt expense an increase in the allowance for doubtifl accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts