Question: these are multiple choices just need to answer them Which of the following is correct when accounting records are maintained on accrual basis (3 pts)

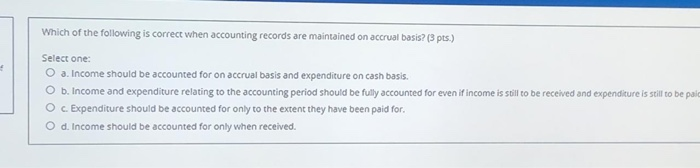

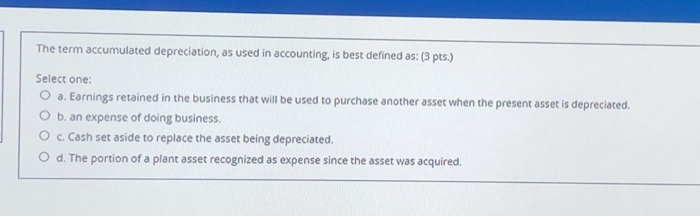

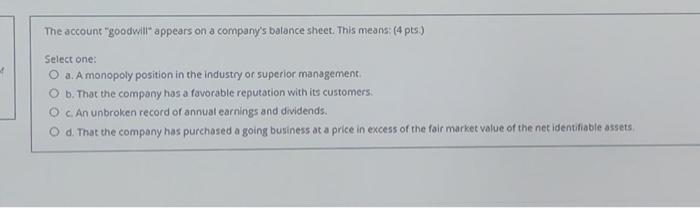

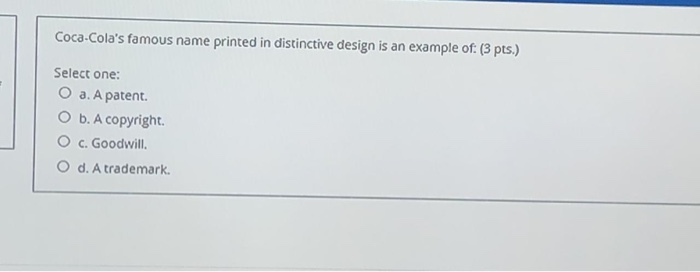

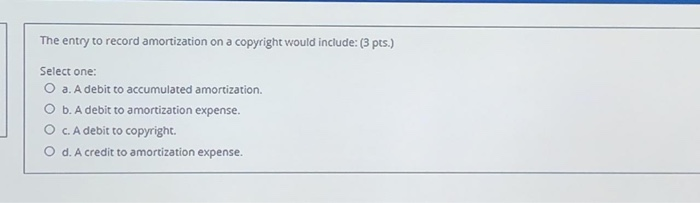

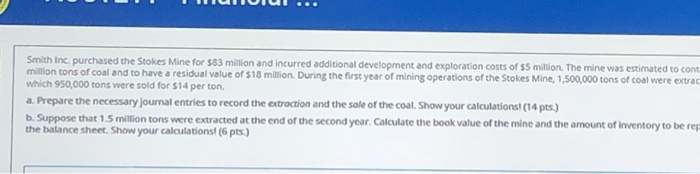

Which of the following is correct when accounting records are maintained on accrual basis (3 pts) Select one: O a. Income should be accounted for on accrual basis and expenditure on cash basis. O b. Income and expenditure relating to the accounting period should be fully accounted for even if income is still to be received and expenditure is still to be paid O c Expenditure should be accounted for only to the extent they have been paid for. Od Income should be accounted for only when received. The term accumulated depreciation, as used in accounting, is best defined as: (3 pts.) Select one: O a. Earnings retained in the business that will be used to purchase another asset when the present asset is depreciated. O b. an expense of doing business O c. Cash set aside to replace the asset being depreciated. O d. The portion of a plant asset recognized as expense since the asset was acquired. The account "goodwill appears on a company's balance sheet. This means: (4 pts.) Select one: O a. A monopoly position in the industry or superior management. O b. That the company has a favorable reputation with its customers. O c. An unbroken record of annual earnings and dividends. O d. That the company has purchased a going business at a price in excess of the fair market value of the net identifiable assets. Coca-Cola's famous name printed in distinctive design is an example of: (3 pts.) Select one: O a. A patent O b. A copyright. O c. Goodwill. O d. A trademark. The entry to record amortization on a copyright would include: (3 pts.) Select one: O a. A debit to accumulated amortization. O b. A debit to amortization expense. O c. A debit to copyright. O d. A credit to amortization expense. II Smith Inc. purchased the Stokes Mine for 583 million and incurred additional development and exploration costs of $5 million. The mine was estimated to cont million tons of coal and to have a residual value of $18 million. During the first year of mining operations of the Stokes Mine, 1,500,000 tons of coal were extra which 950,000 tons were sold for $14 per ton a. Prepare the necessary journal entries to record the extraction and the sale of the coal Show your calculations! (14 pts.) b. Suppose that 1.5 million tons were extracted at the end of the second year. Calculate the book value of the mine and the amount of inventory to be rep the balance sheet. Show your calculations (6 pts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts