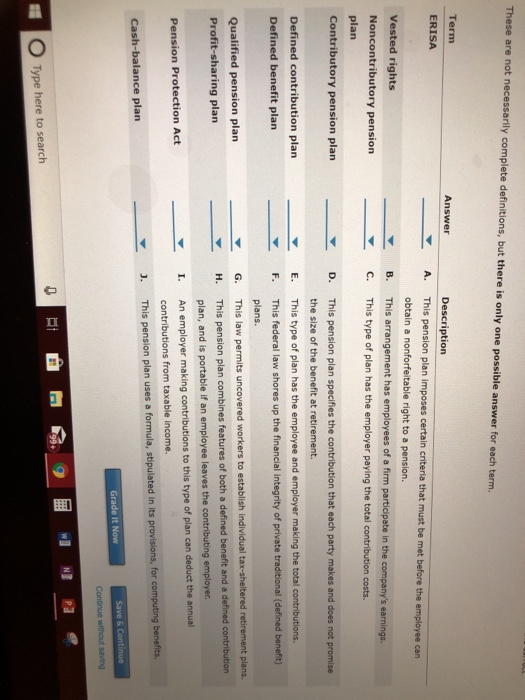

Question: These are not necessarily complete definitions, but there is only one possible answer for each term. Term Answer Description ERISA A. This pension plan imposes

These are not necessarily complete definitions, but there is only one possible answer for each term. Term Answer Description ERISA A. This pension plan imposes certain criteria that must be met before the employee can obtain a nonforfeitable right to a pension. Vested rights B. This arrangement has employees of a firm participate in the company's earnings. Noncontributory pension type of plan has the employer paying the total contribution costs. C. This plan Contributory pension plan This pension plan specifies the contribution that each party makes and does not promise D. the size of the benefit at retirement. Defined contribution plan E. This type of plan has the employee and employer making the total contributions. Defined benefit plan This federal law shores up the financial integrity of private traditional (defined benefit) F. plans. G. This law permits uncovered workers to establish individual tax-sheltered retirement plans. Qualified pension plan H. This pension plan combines features of both a defined benefit and a defined contribution Profit-sharing plan plan, and is portable if an employee leaves the contributing employer I. An employer making contributions to this type of plan can deduct the annual Pension Protection Act contributions from taxable income. J. This pension plan uses a formula, stipulated in its provisions, for computing benefits. Cash-balance plan Save &Continue Grade It Now Continue without saving N Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts