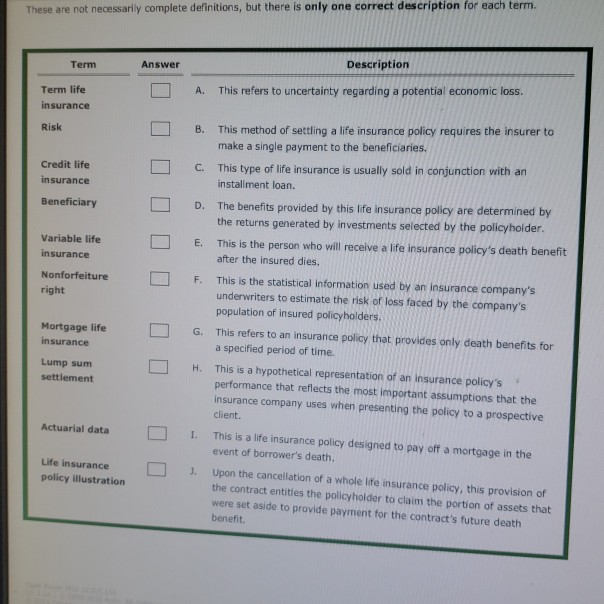

Question: These are not necessarily complete definitions, but there is only one correct description for each term. Description Term Answer A. This refers to uncertainty regarding

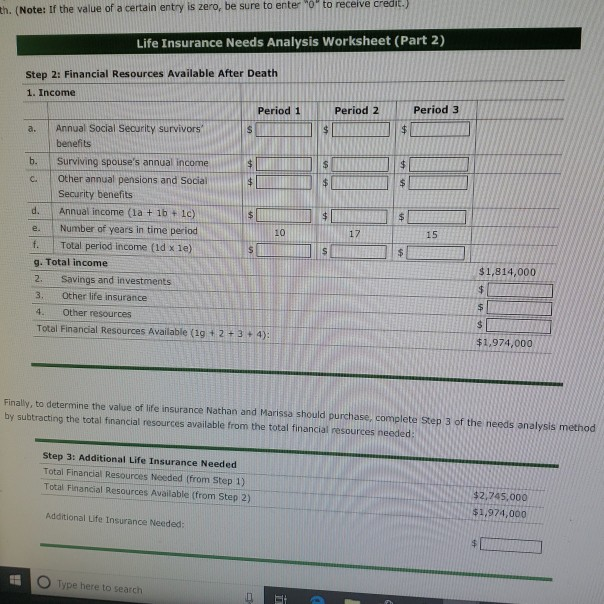

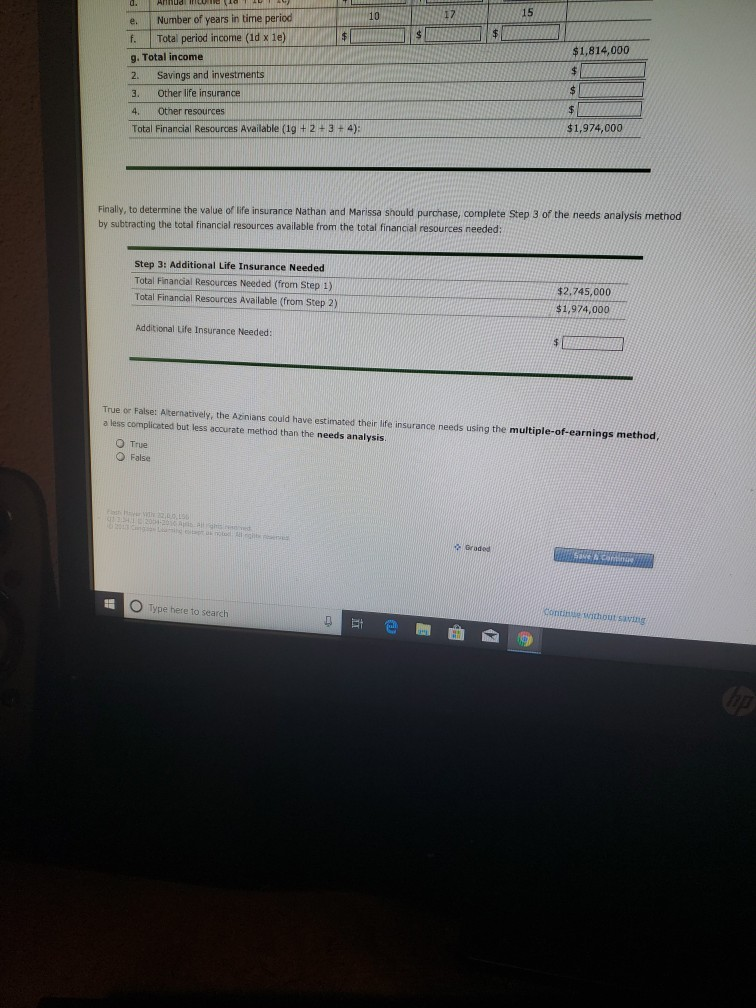

These are not necessarily complete definitions, but there is only one correct description for each term. Description Term Answer A. This refers to uncertainty regarding a potential economic loss B. This method of settling a life insurance policy requires the insurer to C. This type of life insurance is usually sold in conjunction with an D. The benefits provided by this life insurance policy are determined by Term life insurance Risk make a single payment to the beneficiaries Credit life nsurance Beneficiary installment loan the returns generated by investments selected by the policyhoider. Variable life E. This is the person who will receive a life insurance policy's death benefit insurance after the insured dies. Nonforfeiture right F. This is the statistical information used by an insurance company's underwriters to estimate the risk of loss faced by the company's population of insured policyholders. Mortgage life insurance G. This refers to an insurance policy that provides only death benefits for a specified period of time. Lump sum settlement H. This is a hypothetical representation of an Insurance policy's performance that reflects the most important assumptions that the insurance company uses when presenting the policy to a prospective client. This is a life insurance policy designed to pay off a mortgage in the event of borrower's death. Actuarial data I. Luife insuranc policy illustration Upon the cancellation of a whole life insurance policy, this provision of the contract entitles the policyholder to claim the portion of assets that were set aside to provide payment for the contract's future death benefit. . th. (Note: If the value of a certain entry is zero, be sure to enter or to receive credit) Life Insurance Needs Analysis Worksheet (Part 2) Step 2: Financial Resources Available After Death 1. Income Period 1 Period 2 Period 3 a. Annual Social Security survivors benefits b. Surviving spouse's annual income c. Other annual pensions and Social Security benefits d. Annual income (1a + 1b + 1c) e. Number of years in time period f. Total period income (ld x1e) g. Total income 2. Savings and investments 3. Other life insurance 4 Other resources Total Financial Resources Available (1g+ 2 +3+ 4) 10 17 15 $1,814,000 $1,974,000 Finally, to determine the value of life insurance Nathan and Marissa should purchase, complete Step 3 of the needs analysis method by subtracting the total financial resources available from the total financial resources needed Step 3: Additional Life Insurance Needed Total Financial Resources Needed (from Step 1) Total Financial Resources Available (from Step 2) $2,745,000 $1,974,000 Additional Life Insurance Needed: O Type here to search 10 17 15 e. Number of years in time period f. Tota period income (1d x le) g. Total income 2. Savings and investments 3. Other life insurance 4. Other resources Total Financial Resources Available (1g + 2+3 4); $1,814,000 $1,974,000 Finaliy, to determine the value of life insurance Nathan and Marissa should purchase, complete Step 3 of the needs analysis method by subtracting the total financial resources available from the total financial resources needed: Step 3: Additional Life Insurance Needed Total Financial Resources Needed (from Step 1) Total Finandial Resources Available (from Step 2) $2,745,000 $1,974,000 Additional Life Insurance Needed: True or False: Alternatively, the Azinians could have estimated their life insurance needs using the multiple-of-earnings method a less complicoted but less accurate method than the needs analysis O True O False Graded O Type here to search continue without sanng

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts