Question: These are pages 28-29 Questions based on pg: 28-29 Real options: Option to expand Idea: Taking one project gives you the right (but not obligation)

These are pages 28-29

Questions based on pg: 28-29

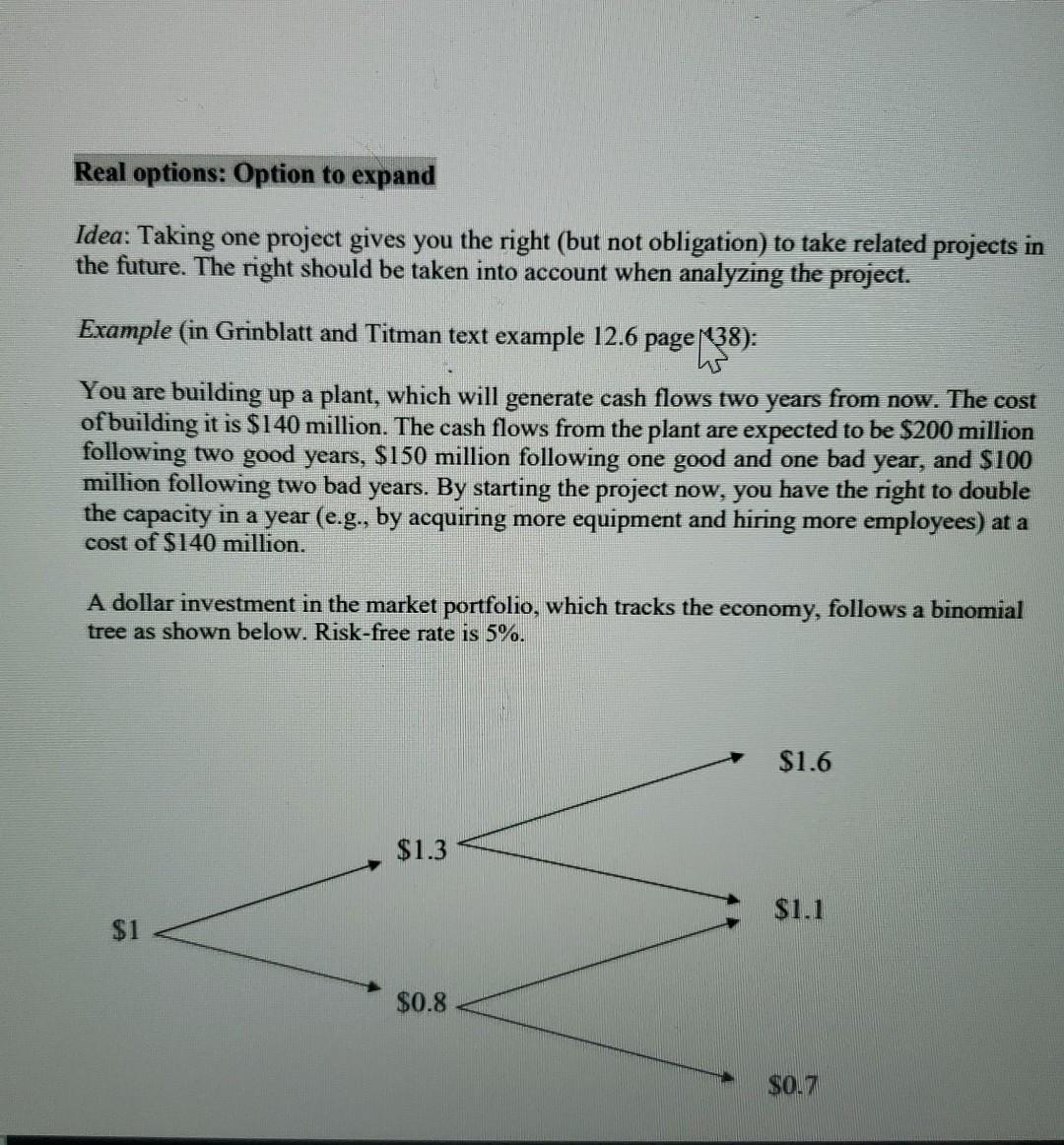

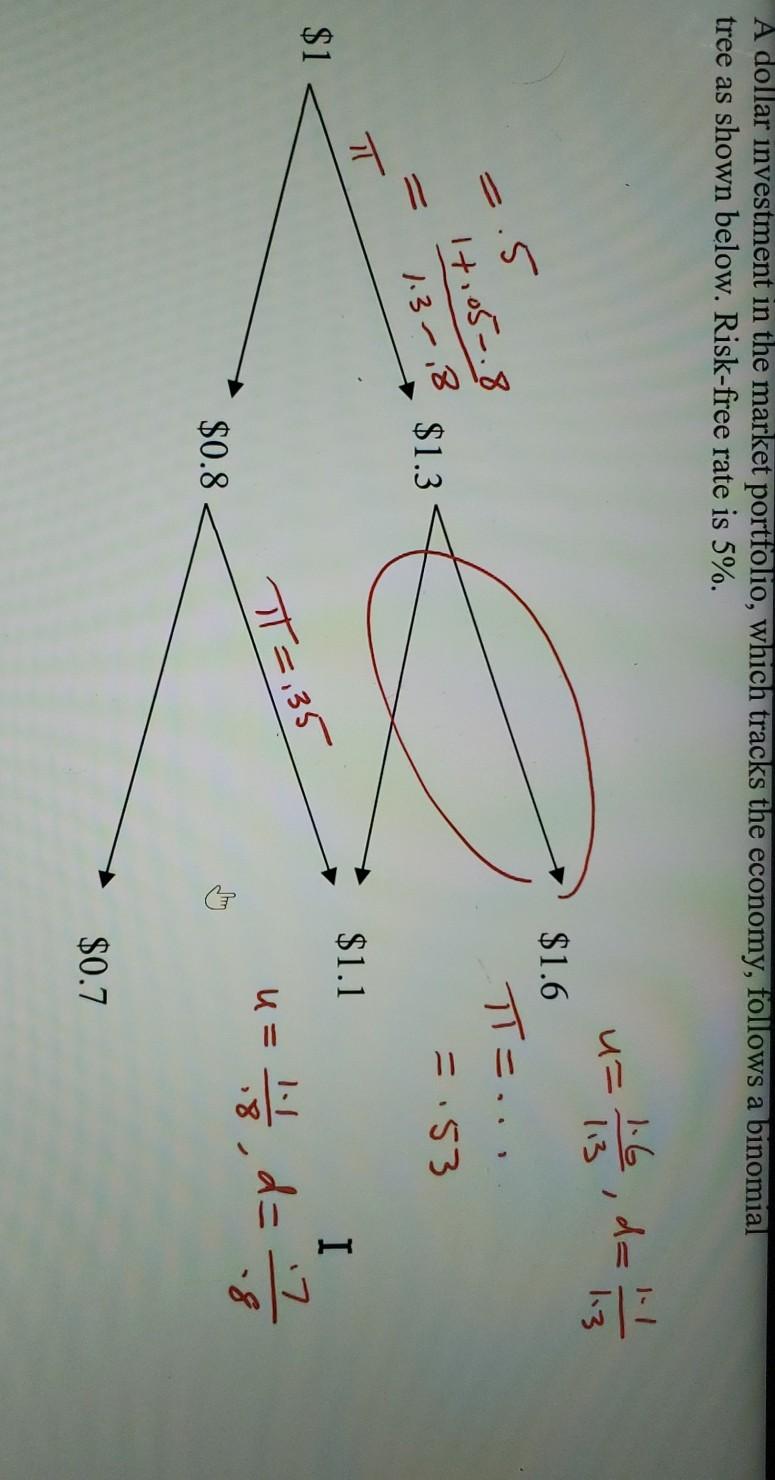

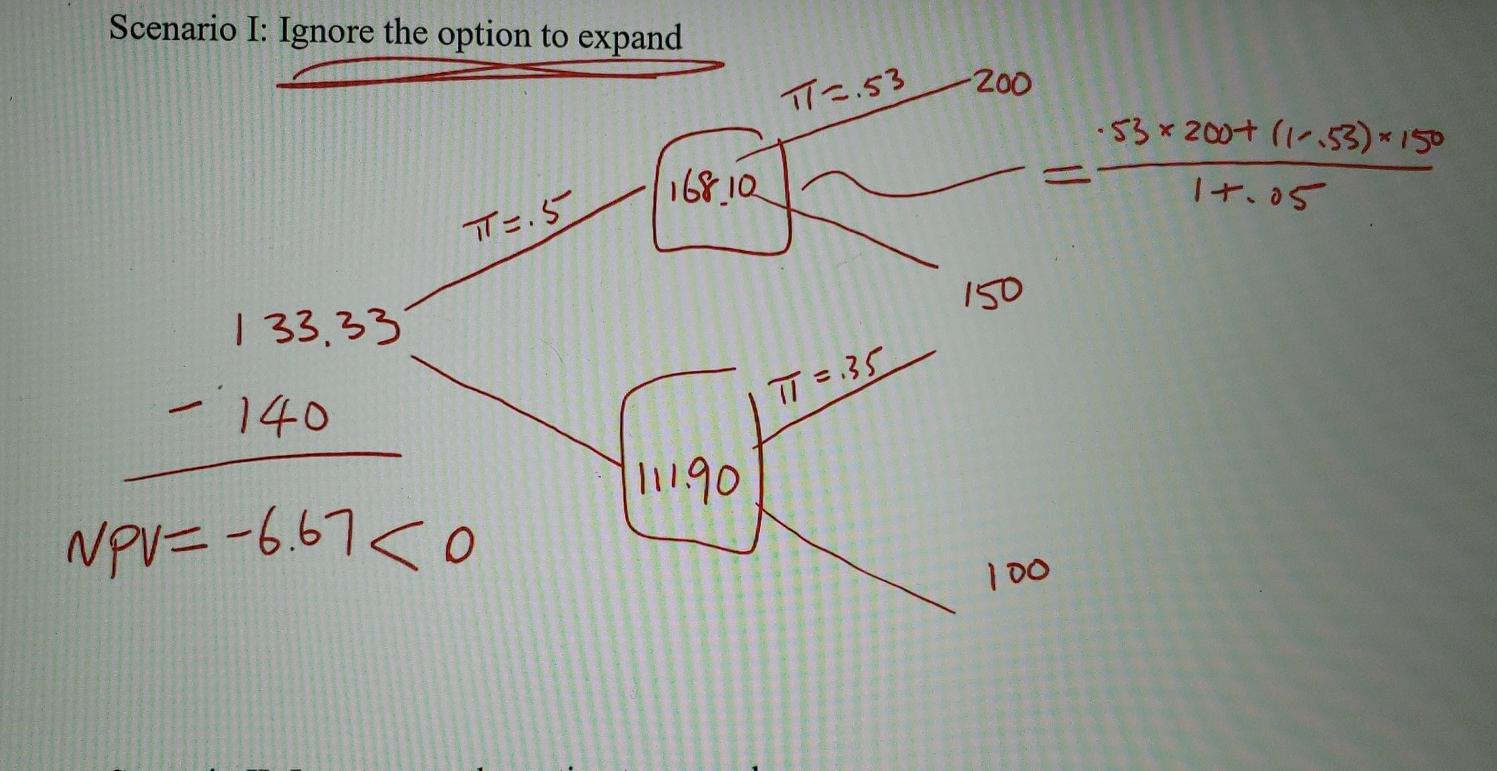

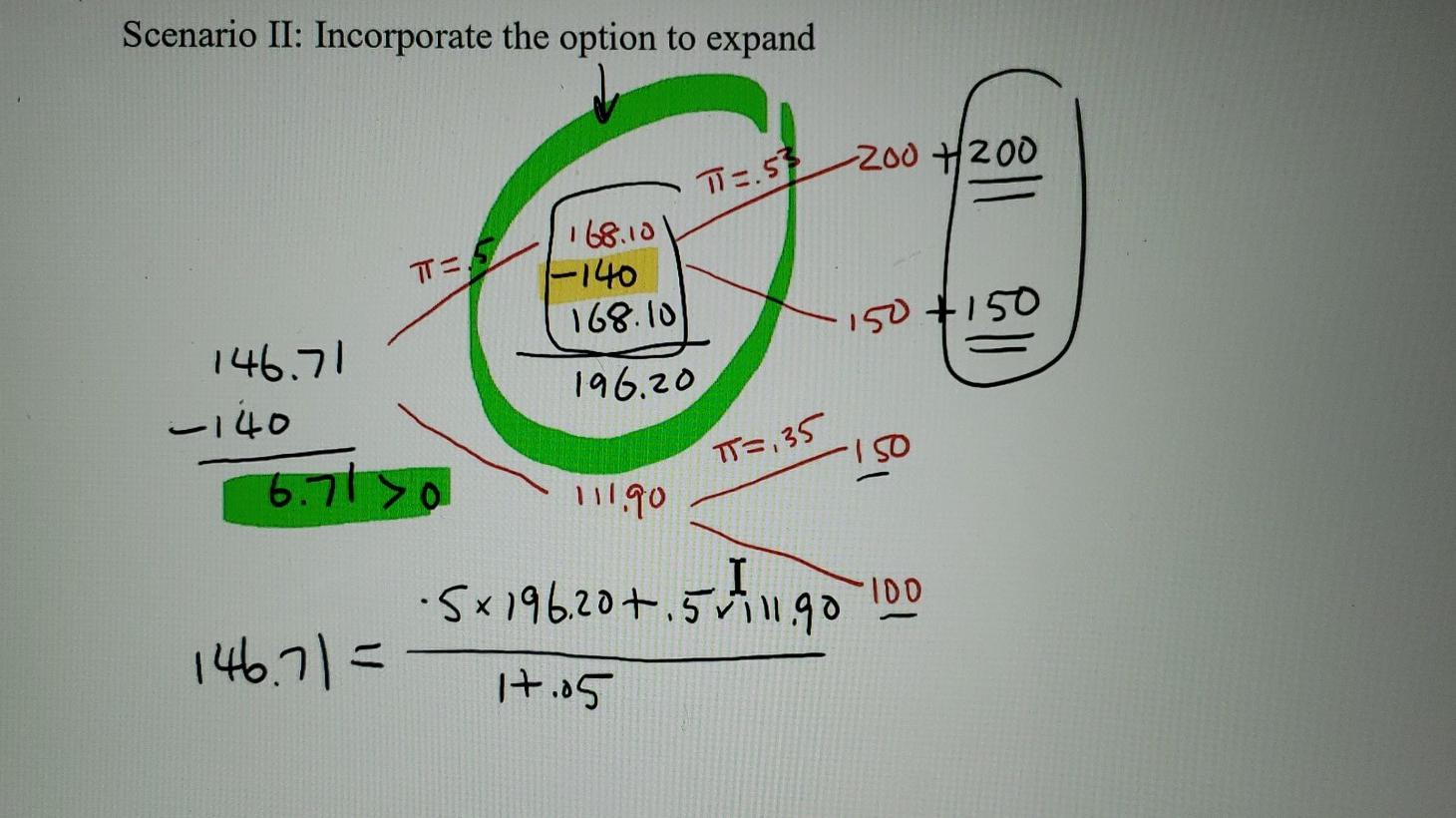

Real options: Option to expand Idea: Taking one project gives you the right (but not obligation) to take related projects in the future. The right should be taken into account when analyzing the project. Example (in Grinblatt and Titman text example 12.6 page M38): You are building up a plant, which will generate cash flows two years from now. The cost of building it is $140 million. The cash flows from the plant are expected to be $200 million following two good years, $150 million following one good and one bad year, and $100 million following two bad years. By starting the project now, you have the right to double the capacity in a year (e.g., by acquiring more equipment and hiring more employees) at a cost of $140 million. A dollar investment in the market portfolio, which tracks the economy, follows a binomial tree as shown below. Risk-free rate is 5%. $1.6 $1.3 $1.1 $1 $0.8 $0.7 A dollar investment in the market portfolio, which tracks the economy, follows a binomial tree as shown below. Risk-free rate is 5%. 1.6 113 3 u= de 1.3 $1.6 T=.. .5 +105.8 1.3 - 8 $1.3 =.53 T $1.1 $1 I 17 T=,35 u= 11 is da $0.8 $0.7 Scenario I: Ignore the option to expand T=.53 -200 -53* 200+ (1-53)*150 It.05 16810 T=.5 150 133.33 = 35 - 140 111.90 NPU=-6.67co 100 Scenario II: Incorporate the option to expand -200 4200 T=.53 T=.5 168.10 -140 168.10 150 150 196.20 146.71 - 140 6.71 so T=,35 -150 111.90 5x196.20+.545.90 100 146.71 = I+.05 Saved Question 3 points For the example covered in Notes pages 28-29, suppose we keep everything else the same but change the risk free rate from 5% to 10%. Which of the following statement is NOT correct? The risk-neutral probability for the binomial tree starting from year zero is 0.60. The risk-neutral probability for the binomial tree starting from year one in the down state is 0.45; that for the binomial tree starting from year one in the up state is 0.66. O If we are in the up state in year one, we choose to double the capacity. That is, we expand the project. If we are in the down state in year one, we choose NOT to expand. Because the risk-free discount rate is higher, in both up and down states of year one, we choose NOT to double the capacity, as the increased cash flows after discounting are not sufficient to cover the extra cost. H Question 4 1 points Saved For the example covered in Notes pages 28-29, suppose we keep everything else the same but change the initial cost of building from $140 to $135, and the extra cost of doubling the capacity from $140 to $135. If in year one we are in the down state, we will NOT choose to double the capacity. In the up state of year one, however, we will choose to double the capacity. True O False Question 2 1 points Saved For the example covered in Notes pages 28-29, suppose we keep everything else the same but change the cash flow following two bad years (page 28) from $100 to $130. If in year one we are in the down state, we will NOT choose to double the capacity. In the up state of year one, however, we will choose to double the capacity. O True False Question 1 1 points lo Saved For the example covered in Notes pages 28-29, suppose we keep everything else the same but change the initial cost of building (page 28) from $140 to $135. The project has a negative NPV without considering the option to expand but a positive NPV after considering the option to expand. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts