Question: These are risks that affect the multinational at the project or corporate level. They can be further sub-divided into those risks arising from the national

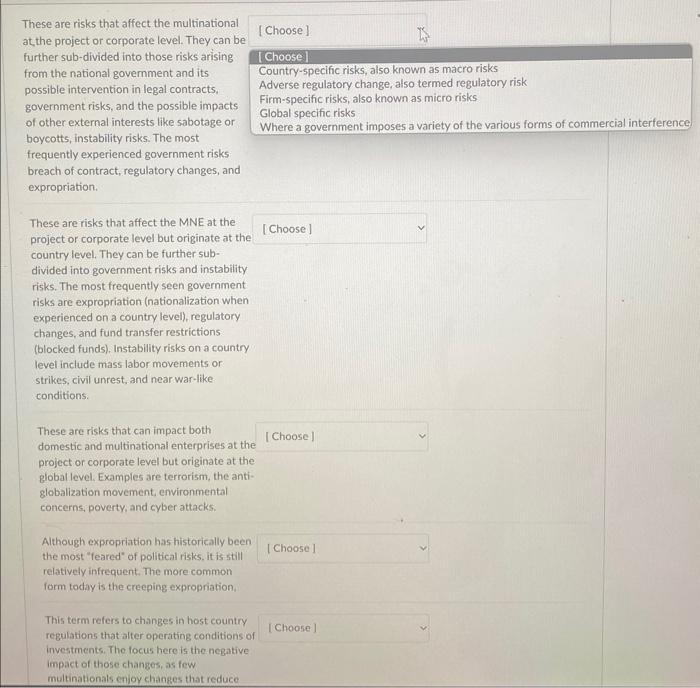

These are risks that affect the multinational at the project or corporate level. They can be further sub-divided into those risks arising from the national government and its possible intervention in legal contracts, government risks, and the possible impacts of other external interests like sabotage or boycotts, instability risks. The most frequently experienced government risks breach of contract, regulatory changes, and expropriation. These are risks that affect the MNE at the project or corporate level but originate at the country level. They can be further subdivided into government risks and instability risks. The most frequently seen government risks are expropriation (nationalization when experienced on a country level), regulatory changes, and fund transfer restrictions (blocked funds), Instability risks on a country level include mass labor movements or strikes, civil unrest, and near war-like conditions. These are risks that can impact both domestic and multinational enterprises at the project or corporate level but originate at the global level. Examples are terrorism, the antiglobalization movement, environmental concerns, poverty, and cyber attacks. Although expropriation has historically been the most "feared" of political risks, it is still relatively infrequent. The more common form today is the creeping expropriation, This term refers to changes in host country regulations that alter operating conditions of investments. The focus here is the negative impact of those changes, as few multinationals enjoy changes that reduce These are risks that affect the multinational at the project or corporate level. They can be further sub-divided into those risks arising from the national government and its possible intervention in legal contracts, government risks, and the possible impacts of other external interests like sabotage or boycotts, instability risks. The most frequently experienced government risks breach of contract, regulatory changes, and expropriation. These are risks that affect the MNE at the project or corporate level but originate at the country level. They can be further subdivided into government risks and instability risks. The most frequently seen government risks are expropriation (nationalization when experienced on a country level), regulatory changes, and fund transfer restrictions (blocked funds), Instability risks on a country level include mass labor movements or strikes, civil unrest, and near war-like conditions. These are risks that can impact both domestic and multinational enterprises at the project or corporate level but originate at the global level. Examples are terrorism, the antiglobalization movement, environmental concerns, poverty, and cyber attacks. Although expropriation has historically been the most "feared" of political risks, it is still relatively infrequent. The more common form today is the creeping expropriation, This term refers to changes in host country regulations that alter operating conditions of investments. The focus here is the negative impact of those changes, as few multinationals enjoy changes that reduce

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts