Question: these are the drop down items that are given for each question. CH As financial reporting advisors, we are asked by the head of Sterling

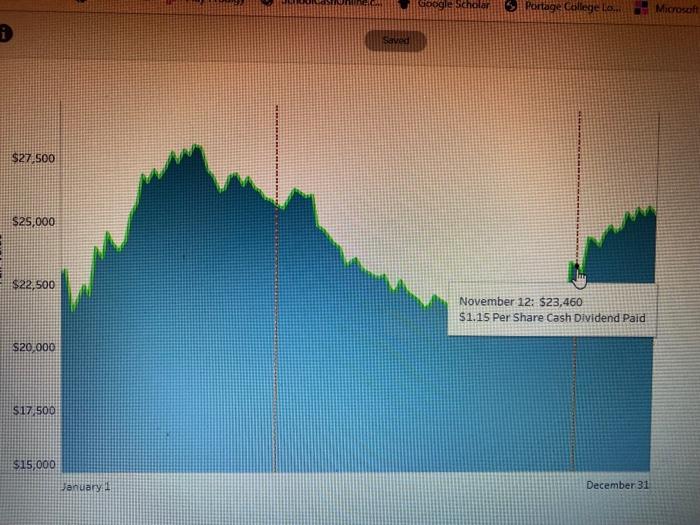

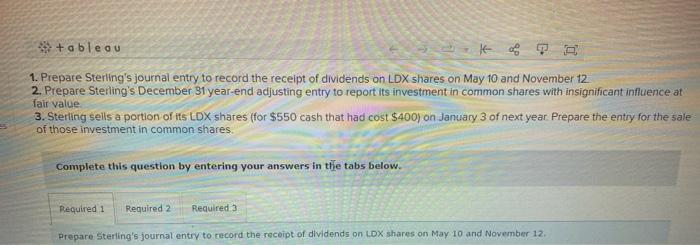

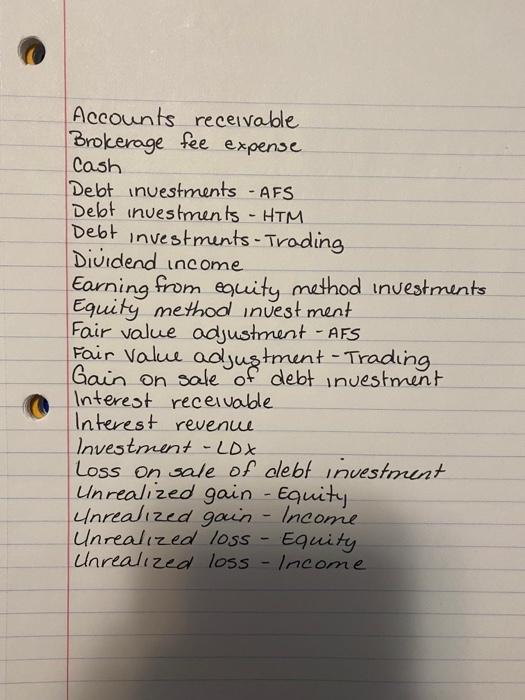

CH As financial reporting advisors, we are asked by the head of Sterling Co to advise in accounting for investment in common shares. This is the first year Sterling had extra cash to invest in investment in common shares, and it purchased 1,000 shares of LDX for $23 on January 1 of this year. The Tableau Dashboard is provided to aid us in our analysis, Fair Value of Stock Investments Portfolio G D 27,500 5,000 May 10: $25,810 $1.00 Per Share Cash Dividend Paid -2,500 0,000 7.500 5.000 January 1 December 31 ogle Scholar Portage College Lo... Microsoft Saved $27.500 $25,000 $22,500 November 12: $23,460 $1.15 Per Share Cash Dividend Paid S20 000 $17 500 $15,000 January December 31 tableau te A 1. Prepare Sterling's journal entry to record the receipt of dividends on LDX shares on May 10 and November 12 2. Prepare Sterling's December 31 year-end adjusting entry to report its investment in common shares with insignificant influence at fair value 3. Sterling sells a portion of its LDX shares (for $550 cash that had cost $400) on January 3 of next year Prepare the entry for the sale of those investment in common shares Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare Sterling's journal entry to record the receipt of dividends on LDX shares on May 10 and November 12. Accounts receivable Brokerage fee expense Cash Debt investments - AFS Debt investments - HTM Debt investments - Trading Dividend income Earning from equity method investments Equity method investment Fair value adjustment - AFS Fair value adjustment - Trading Gain on sale of debt investment Interest receivable. Interest revenue. Investment - Lox. Loss on sale of debt investment Unrealized gain - Equity unrealized gain - Income Unrealized loss - Equity Unrealized loss -Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts