Question: These are three questions on the table above. Each question has 4 options. Thank you for answers 1) The dollar value of the project's annual

These are three questions on the table above. Each question has 4 options. Thank you for answers

1)The dollar value of the project's annual operating revenue (AOR) for the optimistic scenario would be

a)500,000(0.15) b)500,000(1.15) c)500,000 d)500,000(0.85)

2)You are asked to perform a scenario analysis instead of a sensitivity analysis. Assume that the values of the three scenarios (optimistic, most probable and pessimistic) are to be populated from the NPW dollar values of the sensitivity table which you completed above.The project's MARR for the most probable (likely) scenario would be

a)10%(0.85) b)10% c)10%(1.15) d)10%(0.15)

3)You are asked to perform a scenario analysis instead of a sensitivity analysis. Assume that the values of the three scenarios (optimistic, most probable and pessimistic) are to be populated from the NPW dollar values of the sensitivity table which you completed above.The project's life (duration) for the pessimistic scenario would be

a)5(0.15) years b)5(0.85) years c)5 years d)5(1.15) years

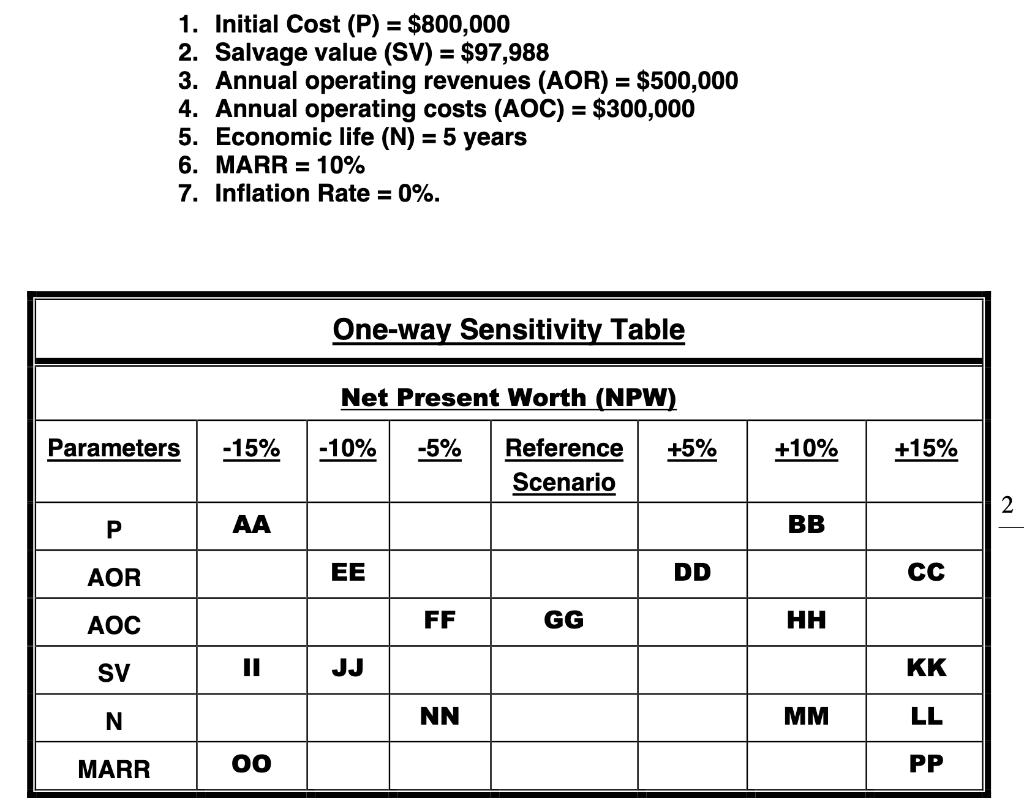

1. Initial Cost (P) = $800,000 2. Salvage value (SV) = $97,988 3. Annual operating revenues (AOR) = $500,000 4. Annual operating costs (AOC) = $300,000 5. Economic life (N) = 5 years 6. MARR = 10% 7. Inflation Rate = 0%. One-way Sensitivity Table Net Present Worth (NPW) Parameters -15% -10% -5% +5% +10% +15% Reference Scenario 2 AA BB AOR EE DD CC AOC FF GG HH SV II JJ KK N NN MM LL MARR OO PP 1. Initial Cost (P) = $800,000 2. Salvage value (SV) = $97,988 3. Annual operating revenues (AOR) = $500,000 4. Annual operating costs (AOC) = $300,000 5. Economic life (N) = 5 years 6. MARR = 10% 7. Inflation Rate = 0%. One-way Sensitivity Table Net Present Worth (NPW) Parameters -15% -10% -5% +5% +10% +15% Reference Scenario 2 AA BB AOR EE DD CC AOC FF GG HH SV II JJ KK N NN MM LL MARR OO PP

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts