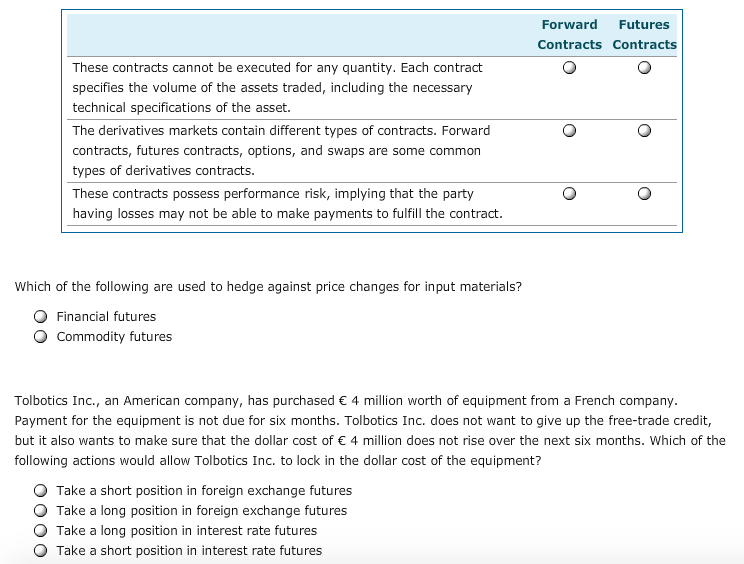

Question: These contracts cannot be executed for any quantity. Each contract specifies the volume of the assets traded, including the necessary technical specifications of the asset.

These contracts cannot be executed for any quantity. Each contract specifies the volume of the assets traded, including the necessary technical specifications of the asset. The derivatives markets contain different types of contracts. Forward contracts, futures contracts, options, and swaps are some common types of derivatives contracts. These contracts possess performance risk, implying that the party having losses may not be able to make payments to fulfill the contract. Which of the following are used to hedge against price changes for input materials? Financial futures Commodity futures Talbots's Inc., an American company, has purchased euro 4 million worth of equipment from a French company. Payment for the equipment is not due for six months. Talbots's Inc. does not want to give up the free-trade credit, but it also wants to make sure that the dollar cost of euro 4 million does not rise over the next six months. Which of the following actions would allow Talbots's Inc. to lock in the dollar cost of the equipment? Take a short position in foreign exchange futures Take a long position in foreign exchange futures Take a long position in interest rate futures Take a short position in interest rate futures

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts