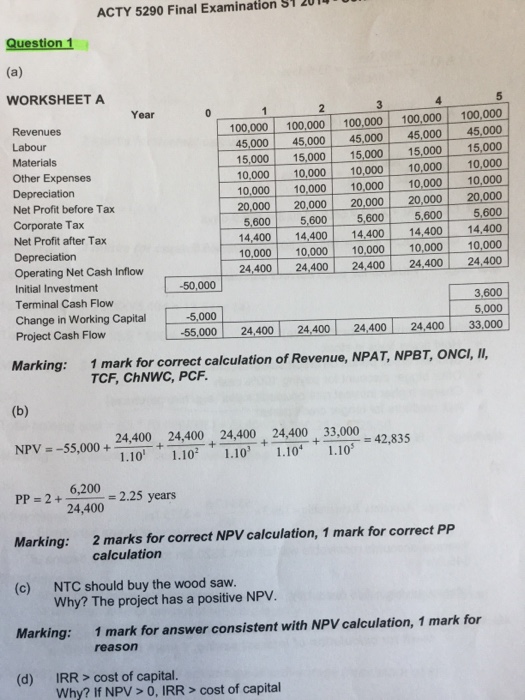

Question: These files attached are question and solution past paper. From the solution on Qtn 1 Part (a), the Terminal Cash Flow is $3600. How do

These files attached are question and solution past paper. From the solution on Qtn 1 Part (a), the Terminal Cash Flow is $3600. How do they find the Terminal Cash Flow of $3600. Thanks

These files attached are question and solution past paper. From the solution on Qtn 1 Part (a), the Terminal Cash Flow is $3600. How do they find the Terminal Cash Flow of $3600. Thanks

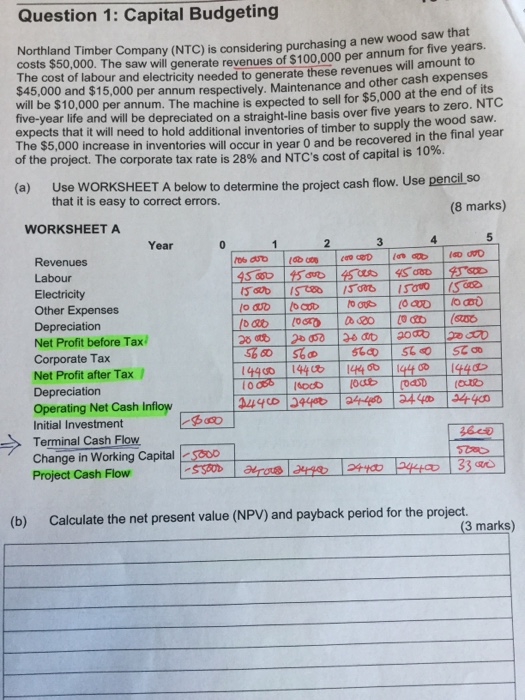

Question 1: Capital Budgeting wood saw that Northland Timber Company (NTC) is considering purchasing a new costs $50,000. Th e saw will generate revenues of $100.000 per annum for five years. nnum respectively. Maintenance and other cash expenses um. The machine is expected to sell for $5,000 at the end of its ply the wood saw The cost of labour and electricity needed to generate these revenues will amount to $45,000 and $15,000 per a will be $10,000 per ann five-year life and will be depreciated on a straight-line basis over five years to zero. NC expects that it will need to hold additional inventories of timber to sup he $5,000 of the project. The corporate tax rate is 28% and NTC's cost of capital is increase in inventories will occur in year 0 and be recovered in the final year 0 T A below to determine the project cash flow. Use pencil so that it is easy to correct errors. (8 marks) WORKSHEET A Year 3 Revenues Labour Electricity Other Expenses Depreciation Net Profit before Tax Corporate Tax Net Profit after Tax / Depreciation Operating Net Cash inflow Initial Investment Terminal Cash Flow 1441144do 1 1440D | 14400 1144a2 Change in Working Capital SooD Project Cash Flow (b) Calculate the net present value (NPV) and payback period for the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts