Question: These profiles will be used in both Project Two Milestone Tax Organizer and Project One. For Project One, you will select a client profile and

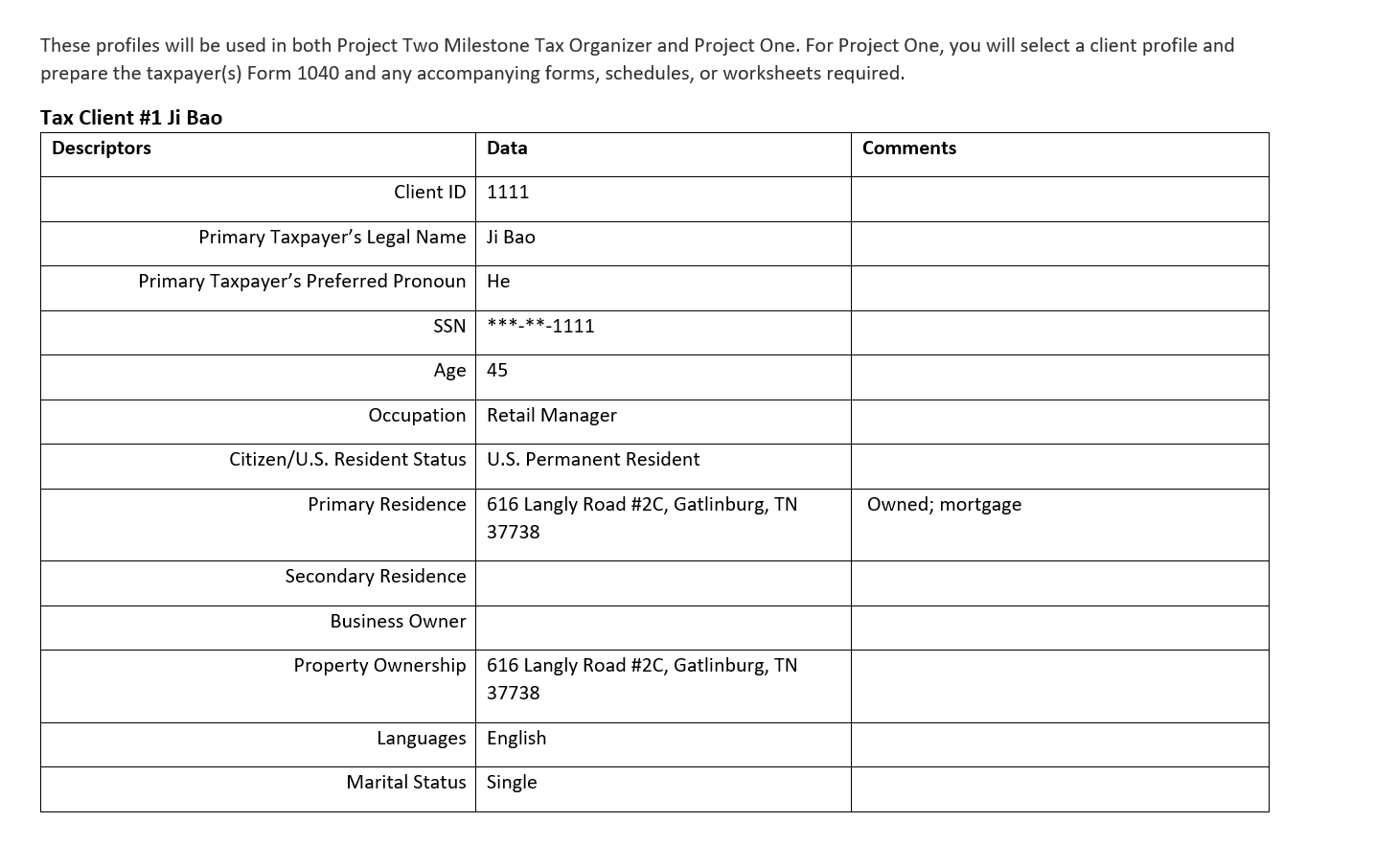

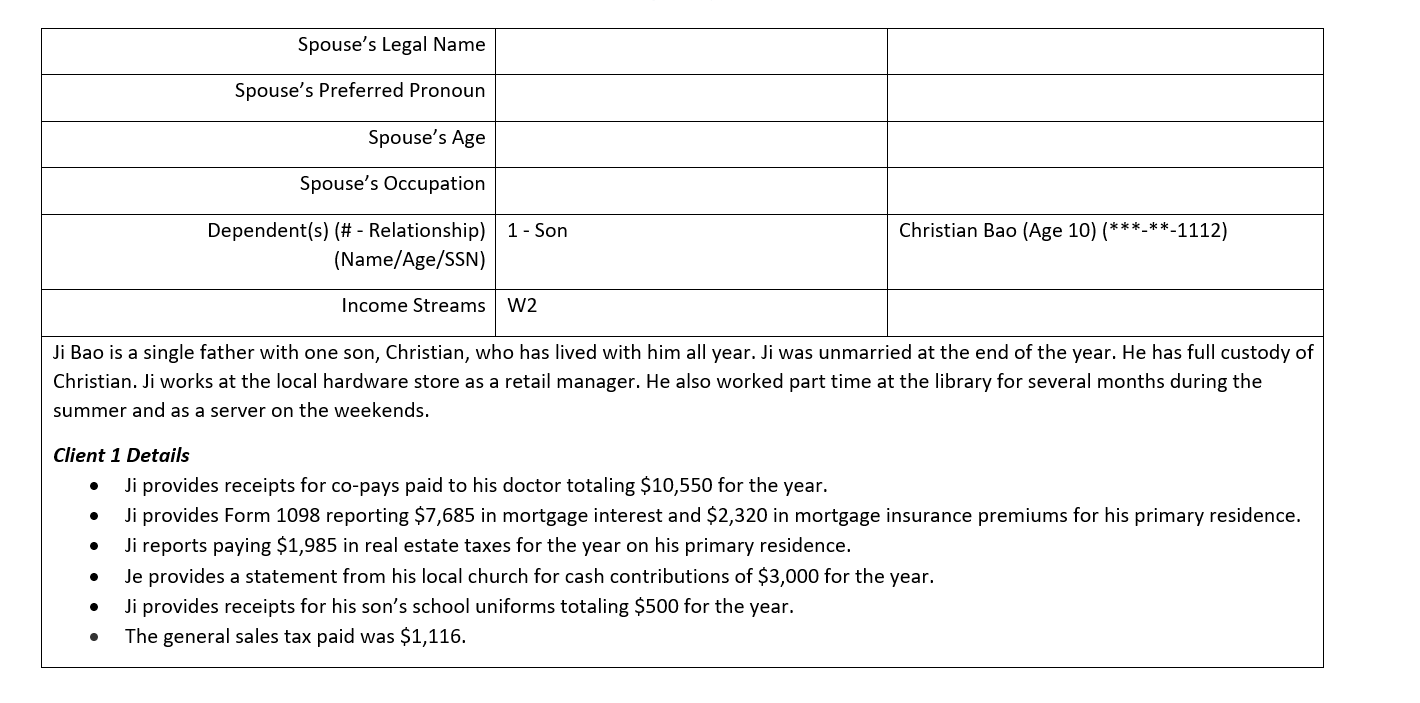

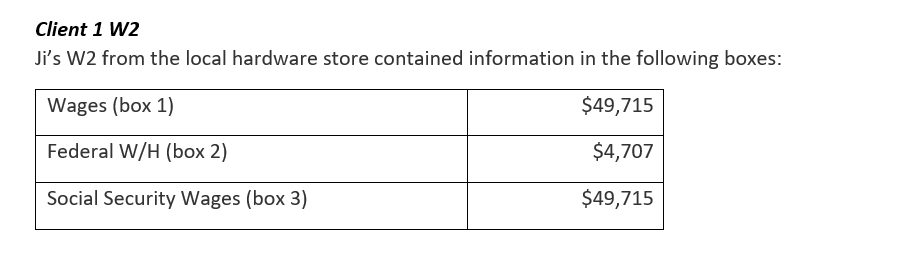

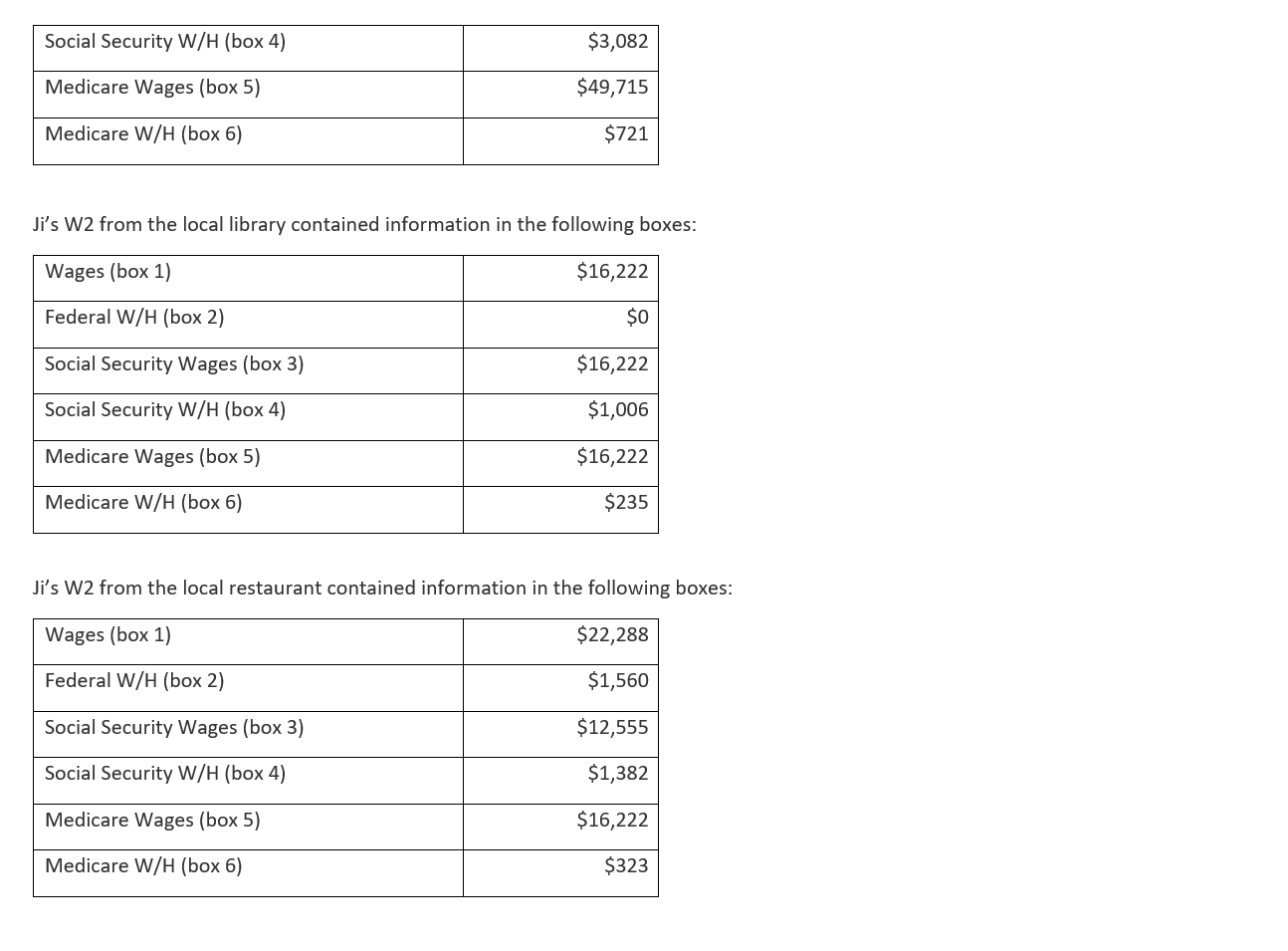

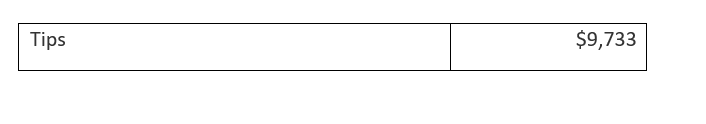

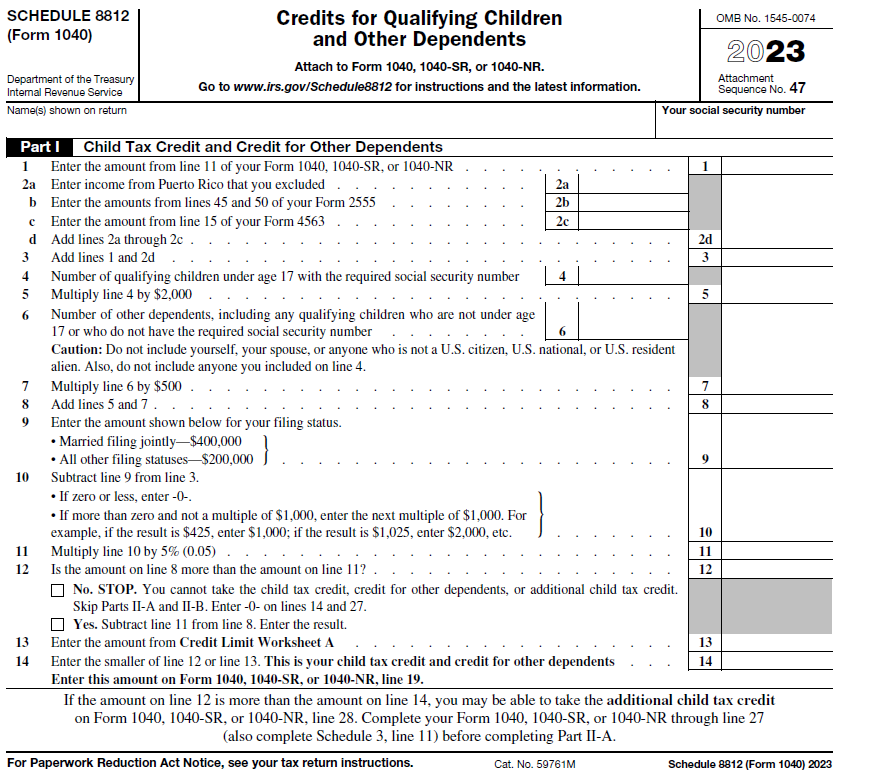

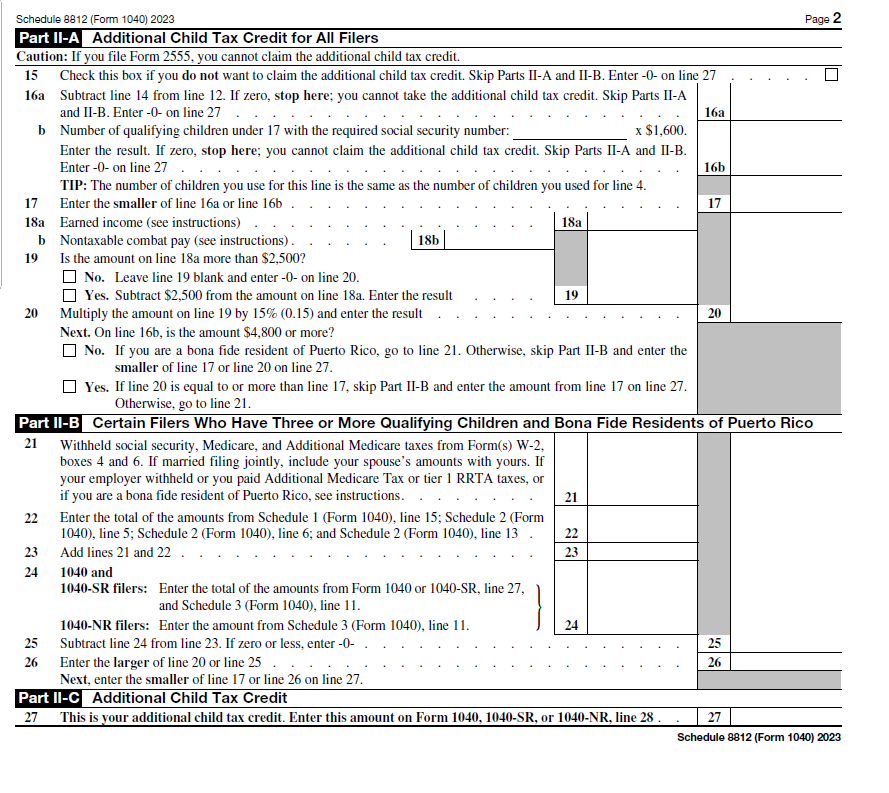

These profiles will be used in both Project Two Milestone Tax Organizer and Project One. For Project One, you will select a client profile and prepare the taxpayer(s) Form 1040 and any accompanying forms, schedules, or worksheets required. Tax Client #1 Ji Bao Descriptors Data Comments Client ID 1111 Primary Taxpayer's Legal Name Ji Bao Primary Taxpayer's Preferred Pronoun He SSN * **_**-1111 Age 45 Occupation Retail Manager Citizen/U.S. Resident Status U.S. Permanent Resident Primary Residence 616 Langly Road #2C, Gatlinburg, TN Owned; mortgage 37738 Secondary Residence Business Owner Property Ownership 616 Langly Road #2C, Gatlinburg, TN 37738 Languages English Marital Status SingleSpouse's Legal Name Spouse's Preferred Pronoun Spouse's Age Spouse's Occupation Dependentls) (# - Relationship) 1 - Son Christian Bao [Age 10}(***-**-1112l (Name/Age/SSN) Income Streams W2 Ji Bao is a single father with one son, Christian, who has lived with him all year. Ji was unmarried at the end of the year. He has full custody of Christian. Ji works at the local hardware store as a retail manager. He also worked part time at the library for several months during the summer and as a server on the weekends. Client 1 Details 0 ii provides receipts for co-pays paid to his doctor totaling $10,550 for the year. 0 ii provides Form 1093 reporting $7,635 in mortgage interest and 52,320 in mortgage insurance premiums for his primary residence. 0 ii reports paying $1,935 in real estate taxes for the year on his primary residence. 0 Je provides a statement from his local church for cash contributions of $3,000 for the year. 0 ii provides receipts for his son's school uniforms totaling $500 for the year. I The general sales tax paid was $1,116. Client 1 W2 Ji's W2 from the local hardware store contained information in the following boxes: Wages (box 1) $49,715 Federal W/H (box 2) $4,707 Social Security Wages (box 3) $49,715 Social Security W/H (box 4) $3,082 Medicare Wages (box 5) $49,715 Medicare W/H (box 6) $721 Ji's W2 from the local library contained information in the following boxes: Wages (box 1) $16,222 Federal W/H (box 2) 50 Social Security Wages (box 3) $16,222 Social Security W/H (box 4) $1,006 Medicare Wages (box 5) $16,222 Medicare W/H (box 6) $235 Ji's W2 from the local restaurant contained information in the following boxes: Wages (box 1) $22,288 Federal W/H (box 2) $1,560 Social Security Wages (box 3) $12,555 Social Security W/H [box 4) $1,382 Medicare Wages (box 5) $16,222 Medicare W/H (box 6) $323 $9,733 TipsSCHEDULE 8812 Credits for Qualifying Children OMB No. 1545-0074 (Form 1040) and Other Dependents 2023 Attach to Form 1040, 1040-SR, or 1040-NR. Department of the Treasury Attachment Internal Revenue Service Go to www.irs.gov/Schedule8812 for instructions and the latest information. Sequence No. 47 Name(s) shown on return Your social security number Part | Child Tax Credit and Credit for Other Dependents Enter the amount from line 11 of your Form 1040, 1040-SR, or 1040-NR 1 2a Enter income from Puerto Rico that you excluded 2a b Enter the amounts from lines 45 and 50 of your Form 2555 2b Enter the amount from line 15 of your Form 4563 Add lines 2a through 2c 2d Add lines 1 and 2d 3 Number of qualifying children under age 17 with the required social security number Multiply line 4 by $2,000 . 5 Number of other dependents, including any qualifying children who are not under age 17 or who do not have the required social security number 6 Caution: Do not include yourself, your spouse, or anyone who is not a U.S. citizen, U.S. national, or U.S. resident alien. Also, do not include anyone you included on line 4. Multiply line 6 by $500 7 Add lines 5 and 7 . 8 Enter the amount shown below for your filing status. . Married filing jointly-$400,000 . All other filing statuses-$200,000 9 10 Subtract line 9 from line 3. If zero or less, enter -0-. If more than zero and not a multiple of $1,000, enter the next multiple of $1,000. For example, if the result is $425, enter $1,000; if the result is $1,025, enter $2,000, etc. 10 Multiply line 10 by 5% (0.05) . 11 12 Is the amount on line 8 more than the amount on line 11? . 12 No. STOP. You cannot take the child tax credit, credit for other dependents, or additional child tax credit. Skip Parts II-A and II-B. Enter -0- on lines 14 and 27. Yes. Subtract line 11 from line 8. Enter the result. 13 Enter the amount from Credit Limit Worksheet A 13 14 Enter the smaller of line 12 or line 13. This is your child tax credit and credit for other dependents 14 Enter this amount on Form 1040, 1040-SR, or 1040-NR, line 19 If the amount on line 12 is more than the amount on line 14, you may be able to take the additional child tax credit on Form 1040, 1040-SR, or 1040-NR, line 28. Complete your Form 1040, 1040-SR, or 1040-NR through line 27 (also complete Schedule 3, line 11) before completing Part II-A. For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 59761M Schedule 8812 (Form 1040) 2023Schedule 8812 (Form 1040) 2023 Page 2 Part II-A Additional Child Tax Credit for All Filers Caution: If you file Form 2535, you cannot claim the additional child tax credit. 15 Check this box if you do not want to claim the additional child tax credit. Skip Parts II-A and II-B. Enter -0- on line 27 16a Subtract line 14 from line 12. If zero, stop here; you cannot take the additional child tax credit. Skip Parts II-A and II-B. Enter -0- on line 27 . 16a b Number of qualifying children under 17 with the required social security number: x $1,600. Enter the result. If zero, stop here; you cannot claim the additional child tax credit. Skip Parts II-A and II-B. Enter -0- on line 27 16b TIP: The number of children you use for this line is the same as the number of children you used for line 4. 17 Enter the smaller of line 16a or line 16b 17 18a Earned income (see instructions). 18a b Nontaxable combat pay (see instructions) . 18b 19 Is the amount on line 18a more than $2,5007 No. Leave line 19 blank and enter -0- on line 20. Yes. Subtract $2,500 from the amount on line 18a. Enter the result 19 20 Multiply the amount on line 19 by 15% (0.15) and enter the result 20 Next. On line 16b, is the amount $4,800 or more? No. If you are a bona fide resident of Puerto Rico, go to line 21. Otherwise, skip Part II-B and enter the smaller of line 17 or line 20 on line 27. Yes. If line 20 is equal to or more than line 17, skip Part II-B and enter the amount from line 17 on line 27. Otherwise, go to line 21. Part II-B Certain Filers Who Have Three or More Qualifying Children and Bona Fide Residents of Puerto Rico 21 Withheld social security, Medicare, and Additional Medicare taxes from Form(s) W-2. boxes 4 and 6. If married filing jointly, include your spouse's amounts with yours. If your employer withheld or you paid Additional Medicare Tax or tier 1 RRTA taxes, or if you are a bona fide resident of Puerto Rico, see instructions. 21 22 Enter the total of the amounts from Schedule 1 (Form 1040), line 15; Schedule 2 (Form 1040), line 5; Schedule 2 (Form 1040), line 6; and Schedule 2 (Form 1040), line 13 22 23 Add lines 21 and 22 . 23 24 1040 and 1040-SR filers: Enter the total of the amounts from Form 1040 or 1040-SR, line 27, and Schedule 3 (Form 1040), line 11. 1040-NR filers: Enter the amount from Schedule 3 (Form 1040), line 11. 24 25 Subtract line 24 from line 23. If zero or less, enter -0- . 25 26 Enter the larger of line 20 or line 25 26 Next, enter the smaller of line 17 or line 26 on line 27. Part II-C Additional Child Tax Credit 27 This is your additional child tax credit. Enter this amount on Form 1040, 1040-SR, or 1040-NR, line 28 27 Schedule 8812 (Form 1040) 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts