Question: These questions are confusing me a little. I keep getting different answers then the solution sheet. Thanks in advance for the help! Question 2- Uneven

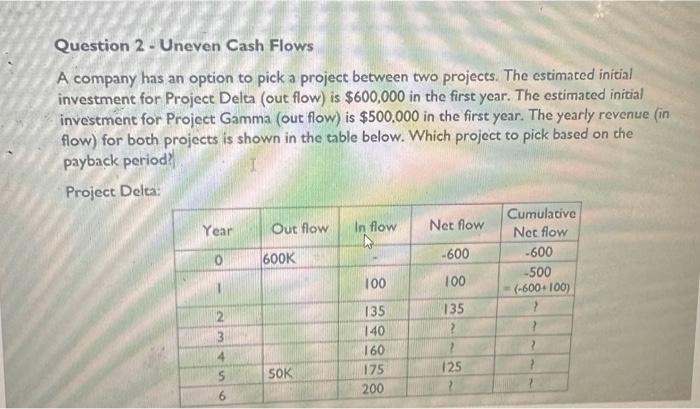

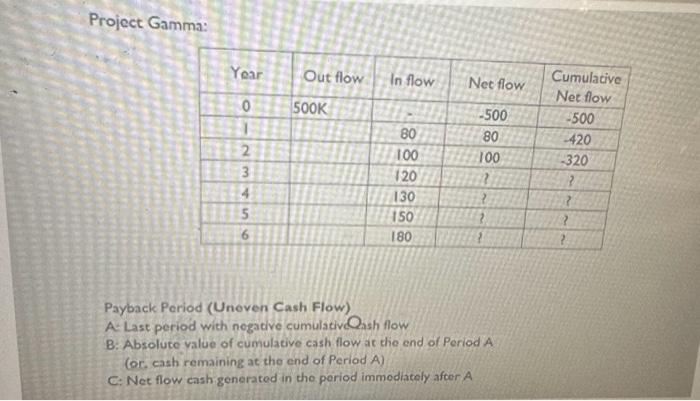

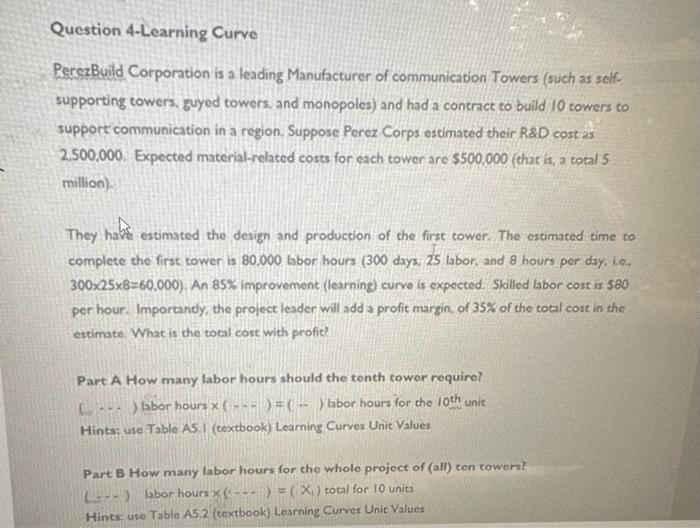

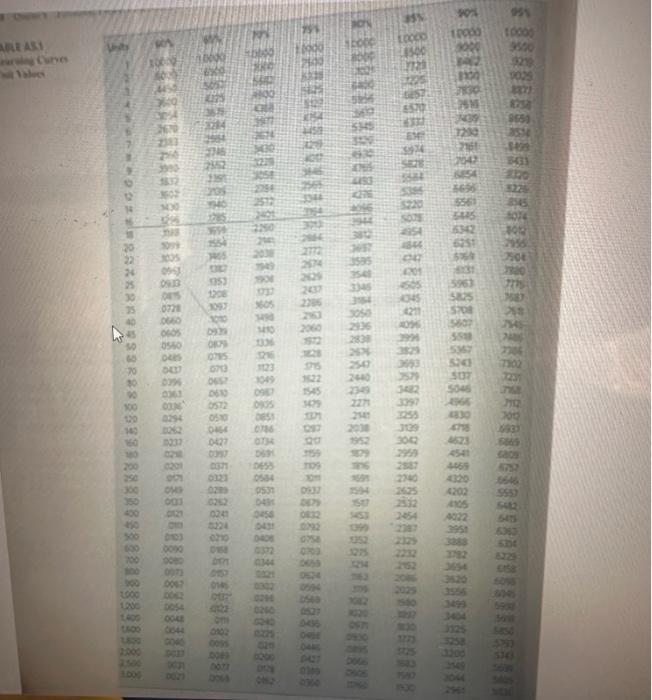

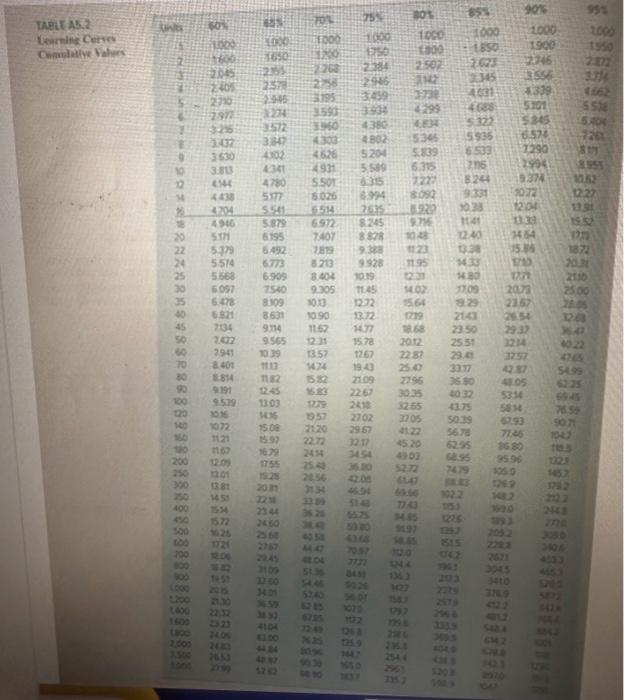

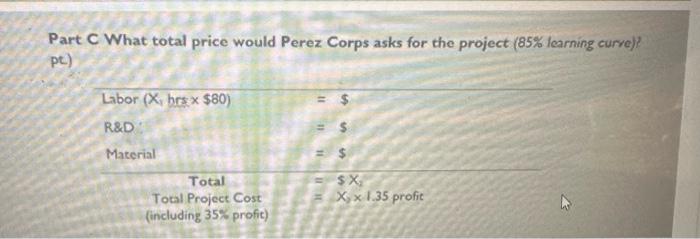

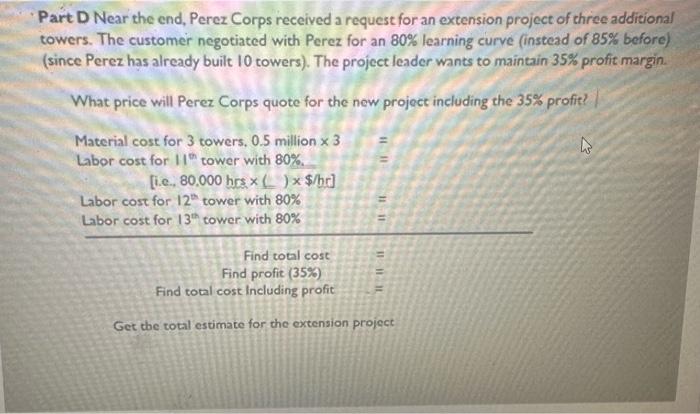

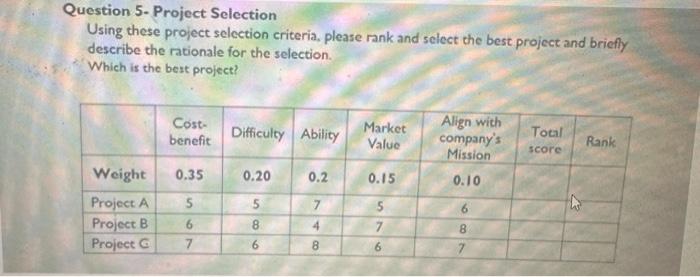

Question 2- Uneven Cash Flows A company has an option to pick a project between two projects. The estimated initial investment for Project Dela (out flow) is $600,000 in the first ycar. The estimated initial investment for Project Gamma (out flow) is $500,000 in the first year. The yearly revenue (in flow) for both projects is shown in the table below. Which project to pick based on the payback period? Project Delta: Part C What total price would Perez Corps asks for the project ( 85% learning curve)? pt) PersaBuild Corporation is a leading Manufacturer of communication Towers (such as selfsupporting towers, guyed towers, and monopoles) and had a contract to bulld 10 cowers to supportcommunication in a region. Suppose Perez Corps estimated their R\&D cost as 2500.000. Expected material-related costs for each tower are $500,000 (chat is, a total 5 million). They hate estimated the design and production of the first cower. The estimated time to complete the first tower is 80.000 bbor hours ( 300 days. 25 labor, and 8 hours per day, be, 300258=60,000 ). An 85% improvement (learning) curve is expected. Skilled labor cost is 580 per hour. Importandy, the project leader will add a profit margin, of 35% of the total eost in the estimate. What is the tocal cost with profic? Part A How many labor hours should the tenth tower require? (....) labor hours x(.)=.() babor hours for the 10 th unit Hints: use Table AS.I (cextbook) Learning Curves Unit Values Part B How many labor hours for the wholo project of (all) ton towers? (...) labor hours x()=(x1) total for 10 units Hints use Table AS.2 (coxtbook) Learning Curres Unic Vatudes Part D Near the end, Perez Corps received a request for an extension project of three additional towers. The customer negotiated with Perez for an 80% learning curve (instead of 85% before) (since Perez has already built 10 towers). The project leader wants to maintain 35% profit margin. What price will Perez Corps quote for the new project including the 35% profit? Find total cost Find profit (35\%) = Find cotal cost Including profit = = Get the total estimate for the extension project Question 5-Project Selection Using these project selection criteria, please rank and select the best project and briefly describe the rationale for the selection. Which is the best project? Zuestion 1- Even Cash Flows A company plans inxest $10.5 million in a project. The project leader expects $2.5 miltion per year for 8 years. Calculate payback period of the project. Question 3- Net Present Value An evalustion team projected the expected earnings from a project as the Year 4 is $300,000. What is the Net Present Value of the Return rate is 2018 ? Project Gamma: Payback Period (Uneven Cash Flow) A. Last period with negative cumulative Qsh flow B: Absolute value of cumulative cash flow at the end of Period A (oc, cash remaining at the end of Period A ) C. Net flow cash generated in the poriod immodiately after A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts