Question: These two questions are from two separate past exams from the same professor. I'm super confused because of the wording and wondering where to go

These two questions are from two separate past exams from the same professor. I'm super confused because of the wording and wondering where to go for each. (I really only need the answer to one since they're basically the same, I just figured more context would make it easier)

Here's my reasoning:

Should have done:

prepaid rent (debit): 3200

cash (credit): 3200

then to adjust monthly

rent expense (debit): 800

prepaid rent (credit): 800

Did do:

prepaid rent (debit): 3200

cash (credit): 3200

then to adjust:

rent payable (debit): 800

cash (credit): 800

Answer Choices:

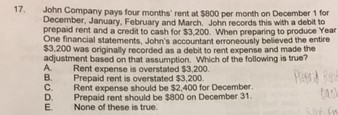

17.

A. Wrong because rent expense is understated $800 at this time

B. Wrong because prepaid rent is (hypothetically) only overstated $800 at this time

C. Wrong, rent expense should be $800 for December

D. Wrong, prepaid rent should be $2,400 on Dec 31 (value of account)

E. Right?

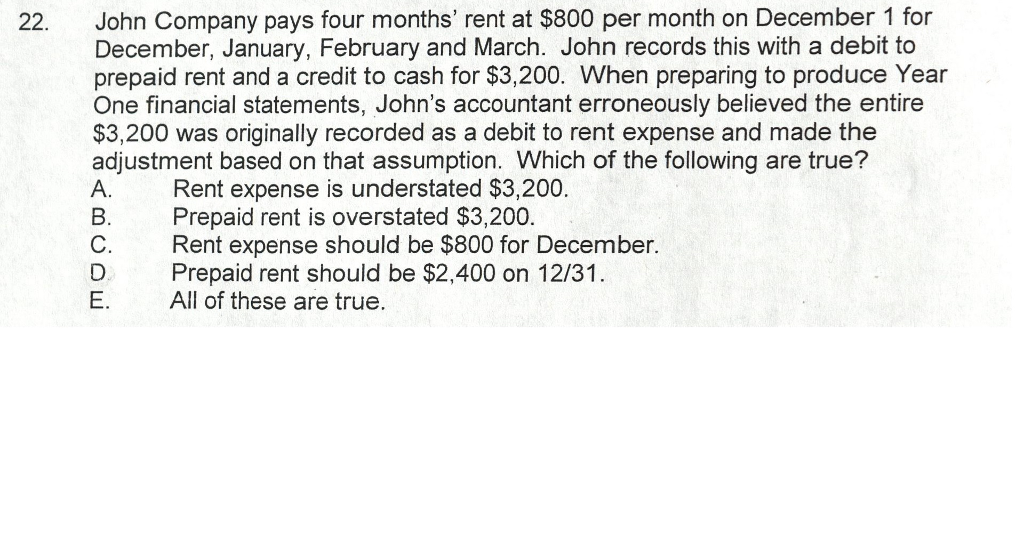

22.

A. Wrong because rent expense is (hypothetically) only understated $800 at this time

B. Wrong because prepaid rent is (hypothetically) only overstated $800 at this time

C. Right?

D. Right?

E. Maybe?

So the only combinations I can see for both these questions are

17. B and 22. E (this banks on the idea that the over/understatements are total and not based on the month)

or

17. D and 22. C (this banks on the idea that C and D for both only refer to the monthly adjustment entry values, and not to the balance in the accounts. This essentially makes it so that the phrasing "on Dec 31" and "for December" are interchangeable)

Probably didn't need all this explanation, but hopefully it helps. Thanks

17, John Company pays four months' rent at $800 per month on December 1 for rent and a credit to cash for $3,200. When preparing to produce Year One financial statements, John's accountant erroneously believed the entire $3.200 was originally recorded as a debit to rent expense and made the adjustment based on that assumption. Which of the following is true? A Rent expense is overstated $3.200. B. Prepaid rent is overstated $3,200. C. Rent expense should be $2,400 for December D. Prepaid rent should be $800 on December 31 E. None of these is true

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts