Question: These two questions are wrong, can anyone help me out here :/ Problem 5-7 IRR rule You have the chance to participate in a project

These two questions are wrong, can anyone help me out here :/

These two questions are wrong, can anyone help me out here :/

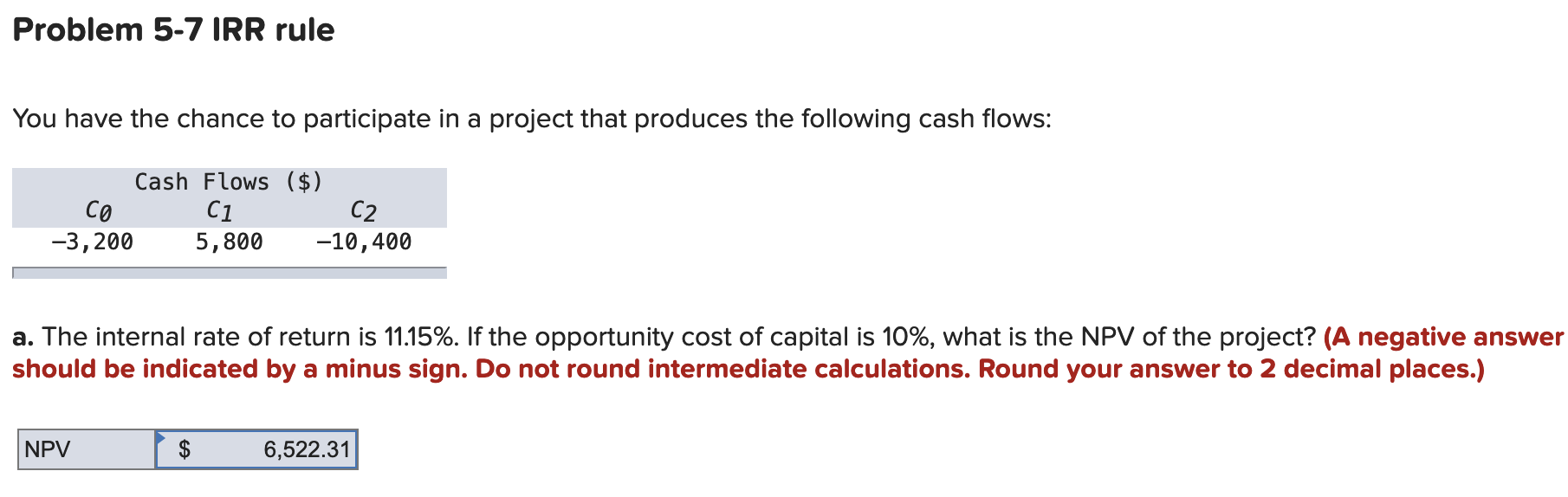

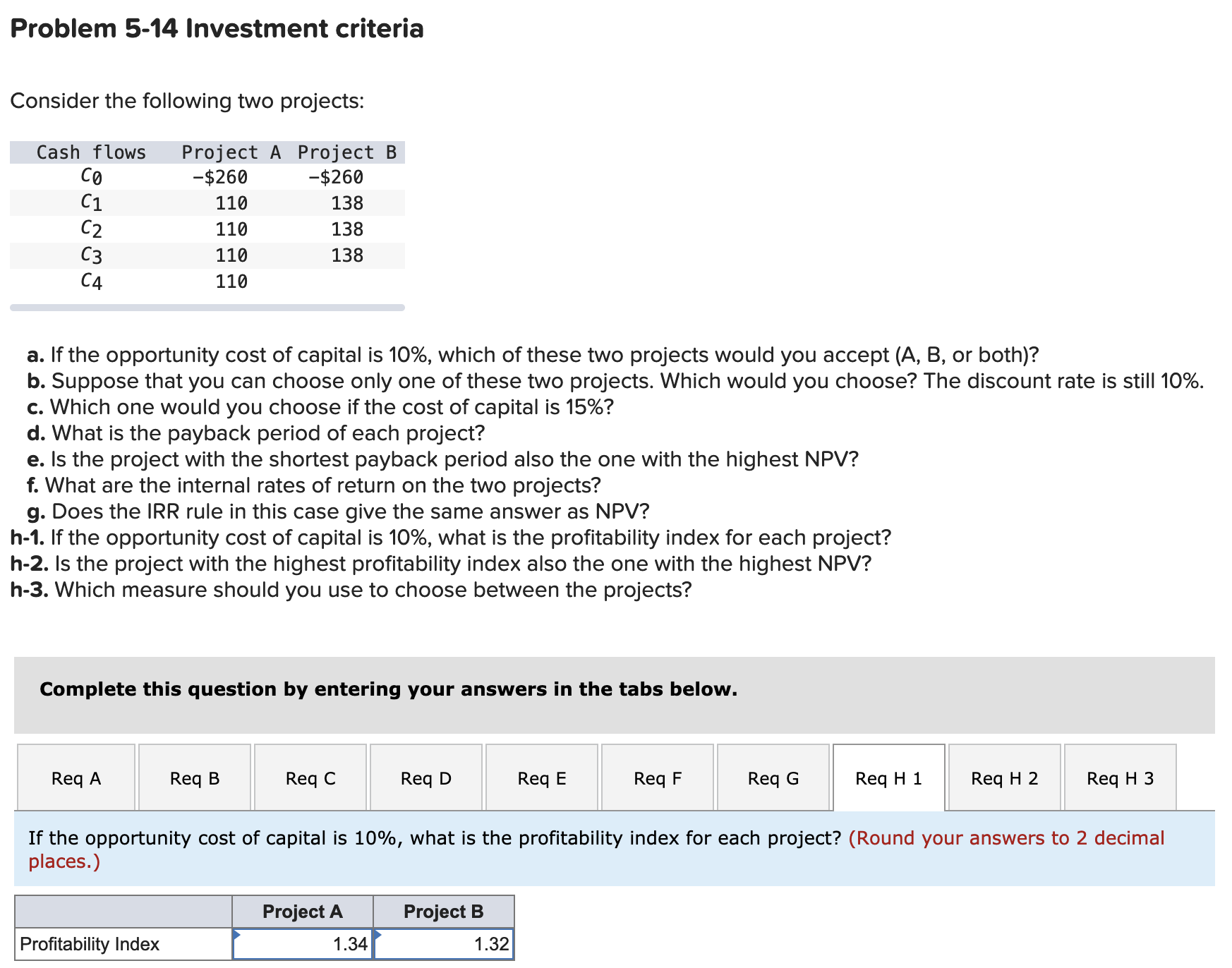

Problem 5-7 IRR rule You have the chance to participate in a project that produces the following cash flows: Cash Flows ($) co C1 C2 -3,200 5,800 -10,400 a. The internal rate of return is 11.15%. If the opportunity cost of capital is 10%, what is the NPV of the project? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.) NPV 6,522.31 Problem 5-14 Investment criteria Consider the following two projects: Cash flows C1 Project A Project B -$260 -$260 110 138 110 138 C2 C3 C4 110 138 110 a. If the opportunity cost of capital is 10%, which of these two projects would you accept (A, B, or both)? b. Suppose that you can choose only one of these two projects. Which would you choose? The discount rate is still 10%. c. Which one would you choose if the cost of capital is 15%? d. What is the payback period of each project? e. Is the project with the shortest payback period also the one with the highest NPV? f. What are the internal rates of return on the two projects? g. Does the IRR rule in this case give the same answer as NPV? h-1. If the opportunity cost of capital is 10%, what is the profitability index for each project? h-2. Is the project with the highest profitability index also the one with the highest NPV? h-3. Which measure should you use to choose between the projects? Complete this question by entering your answers in the tabs below. Req A Req B Reqc Req D Req E Reg F Req G Req H1 Reg H 2 Req H3 If the opportunity cost of capital is 10%, what is the profitability index for each project? (Round your answers to 2 decimal places.) Project A Project B Profitability Index 1.34 1.32

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts