Question: theses questions go togther. please solve and help. Given the following information answer questions 22 and 23: The current stock price of Tesla is $705,

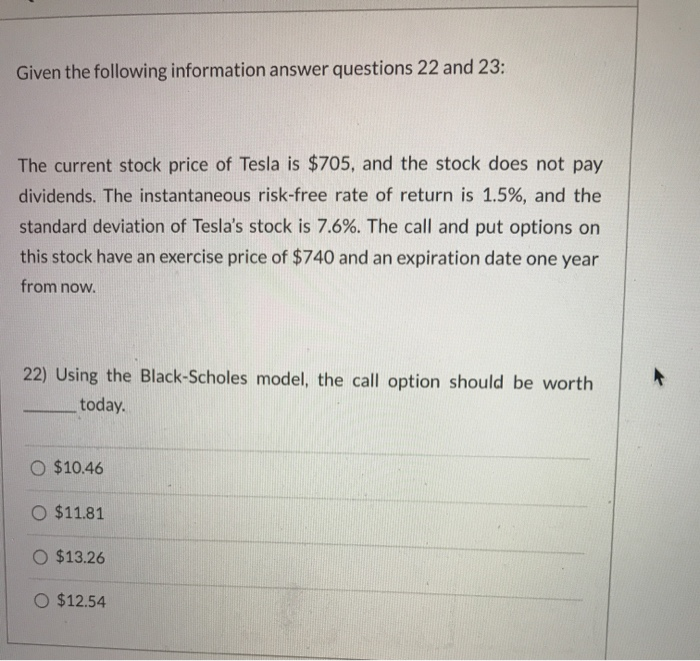

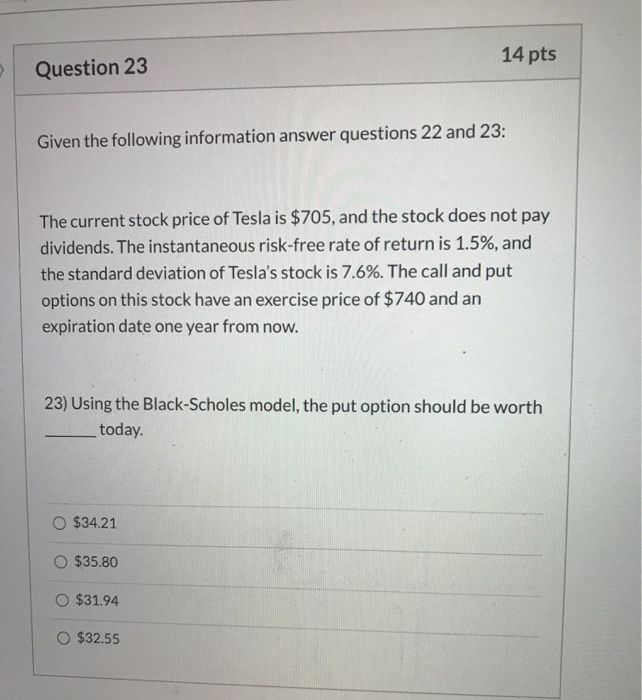

Given the following information answer questions 22 and 23: The current stock price of Tesla is $705, and the stock does not pay dividends. The instantaneous risk-free rate of return is 1.5%, and the standard deviation of Tesla's stock is 7.6%. The call and put options on this stock have an exercise price of $740 and an expiration date one year from now. 22) Using the Black-Scholes model, the call option should be worth today. O $10.46 O $11.81 $13.26 O $12.54 14 pts Question 23 Given the following information answer questions 22 and 23: The current stock price of Tesla is $705, and the stock does not pay dividends. The instantaneous risk-free rate of return is 1.5%, and the standard deviation of Tesla's stock is 7.6%. The call and put options on this stock have an exercise price of $740 and an expiration date one year from now. 23) Using the Black-Scholes model, the put option should be worth today. O $34.21 O $35.80 O $31.94 O $32.55

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts