Question: they are asking for the blank boxes. Question 1 1 pts Consider a 10-year bond with an annual coupon rate of 5%. The bond pays

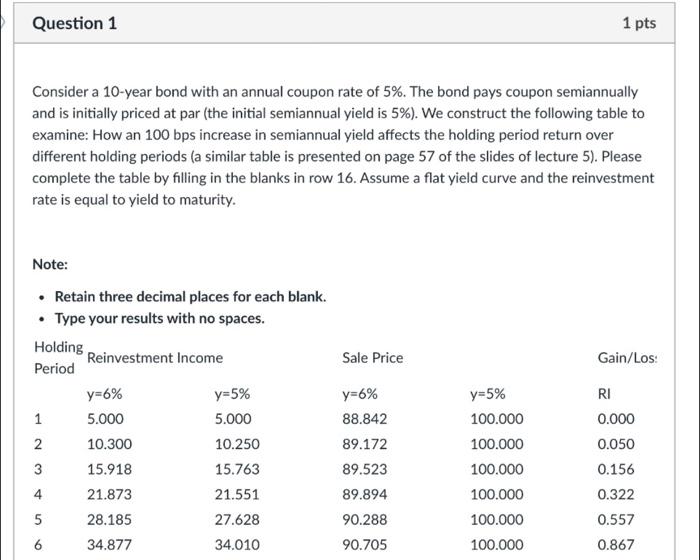

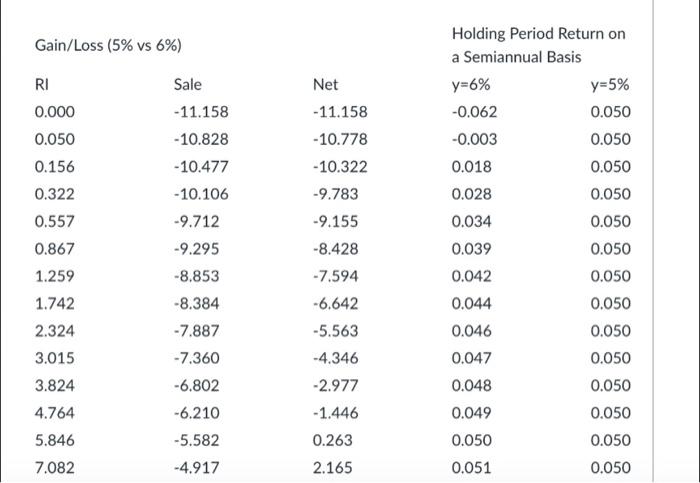

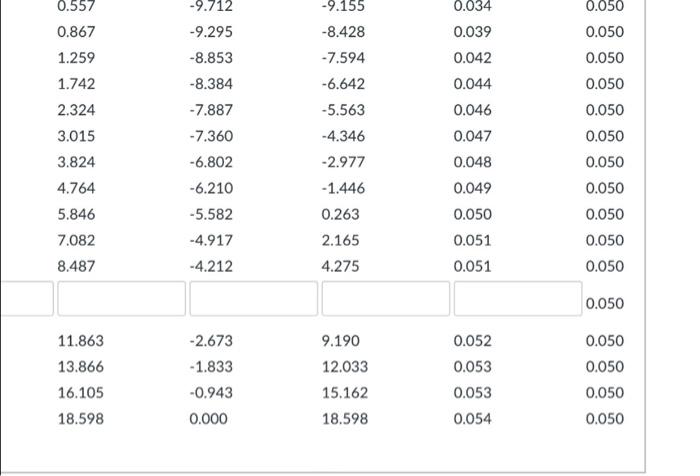

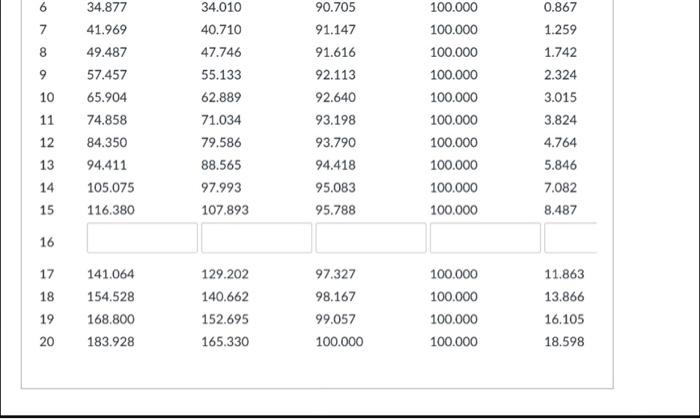

Question 1 1 pts Consider a 10-year bond with an annual coupon rate of 5%. The bond pays coupon semiannually and is initially priced at par (the initial semiannual yield is 5%). We construct the following table to examine: How an 100 bps increase in semiannual yield affects the holding period return over different holding periods (a similar table is presented on page 57 of the slides of lecture 5). Please complete the table by filling in the blanks in row 16. Assume a flat yield curve and the reinvestment rate is equal to yield to maturity. Note: Sale Price Gain/Los: Retain three decimal places for each blank. Type your results with no spaces. Holding Reinvestment Income Period y=6% y=5% 1 5.000 5.000 10.300 10.250 15.918 15.763 21.873 21.551 28.185 27.628 6 34.877 34.010 N 3 4 5 y=6% 88.842 89.172 89.523 89.894 90.288 90.705 y=5% 100.000 100.000 100.000 100.000 100.000 100.000 RI 0.000 0.050 0.156 0.322 0.557 0.867 Gain/Loss (5% vs 6%) Net -11.158 -10.778 -10.322 -9.783 RI 0.000 0.050 0.156 0.322 0.557 0.867 1.259 1.742 2.324 3.015 3.824 4.764 Sale - 11.158 - 10.828 - 10.477 - 10.106 -9.712 -9.295 -8.853 -8.384 -7.887 -7.360 -6.802 -6.210 -5.582 -4.917 -9.155 -8.428 -7.594 Holding Period Return on a Semiannual Basis y=6% y=5% -0.062 0.050 -0.003 0.050 0.018 0.050 0.028 0.050 0.034 0.050 0.039 0.050 0.042 0.050 0.044 0.050 0.046 0.050 0.047 0.050 0.048 0.050 0.049 0.050 0.050 0.050 0.051 0.050 -6.642 -5.563 -4.346 -2.977 -1.446 0.263 5.846 7.082 2.165 -9.155 0.557 0.867 1.259 -9.712 -9.295 -8.853 -8.428 -7.594 0.034 0.039 0.042 1.742 2.324 3.015 3.824 4.764 5.846 7.082 8.487 -8.384 -7.887 -7.360 -6.802 -6.210 -5.582 -4.917 -4.212 -6.642 -5.563 -4.346 -2.977 - 1.446 0.263 2.165 4.275 0.044 0.046 0.047 0.048 0.049 0.050 0.051 0.051 0.050 0.050 0.050 0.050 0.050 0.050 0.050 0.050 0.050 0.050 0.050 0.050 11.863 13.866 16.105 18.598 -2.673 -1.833 -0.943 0.000 9.190 12.033 15.162 18.598 0.052 0.053 0.053 0.054 0.050 0.050 0.050 0.050 6 7 8 9 34.877 41.969 49.487 57.457 65.904 74.858 84.350 94.411 105.075 116.380 10 34.010 40.710 47.746 55.133 62.889 71.034 79.586 88.565 97.993 107.893 90.705 91.147 91.616 92.113 92.640 93.198 93.790 94.418 95.083 95.788 100.000 100.000 100.000 100.000 100.000 100.000 100.000 100.000 100.000 100.000 0.867 1.259 1.742 2.324 3.015 3.824 4.764 11 12 5.846 13 14 7.082 8.487 15 16 17 18 141.064 154.528 168.800 183.928 129.202 140.662 152.695 165.330 97.327 98.167 99.057 100.000 100.000 100.000 100.000 100.000 11.863 13.866 16.105 18.598 19 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts