Question: They would all like to avoid personal liability for debts of the business and / or wrongful acts of each other. They would also like

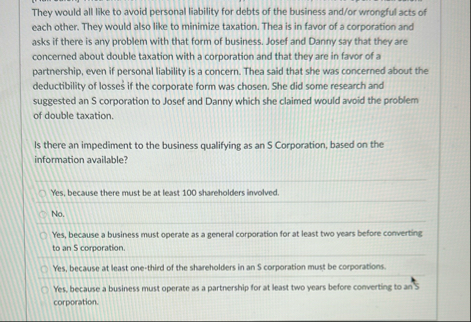

They would all like to avoid personal liability for debts of the business andor wrongful acts of each other. They would also like to minimize taxation. Thea is in favor of a corporation and asks if there is any problem with that form of business. Josef and Danny say that they are concerned about double taxation with a corporation and that they are in favor of a partnership, even if personal liability is a concern. Thea said that she was concerned about the deductibility of losses if the corporate form was chosen. She did some research and suggested an S corporation to Josef and Danny which she claimed would avoid the problem of double taxation.

Is there an impediment to the business qualifying as an S Corporation, based on the information available?

Yes, because there must be at least shareholders involved.

No

Yes, because a business must operate as a general corporation for at least two years before converting to an corporation.

Yes, because at least onethird of the shareholders in an $ corporation must be corporations.

Yes, because a business must operate as a partnership for at least two years before comverting to an $ corporation.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock