Question: Thinking Hat would like to start a new project which will require $28 million in the initial cost. The company is planning to raise this

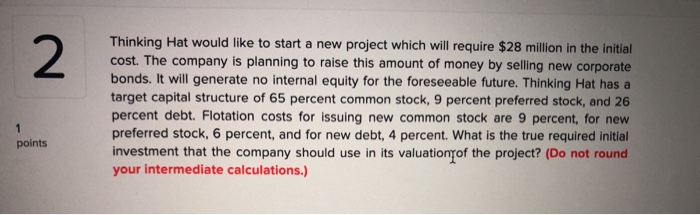

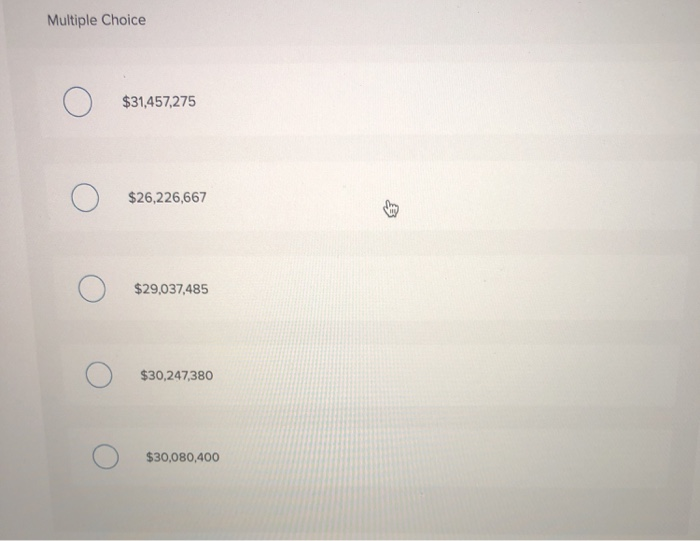

Thinking Hat would like to start a new project which will require $28 million in the initial cost. The company is planning to raise this amount of money by selling new corporate bonds. It will generate no internal equity for the foreseeable future. Thinking Hat has a target capital structure of 65 percent common stock, 9 percent preferred stock, and 26 percent debt. Flotation costs for issuing new common stock are 9 percent, for new preferred stock, 6 percent, and for new debt, 4 percent. What is the true required initial investment that the company should use in its valuationof the project? (Do not round your intermediate calculations.) points Multiple Choice $31,457,275 $26,226,667 $29,037,485 $30,247,380 $30,080,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts