Question: third photo is part two of problem 3. Payment = Loan Amount divided by Table Factor Problem 1 Your business is planning to borrow $350,000.

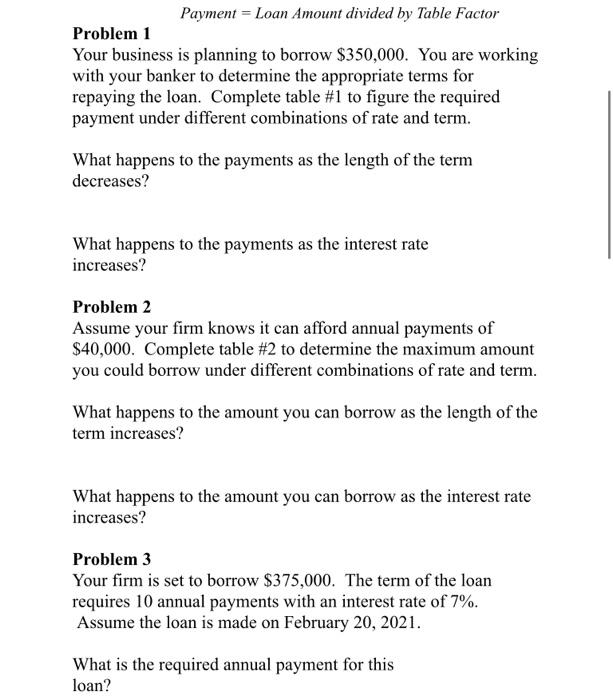

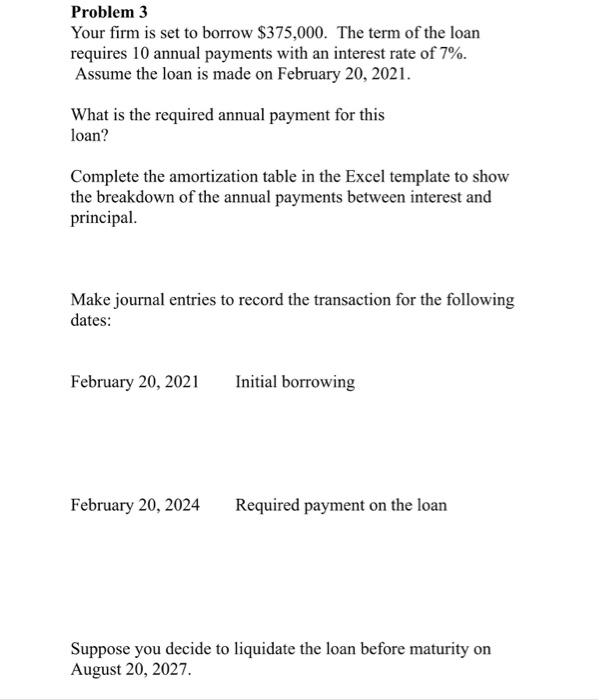

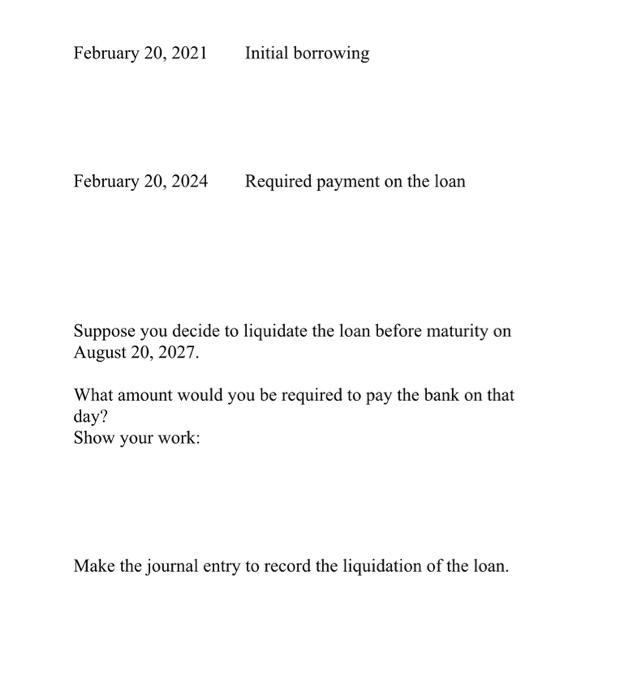

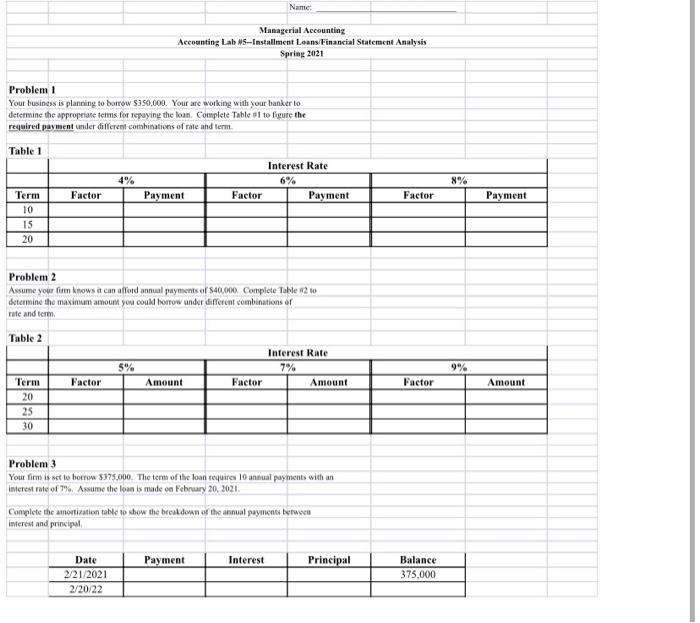

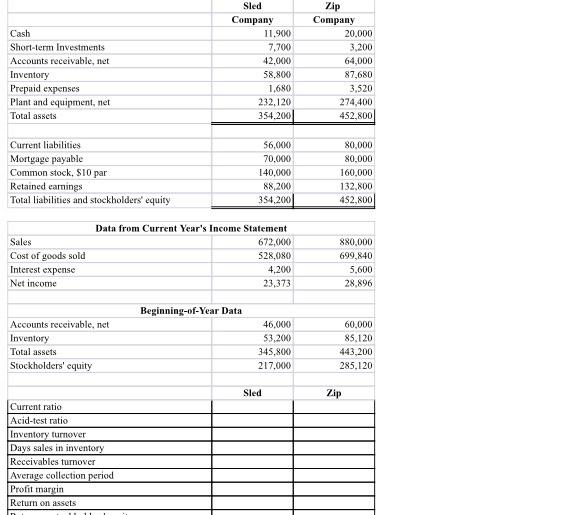

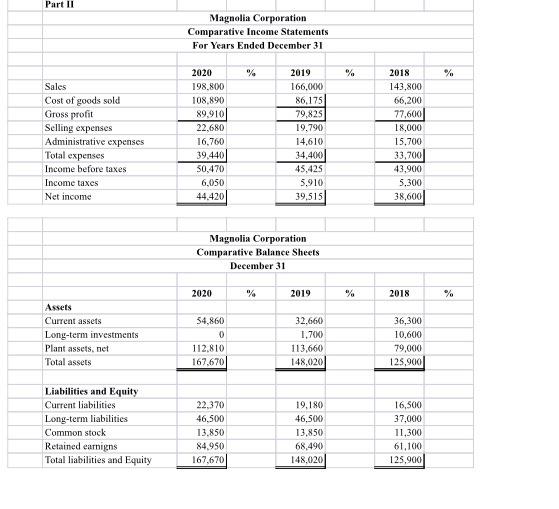

Payment = Loan Amount divided by Table Factor Problem 1 Your business is planning to borrow $350,000. You are working with your banker to determine the appropriate terms for repaying the loan. Complete table #1 to figure the required payment under different combinations of rate and term. What happens to the payments as the length of the term decreases? What happens to the payments as the interest rate increases? Problem 2 Assume your firm knows it can afford annual payments of $40,000. Complete table #2 to determine the maximum amount you could borrow under different combinations of rate and term. What happens to the amount you can borrow as the length of the term increases? What happens to the amount you can borrow as the interest rate increases? Problem 3 Your firm is set to borrow $375,000. The term of the loan requires 10 annual payments with an interest rate of 7%. Assume the loan is made on February 20, 2021. What is the required annual payment for this loan? Problem 3 Your firm is set to borrow $375,000. The term of the loan requires 10 annual payments with an interest rate of 7%. Assume the loan is made on February 20, 2021. What is the required annual payment for this loan? Complete the amortization table in the Excel template to show the breakdown of the annual payments between interest and principal Make journal entries to record the transaction for the following dates: February 20, 2021 Initial borrowing February 20, 2024 Required payment on the loan Suppose you decide to liquidate the loan before maturity on August 20, 2027 February 20, 2021 Initial borrowing February 20, 2024 Required payment on the loan Suppose you decide to liquidate the loan before maturity on August 20, 2027. What amount would you be required to pay the bank on that day? Show your work: Make the journal entry to record the liquidation of the loan. Name: Managerial Accounting Accounting Lab N5--Installment Loans Financial Statement Analysis Spring 2021 Problem 1 Your business is planning to borrow $350,000. Your are working with your banker to determine the appropriate tems for repaying the loan. Complete Table to figure the required payment under different combinations of rate and term Table 1 4% Interest Rate 6% Factor Payment 8% Factor Payment Factor Payment Term 10 15 20 Problem 2 Assume your firm knows it can afford annual payments of $40,000 Complete Table 210 determine the maximum amount you could borrow under different combinations or rate and term Table 2 5% Interest Rate 7% Amount 9% Factor Amount Factor Factor Amount Term 20 25 30 Problem 3 Your firm is set to borrow $375.000. The term of the loan require 10 annual payments with an interest rate of 7%. Assume the loan is made on February 20, 2021 Complete the amortization table to show the break doan of the annual payments between interest and principal Payment Interest Principal Date 2/21/2021 2/20/22 Balance 375,000 Cash Short-term Investments Accounts receivable, net Inventory Prepaid expenses Plant and equipment, net Total assets Sled Company 11.900 7,700 42.000 58.800 1.680 232,120 354.200 Zip Company 20.000 3.200 64.000 87,680 3.520 274,400 452,800 Current liabilities Mortgage payable Common stock, Sio par Retained earings Total liabilities and stockholders' equity 56,000 70.000 140,000 88,200 354,200 80,000 80,000 160,000 132.800 452,800 Sales Cost of goods sold Interest expense Net income Data from Current Year's Income Statement 672,000 528.080 4.200 23,373 880,000 699,840 5,600 28.896 Beginning-of-Year Data Accounts receivable.net Inventory Total assets Stockholders' equity 46,000 53.200 345,800 217,000 60,000 85,120 443,200 285,120 Sled Zip Current ratio Acid-test ratio Inventory turnover Days sales in inventory Receivables turnover Average collection period Profit margin Return on assets Part II Magnolia Corporation Comparative Income Statements For Years Ended December 31 % % % Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income taxes Net income 2020 198,800 108,890 89,910 22.680 16,760 39,440 50,470 6,050 44.420 2019 166,00K) 86,175 79,825 19.790 14,610 34,400 45,425 5.910 39,5151 2018 143.800 66,200 77,600 18,000 15,700 33,7001 43,900 5.300 38,600 Magnolia Corporation Comparative Balance Sheets December 31 2020 2019 % 2018 % Assets Current assets Long-term investments Plant assets.net Total assets 54,860 0 112.810 167,670 32.660) 1,700 113,660 148,020 36,300 10,600 79,000 125.900 Liabilities and Equity Current liabilities Long-term liabilities Common stock Retained earnigns Total liabilities and Equity 22,370 46,500 13.850 84.950 167,670 19,180 46,500 13,850 68,490 148,020 16,500 37.000 11,300 61,100 125.900 Payment = Loan Amount divided by Table Factor Problem 1 Your business is planning to borrow $350,000. You are working with your banker to determine the appropriate terms for repaying the loan. Complete table #1 to figure the required payment under different combinations of rate and term. What happens to the payments as the length of the term decreases? What happens to the payments as the interest rate increases? Problem 2 Assume your firm knows it can afford annual payments of $40,000. Complete table #2 to determine the maximum amount you could borrow under different combinations of rate and term. What happens to the amount you can borrow as the length of the term increases? What happens to the amount you can borrow as the interest rate increases? Problem 3 Your firm is set to borrow $375,000. The term of the loan requires 10 annual payments with an interest rate of 7%. Assume the loan is made on February 20, 2021. What is the required annual payment for this loan? Problem 3 Your firm is set to borrow $375,000. The term of the loan requires 10 annual payments with an interest rate of 7%. Assume the loan is made on February 20, 2021. What is the required annual payment for this loan? Complete the amortization table in the Excel template to show the breakdown of the annual payments between interest and principal Make journal entries to record the transaction for the following dates: February 20, 2021 Initial borrowing February 20, 2024 Required payment on the loan Suppose you decide to liquidate the loan before maturity on August 20, 2027 February 20, 2021 Initial borrowing February 20, 2024 Required payment on the loan Suppose you decide to liquidate the loan before maturity on August 20, 2027. What amount would you be required to pay the bank on that day? Show your work: Make the journal entry to record the liquidation of the loan. Name: Managerial Accounting Accounting Lab N5--Installment Loans Financial Statement Analysis Spring 2021 Problem 1 Your business is planning to borrow $350,000. Your are working with your banker to determine the appropriate tems for repaying the loan. Complete Table to figure the required payment under different combinations of rate and term Table 1 4% Interest Rate 6% Factor Payment 8% Factor Payment Factor Payment Term 10 15 20 Problem 2 Assume your firm knows it can afford annual payments of $40,000 Complete Table 210 determine the maximum amount you could borrow under different combinations or rate and term Table 2 5% Interest Rate 7% Amount 9% Factor Amount Factor Factor Amount Term 20 25 30 Problem 3 Your firm is set to borrow $375.000. The term of the loan require 10 annual payments with an interest rate of 7%. Assume the loan is made on February 20, 2021 Complete the amortization table to show the break doan of the annual payments between interest and principal Payment Interest Principal Date 2/21/2021 2/20/22 Balance 375,000 Cash Short-term Investments Accounts receivable, net Inventory Prepaid expenses Plant and equipment, net Total assets Sled Company 11.900 7,700 42.000 58.800 1.680 232,120 354.200 Zip Company 20.000 3.200 64.000 87,680 3.520 274,400 452,800 Current liabilities Mortgage payable Common stock, Sio par Retained earings Total liabilities and stockholders' equity 56,000 70.000 140,000 88,200 354,200 80,000 80,000 160,000 132.800 452,800 Sales Cost of goods sold Interest expense Net income Data from Current Year's Income Statement 672,000 528.080 4.200 23,373 880,000 699,840 5,600 28.896 Beginning-of-Year Data Accounts receivable.net Inventory Total assets Stockholders' equity 46,000 53.200 345,800 217,000 60,000 85,120 443,200 285,120 Sled Zip Current ratio Acid-test ratio Inventory turnover Days sales in inventory Receivables turnover Average collection period Profit margin Return on assets Part II Magnolia Corporation Comparative Income Statements For Years Ended December 31 % % % Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income taxes Net income 2020 198,800 108,890 89,910 22.680 16,760 39,440 50,470 6,050 44.420 2019 166,00K) 86,175 79,825 19.790 14,610 34,400 45,425 5.910 39,5151 2018 143.800 66,200 77,600 18,000 15,700 33,7001 43,900 5.300 38,600 Magnolia Corporation Comparative Balance Sheets December 31 2020 2019 % 2018 % Assets Current assets Long-term investments Plant assets.net Total assets 54,860 0 112.810 167,670 32.660) 1,700 113,660 148,020 36,300 10,600 79,000 125.900 Liabilities and Equity Current liabilities Long-term liabilities Common stock Retained earnigns Total liabilities and Equity 22,370 46,500 13.850 84.950 167,670 19,180 46,500 13,850 68,490 148,020 16,500 37.000 11,300 61,100 125.900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts