Question: Third times asking please help (must show all work equations) Sleepwell Co. produces foam-topped mattresses and foam mattress pads. The mattress pads were originally designed

Third times asking please help

(must show all work equations)

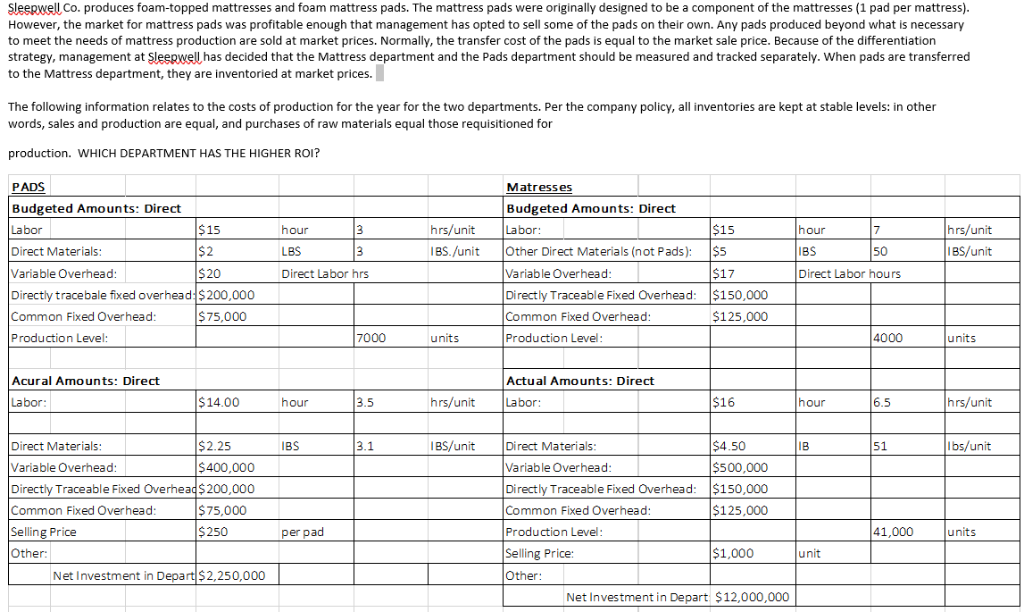

Sleepwell Co. produces foam-topped mattresses and foam mattress pads. The mattress pads were originally designed to be a component of the mattresses (1 pad per mattress) However, the market for mattress pads was profitable enough that management has opted to sell some of the pads on their own. Any pads produced beyond what is necessary to meet the needs of mattress production are sold at market prices. Normally, the transfer cost of the pads is equal to the market sale price. Because of the differentiation strategy, management at Sleepwell has decided that the Mattress department and the Pads department should be measured and tracked separately. When pads are transferred to the Mattress department, they are inventoried at market prices. The following information relates to the costs of production for the year for the two departments. Per the company policy, all inventories are kept at stable levels: in other words, sales and production are equal, and purchases of raw materials equal those requisitioned for production. WHICH DEPARTMENT HAS THE HIGHER ROI? PADS Budgeted Amounts: Direct Labor Direct Materials Variable Overhead Directly tracebale fixed overhead $200,000 Common Fixed Overhead Production Level Matress es Budgeted Amounts: Direct $15 $2 $20 $15 hour LBS Direct Labor hrs hrs/unit Labor: IBS./unit Other Direct Materials (not Pads): $5 hour IBS Direct Labor hours hrs/unit IBS/unit 50 $17 Variable Overhead Directly Traceable Fixed Overhead: $150,000 Common Fixed Overhead Production Level $75,000 $125,000 7000 4000 units units Acural Amounts: Direct Actual Amounts: Direct 14.00 3.5 hrs/unit Labor: $16 6.5 hrs/unit Labor hour hour $4.50 $500,000 Direct Materials Variable Overhead Directly Traceable Fixed Overhead$200,000 Common Fixed Overhead Selling Price Other 2.25 $400,000 IBS 3.1 B/unitDirect Materials 51 lbs/unit IB Variable Overhead Directly Traceable Fixed Overhead: $150,000 Common Fixed Overhead Production Level Selling Price: Other 125,000 $75,000 $250 per pad 41,000 units $1,000 unit Net Investment in Depart $2,250,000 Net Investment in Depart $12,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts