Question: this abould be clear please look at the other question that should be clear othbrok industries is evaluating the following the independent senter financing arrangements.

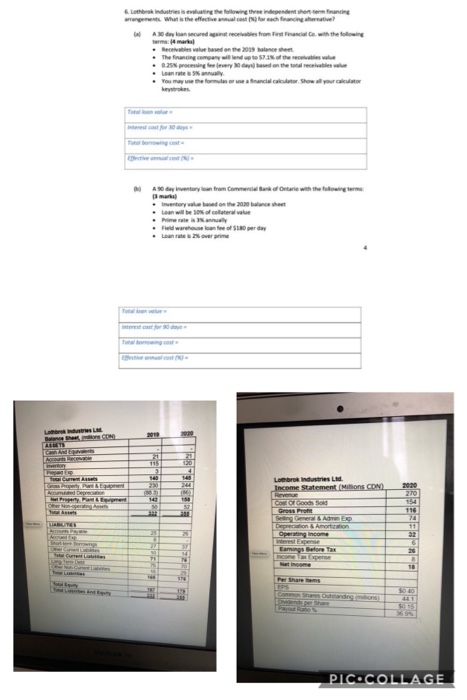

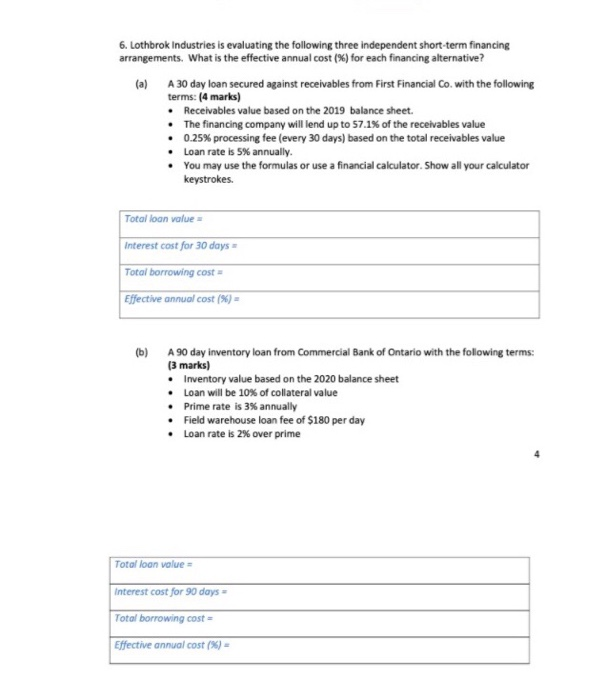

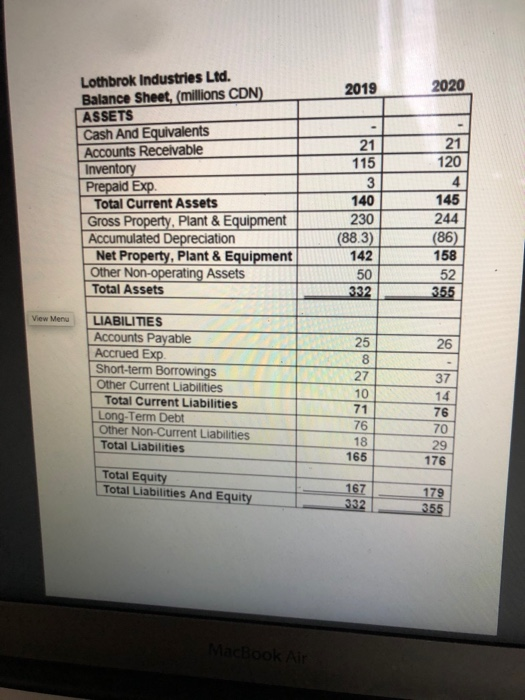

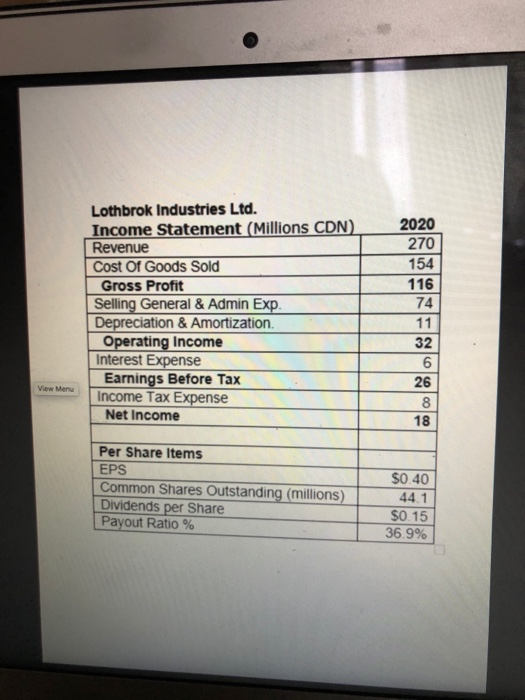

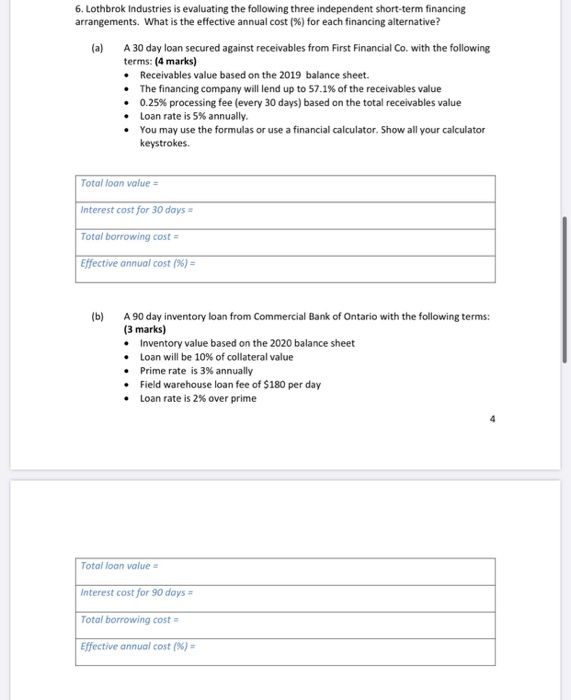

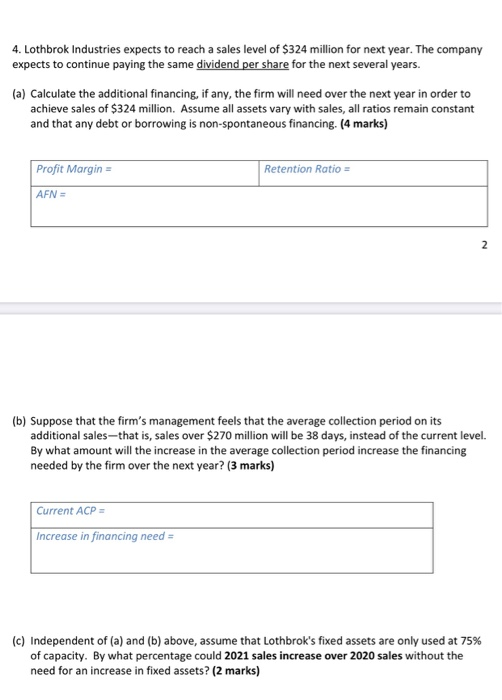

othbrok industries is evaluating the following the independent senter financing arrangements. What the effectiveness for each financingarnative? Adny konsecured preces from First Co with the following Receivables value based on the 2013 balance sheet The financing company will land up to 73 of the rele 0.25% processing fee every dan based on the total receivables value Larutely You may use the former financial Show all your calculator Inventory le based on the 200 balance sheet Loan will be nocte . Primera . Feld warehouse loan fee of $180 per day Instre TS 120 4 145 244 sed TI LAPSE Acad Deprem 2020 270 154 116 Othere 90 Lobo Industries La Income Statement (Milons CON Cost Of Goods So Seling General Admin Ep Deprecation & Amortization Operating Income Lamangs Before Tax CUTE A 23 TE 18 $0.00 015 PIC COLLAGE 6. Lothbrok Industries is evaluating the following three independent short-term financing arrangements. What is the effective annual cost (%) for each financing alternative? (a) A 30 day loan secured against receivables from First Financial Co. with the following terms: (4 marks) Receivables value based on the 2019 balance sheet. The financing company will lend up to 57.1% of the receivables value . 0.25% processing fee (every 30 days) based on the total receivables value Loan rate is 5% annually. You may use the formulas or use a financial calculator Show all your calculator keystrokes. Total loan value Interest cost for 30 days Total borrowing cost - Effective annual cost (%) - (b) A 90 day inventory loan from Commercial Bank of Ontario with the following terms: (3 marks) Inventory value based on the 2020 balance sheet Loan will be 10% of collateral value Prime rate is 3% annually Field warehouse loan fee of $180 per day Loan rate is 2% over prime Total loan value = Interest cost for 90 days Total borrowing cost = Effective annual cost (%) = 2019 2020 Lothbrok Industries Ltd. Balance Sheet, (millions CDN) ASSETS Cash And Equivalents Accounts Receivable Inventory Prepaid Exp. Total Current Assets Gross Property. Plant & Equipment Accumulated Depreciation Net Property, Plant & Equipment Other Non-operating Assets Total Assets 21 115 3 140 230 (88.3) 142 50 332 21 120 4 145 244 (86) 158 52 355 View Menu 26 LIABILITIES Accounts Payable Accrued Exp Short-term Borrowings Other Current Liabilities Total Current Liabilities Long-Term Debt Other Non-Current Liabilities Total Liabilities 25 8 27 10 71 76 18 165 37 14 76 70 29 176 Total Equity Total Liabilities And Equity 167 332 179 355 MacBook Air Lothbrok Industries Ltd. Income Statement (Millions CDN) Revenue Cost Of Goods Sold Gross Profit Selling General & Admin Exp. Depreciation & Amortization. Operating Income Interest Expense Earnings Before Tax Income Tax Expense Net Income 2020 270 154 116 74 11 32 View Menu 6 26 8 18 Per Share Items EPS Common Shares Outstanding (millions) Dividends per Share Payout Ratio % $0.40 44.1 $0.15 36.9% 6. Lothbrok Industries is evaluating the following three independent short-term financing arrangements. What is the effective annual cost (%) for each financing alternative? (a) A 30 day loan secured against receivables from First Financial Co. with the following terms: (4 marks) Receivables value based on the 2019 balance sheet. The financing company will lend up to 57.1% of the receivables value 0.25% processing fee (every 30 days) based on the total receivables value Loan rate is 5% annually. You may use the formulas or use a financial calculator. Show all your calculator keystrokes. Total loan value Interest cost for 30 days Total borrowing cost = Effective annual cost (%) = (b) A 90 day inventory loan from Commercial Bank of Ontario with the following terms: (3 marks) Inventory value based on the 2020 balance sheet Loan will be 10% of collateral value Prime rate is 3% annually Field warehouse loan fee of $180 per day Loan rate is 2% over prime 4 Total loan value Interest cost for 90 days Total borrowing cost = Effective annual cost (%) = 4. Lothbrok Industries expects to reach a sales level of $324 million for next year. The company expects to continue paying the same dividend per share for the next several years. (a) Calculate the additional financing, if any, the firm will need over the next year in order to achieve sales of $324 million. Assume all assets vary with sales, all ratios remain constant and that any debt or borrowing is non-spontaneous financing. (4 marks) Profit Margin= Retention Ratio = AFN = 2 (b) Suppose that the firm's management feels that the average collection period on its additional sales-that is, sales over $270 million will be 38 days, instead of the current level. By what amount will the increase in the average collection period increase the financing needed by the firm over the next year? (3 marks) Current ACP = Increase in financing need = (c) Independent of (a) and (b) above, assume that Lothbrok's fixed assets are only used at 75% of capacity. By what percentage could 2021 sales increase over 2020 sales without the need for an increase in fixed assets? (2 marks) othbrok industries is evaluating the following the independent senter financing arrangements. What the effectiveness for each financingarnative? Adny konsecured preces from First Co with the following Receivables value based on the 2013 balance sheet The financing company will land up to 73 of the rele 0.25% processing fee every dan based on the total receivables value Larutely You may use the former financial Show all your calculator Inventory le based on the 200 balance sheet Loan will be nocte . Primera . Feld warehouse loan fee of $180 per day Instre TS 120 4 145 244 sed TI LAPSE Acad Deprem 2020 270 154 116 Othere 90 Lobo Industries La Income Statement (Milons CON Cost Of Goods So Seling General Admin Ep Deprecation & Amortization Operating Income Lamangs Before Tax CUTE A 23 TE 18 $0.00 015 PIC COLLAGE 6. Lothbrok Industries is evaluating the following three independent short-term financing arrangements. What is the effective annual cost (%) for each financing alternative? (a) A 30 day loan secured against receivables from First Financial Co. with the following terms: (4 marks) Receivables value based on the 2019 balance sheet. The financing company will lend up to 57.1% of the receivables value . 0.25% processing fee (every 30 days) based on the total receivables value Loan rate is 5% annually. You may use the formulas or use a financial calculator Show all your calculator keystrokes. Total loan value Interest cost for 30 days Total borrowing cost - Effective annual cost (%) - (b) A 90 day inventory loan from Commercial Bank of Ontario with the following terms: (3 marks) Inventory value based on the 2020 balance sheet Loan will be 10% of collateral value Prime rate is 3% annually Field warehouse loan fee of $180 per day Loan rate is 2% over prime Total loan value = Interest cost for 90 days Total borrowing cost = Effective annual cost (%) = 2019 2020 Lothbrok Industries Ltd. Balance Sheet, (millions CDN) ASSETS Cash And Equivalents Accounts Receivable Inventory Prepaid Exp. Total Current Assets Gross Property. Plant & Equipment Accumulated Depreciation Net Property, Plant & Equipment Other Non-operating Assets Total Assets 21 115 3 140 230 (88.3) 142 50 332 21 120 4 145 244 (86) 158 52 355 View Menu 26 LIABILITIES Accounts Payable Accrued Exp Short-term Borrowings Other Current Liabilities Total Current Liabilities Long-Term Debt Other Non-Current Liabilities Total Liabilities 25 8 27 10 71 76 18 165 37 14 76 70 29 176 Total Equity Total Liabilities And Equity 167 332 179 355 MacBook Air Lothbrok Industries Ltd. Income Statement (Millions CDN) Revenue Cost Of Goods Sold Gross Profit Selling General & Admin Exp. Depreciation & Amortization. Operating Income Interest Expense Earnings Before Tax Income Tax Expense Net Income 2020 270 154 116 74 11 32 View Menu 6 26 8 18 Per Share Items EPS Common Shares Outstanding (millions) Dividends per Share Payout Ratio % $0.40 44.1 $0.15 36.9% 6. Lothbrok Industries is evaluating the following three independent short-term financing arrangements. What is the effective annual cost (%) for each financing alternative? (a) A 30 day loan secured against receivables from First Financial Co. with the following terms: (4 marks) Receivables value based on the 2019 balance sheet. The financing company will lend up to 57.1% of the receivables value 0.25% processing fee (every 30 days) based on the total receivables value Loan rate is 5% annually. You may use the formulas or use a financial calculator. Show all your calculator keystrokes. Total loan value Interest cost for 30 days Total borrowing cost = Effective annual cost (%) = (b) A 90 day inventory loan from Commercial Bank of Ontario with the following terms: (3 marks) Inventory value based on the 2020 balance sheet Loan will be 10% of collateral value Prime rate is 3% annually Field warehouse loan fee of $180 per day Loan rate is 2% over prime 4 Total loan value Interest cost for 90 days Total borrowing cost = Effective annual cost (%) = 4. Lothbrok Industries expects to reach a sales level of $324 million for next year. The company expects to continue paying the same dividend per share for the next several years. (a) Calculate the additional financing, if any, the firm will need over the next year in order to achieve sales of $324 million. Assume all assets vary with sales, all ratios remain constant and that any debt or borrowing is non-spontaneous financing. (4 marks) Profit Margin= Retention Ratio = AFN = 2 (b) Suppose that the firm's management feels that the average collection period on its additional sales-that is, sales over $270 million will be 38 days, instead of the current level. By what amount will the increase in the average collection period increase the financing needed by the firm over the next year? (3 marks) Current ACP = Increase in financing need = (c) Independent of (a) and (b) above, assume that Lothbrok's fixed assets are only used at 75% of capacity. By what percentage could 2021 sales increase over 2020 sales without the need for an increase in fixed assets? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts