Question: This all one question Styles Editing 1. You are a Security Analyst at Oman Data Park Inc., and your Chief Information Security Officer has requested

This all one question

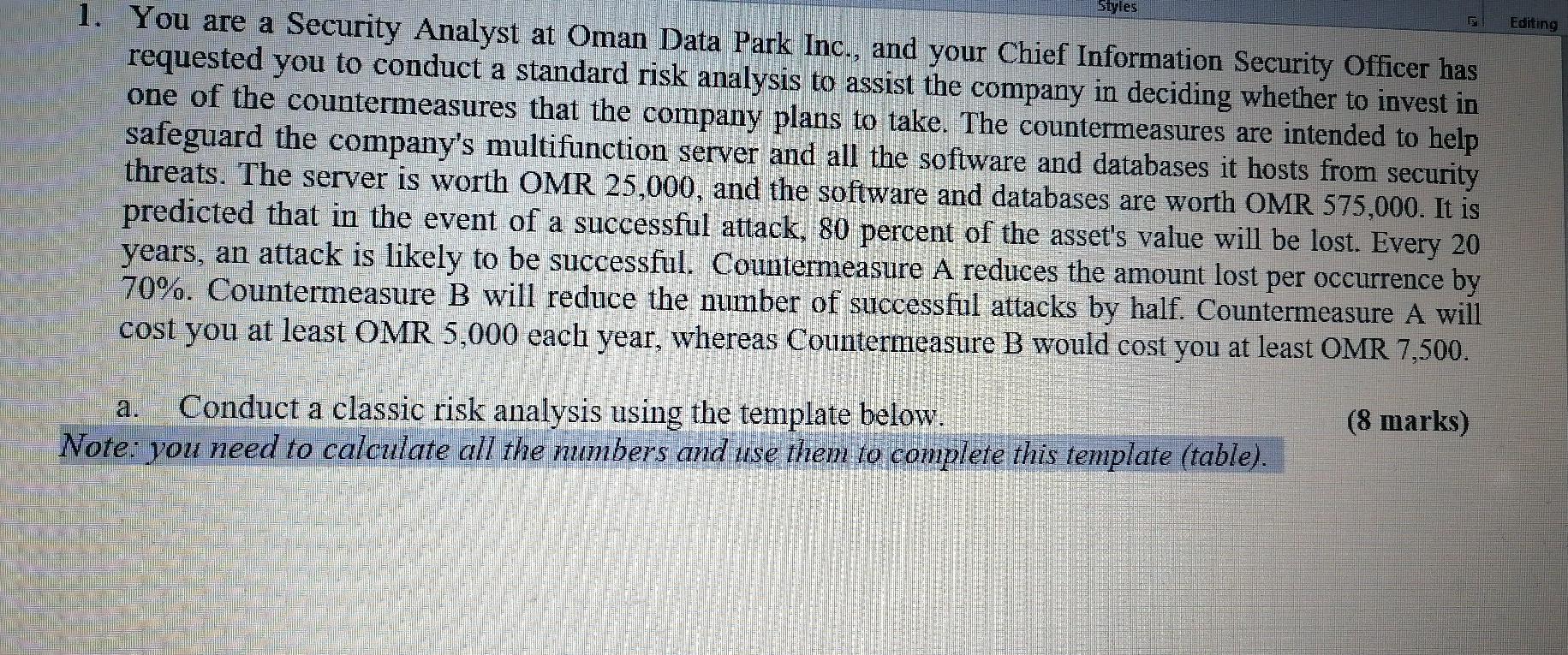

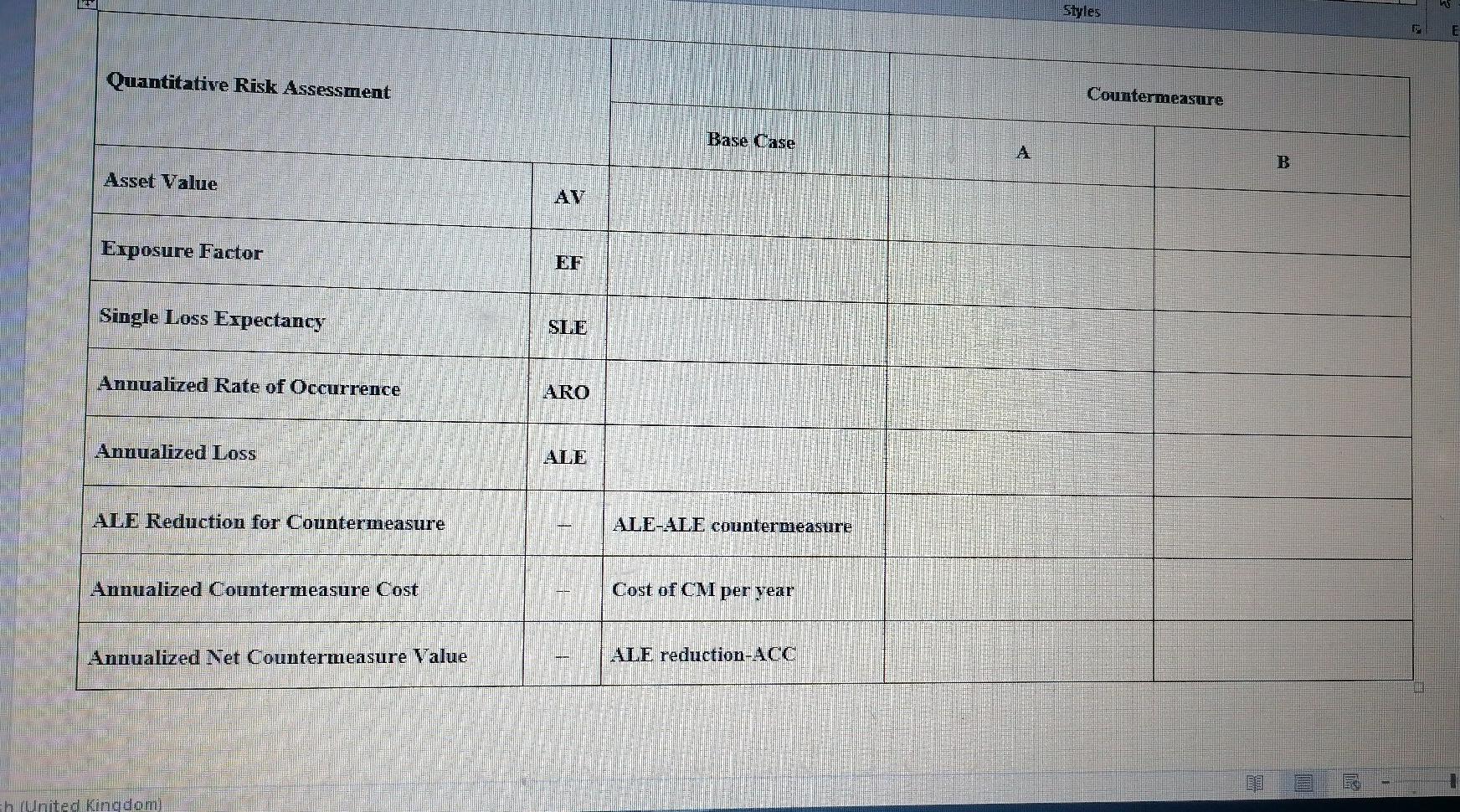

Styles Editing 1. You are a Security Analyst at Oman Data Park Inc., and your Chief Information Security Officer has requested you to conduct a standard risk analysis to assist the company in deciding whether to invest in one of the countermeasures that the company plans to take. The countermeasures are intended to help safeguard the company's multifunction server and all the software and databases it hosts from security threats. The server is worth OMR 25,000, and the software and databases are worth OMR 575,000. It is predicted that in the event of a successful attack, 80 percent of the asset's value will be lost. Every 20 years, an attack is likely to be successful. Countermeasure A reduces the amount lost per occurrence by 70%. Countermeasure B will reduce the number of successful attacks by half. Countermeasure A will cost you at least OMR 5,000 each year, whereas Countermeasure B would cost you at least OMR 7,500. Conduct a classic risk analysis using the template below. (8 marks) Note: you need to calculate all the numbers and use them to complete this template (table). Styles E Quantitative Risk Assessment Countermeasure Base Case A B Asset Value AV Exposure Factor Single Loss Espectancy SLE Annualized Rate of O urrence ARO Annualized Loss ALE ALE Reduction for Countermeasure ALE-ALE countermeasure Annualized Countermeasure Cost Cost of CM per year Annualized Net Countermeasure Value ALE reduction-ACC Eh United Kingdom) b. Which of the two countermeasures should Oman Data Park Inc. implement based on the risk analysis results? (If any). (1 mark) c. Explain your choice of countermeasure by providing supporting information from the risk analysis you conducted in response to Question 1 (1 mark) Styles Editing 1. You are a Security Analyst at Oman Data Park Inc., and your Chief Information Security Officer has requested you to conduct a standard risk analysis to assist the company in deciding whether to invest in one of the countermeasures that the company plans to take. The countermeasures are intended to help safeguard the company's multifunction server and all the software and databases it hosts from security threats. The server is worth OMR 25,000, and the software and databases are worth OMR 575,000. It is predicted that in the event of a successful attack, 80 percent of the asset's value will be lost. Every 20 years, an attack is likely to be successful. Countermeasure A reduces the amount lost per occurrence by 70%. Countermeasure B will reduce the number of successful attacks by half. Countermeasure A will cost you at least OMR 5,000 each year, whereas Countermeasure B would cost you at least OMR 7,500. Conduct a classic risk analysis using the template below. (8 marks) Note: you need to calculate all the numbers and use them to complete this template (table). Styles E Quantitative Risk Assessment Countermeasure Base Case A B Asset Value AV Exposure Factor Single Loss Espectancy SLE Annualized Rate of O urrence ARO Annualized Loss ALE ALE Reduction for Countermeasure ALE-ALE countermeasure Annualized Countermeasure Cost Cost of CM per year Annualized Net Countermeasure Value ALE reduction-ACC Eh United Kingdom) b. Which of the two countermeasures should Oman Data Park Inc. implement based on the risk analysis results? (If any). (1 mark) c. Explain your choice of countermeasure by providing supporting information from the risk analysis you conducted in response to Question 1 (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts