Question: this all the questions its completed Exercisel: Correct the accounting errors: ( 4marks) April 1, Company ABC purchases equipment for 1000 and supplies for 2000

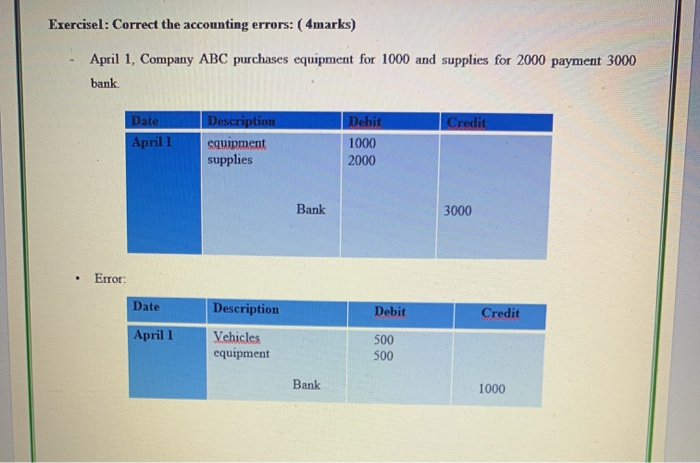

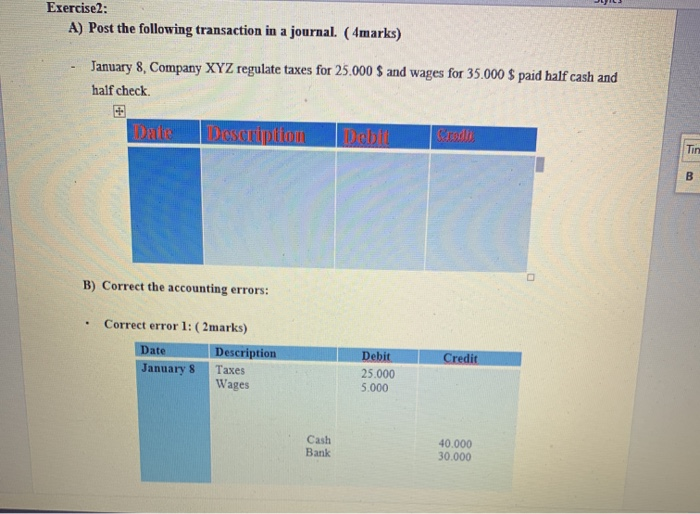

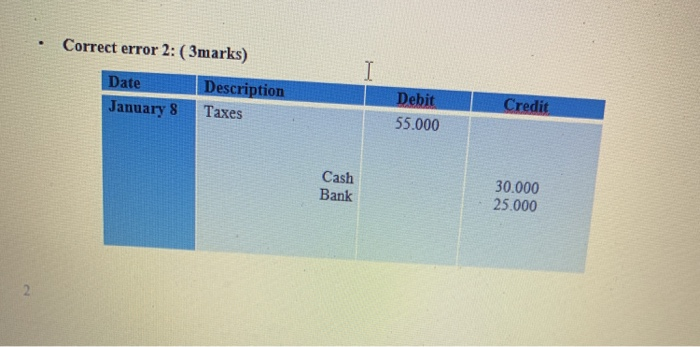

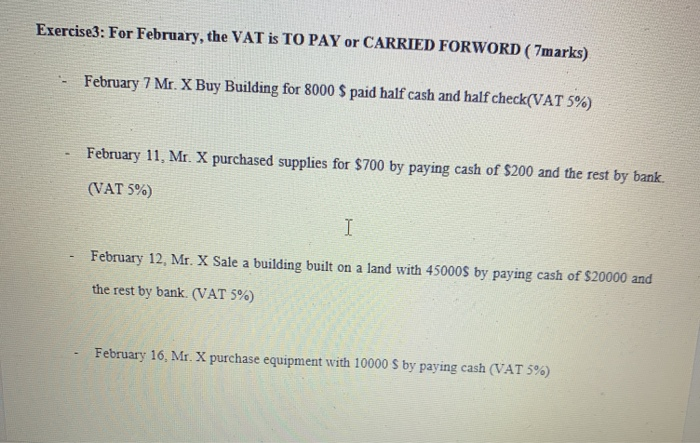

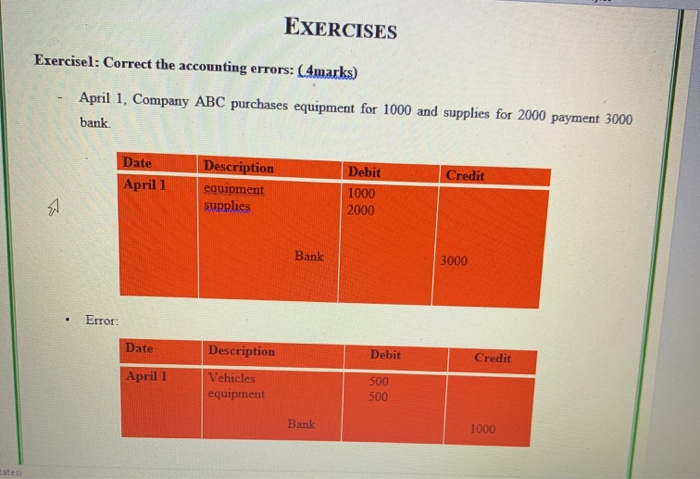

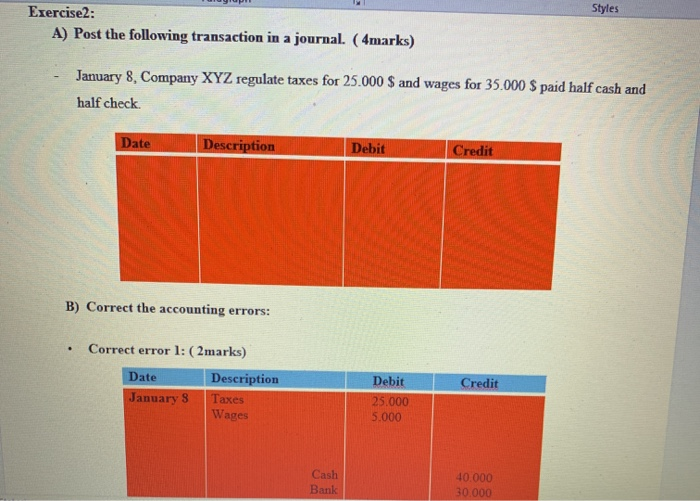

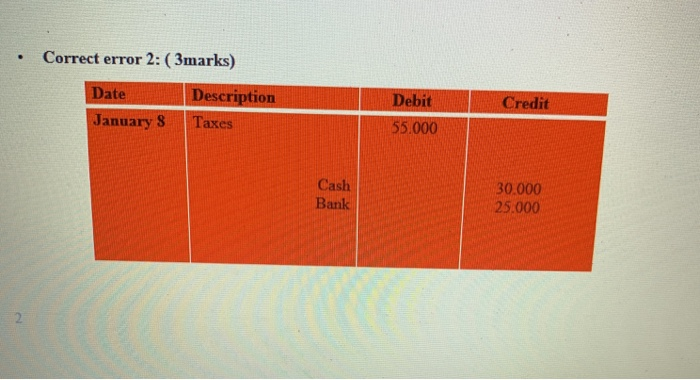

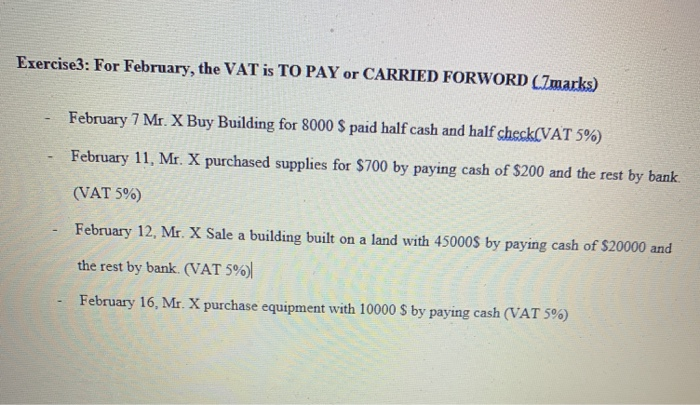

Exercisel: Correct the accounting errors: ( 4marks) April 1, Company ABC purchases equipment for 1000 and supplies for 2000 payment 3000 bank Credit April 1 Description equipment supplies Debit 1000 2000 Bank 3000 Error: Date Description Debit Credit April 1 Vehicles equipment 500 500 Bank 1000 Exercise2: A) Post the following transaction in a journal. (4marks) January 8, Company XYZ regulate taxes for 25.000 $ and wages for 35.000 $ paid half cash and half check. Dale Description B) Correct the accounting errors: Correct error 1: (2 marks) Date Description January 8 Taxes Debit 25.000 5.000 Wages Cash Bank 40.000 30.000 Correct error 2: (3marks) Date Description January 8 Taxes Credit Debit 55.000 Cash Bank 30.000 25.000 Exercise3: For February, the VAT is TO PAY or CARRIED FORWORD ( 7marks) - February 7 Mr.X Buy Building for 8000 $ paid half cash and half check(VAT 5%) February 11, Mr.X purchased supplies for $700 by paying cash of $200 and the rest by bank. (VAT 5%) February 12, Mr. X Sale a building built on a land with 45000$ by paying cash of $20000 and the rest by bank. (VAT 5%) - February 16, Mr.X purchase equipment with 10000 S by paying cash (VAT 5%) EXERCISES Exercisel: Correct the accounting errors: (4marks) April 1. Company ABC purchases equipment for 1000 and supplies for 2000 payment 3000 bank. Date Aprill Credit Description equipment supplies Debit 1000 2000 Bank 3000 Error: Date Description Debit Credit Aprill Vehicles equipment 500 500 Bank 1000 Suvies Exercise2: A) Post the following transaction in a journal. (4marks) January 8, Company XYZ regulate taxes for 25.000 $ and wages for 35.000 $ paid half cash and half check Date Description Debit Credit B) Correct the accounting errors: Correct error 1: (2marks) Date Description January 8 Taxes Wages Credit Debit 25.000 5.000 Cash 40.000 30 000 Bank Correct error 2: ( 3marks) Credi Date January 8 Description Taxes Debit 55.000 Cash Bank 30.000 25.000 Exercise3: For February, the VAT is TO PAY or CARRIED FORWORD (7marks) February 7 Mr.X Buy Building for 8000 $ paid half cash and half check VAT 5%) February 11, Mr. X purchased supplies for $700 by paying cash of $200 and the rest by bank (VAT 5%) February 12, Mr. X Sale a building built on a land with 45000s by paying cash of $20000 and the rest by bank. (VAT 5% February 16, Mr. X purchase equipment with 10000 $ by paying cash (VAT 5%) Exercisel: Correct the accounting errors: ( 4marks) April 1, Company ABC purchases equipment for 1000 and supplies for 2000 payment 3000 bank Credit April 1 Description equipment supplies Debit 1000 2000 Bank 3000 Error: Date Description Debit Credit April 1 Vehicles equipment 500 500 Bank 1000 Exercise2: A) Post the following transaction in a journal. (4marks) January 8, Company XYZ regulate taxes for 25.000 $ and wages for 35.000 $ paid half cash and half check. Dale Description B) Correct the accounting errors: Correct error 1: (2 marks) Date Description January 8 Taxes Debit 25.000 5.000 Wages Cash Bank 40.000 30.000 Correct error 2: (3marks) Date Description January 8 Taxes Credit Debit 55.000 Cash Bank 30.000 25.000 Exercise3: For February, the VAT is TO PAY or CARRIED FORWORD ( 7marks) - February 7 Mr.X Buy Building for 8000 $ paid half cash and half check(VAT 5%) February 11, Mr.X purchased supplies for $700 by paying cash of $200 and the rest by bank. (VAT 5%) February 12, Mr. X Sale a building built on a land with 45000$ by paying cash of $20000 and the rest by bank. (VAT 5%) - February 16, Mr.X purchase equipment with 10000 S by paying cash (VAT 5%) EXERCISES Exercisel: Correct the accounting errors: (4marks) April 1. Company ABC purchases equipment for 1000 and supplies for 2000 payment 3000 bank. Date Aprill Credit Description equipment supplies Debit 1000 2000 Bank 3000 Error: Date Description Debit Credit Aprill Vehicles equipment 500 500 Bank 1000 Suvies Exercise2: A) Post the following transaction in a journal. (4marks) January 8, Company XYZ regulate taxes for 25.000 $ and wages for 35.000 $ paid half cash and half check Date Description Debit Credit B) Correct the accounting errors: Correct error 1: (2marks) Date Description January 8 Taxes Wages Credit Debit 25.000 5.000 Cash 40.000 30 000 Bank Correct error 2: ( 3marks) Credi Date January 8 Description Taxes Debit 55.000 Cash Bank 30.000 25.000 Exercise3: For February, the VAT is TO PAY or CARRIED FORWORD (7marks) February 7 Mr.X Buy Building for 8000 $ paid half cash and half check VAT 5%) February 11, Mr. X purchased supplies for $700 by paying cash of $200 and the rest by bank (VAT 5%) February 12, Mr. X Sale a building built on a land with 45000s by paying cash of $20000 and the rest by bank. (VAT 5% February 16, Mr. X purchase equipment with 10000 $ by paying cash (VAT 5%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts