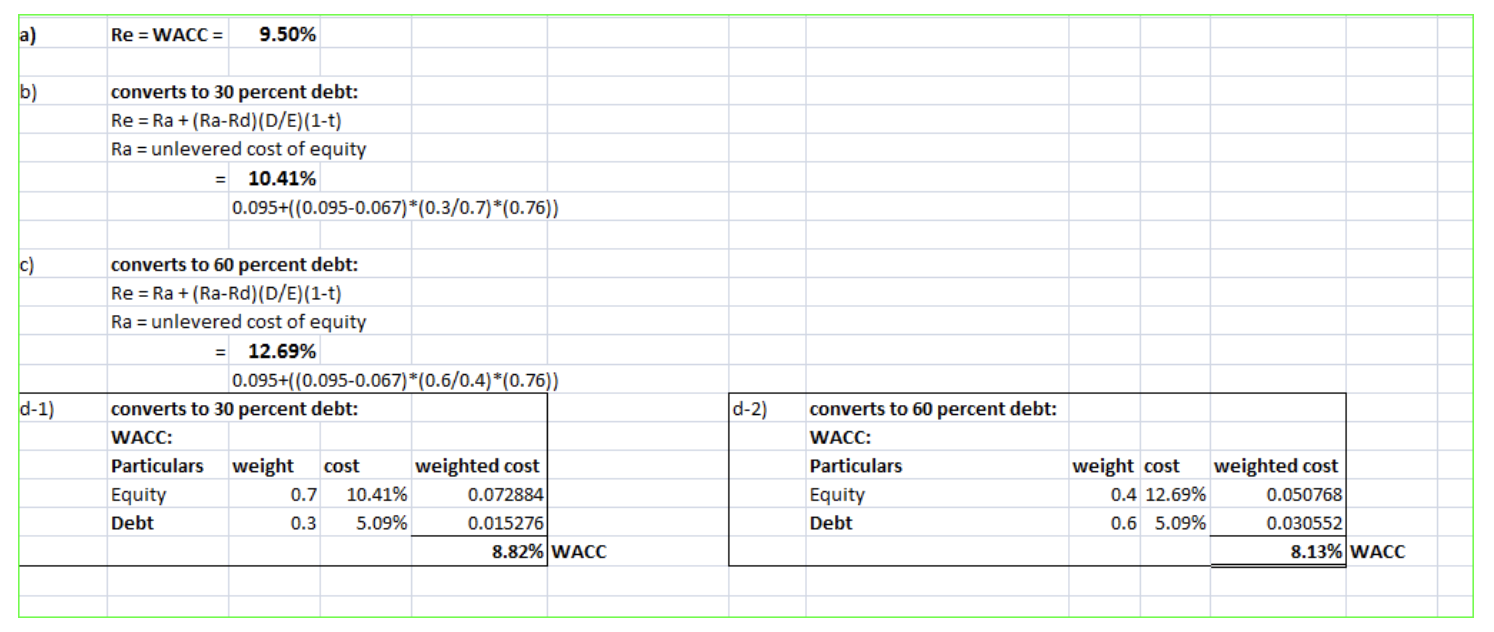

Question: This answer posted by another Chegg user makes total sense to me besides the 5.09% for the cost of Debt in d-1 and d-2. Could

This answer posted by another Chegg user makes total sense to me besides the 5.09% for the cost of Debt in d-1 and d-2. Could you please explain where the 5.09% came from. Thank you!

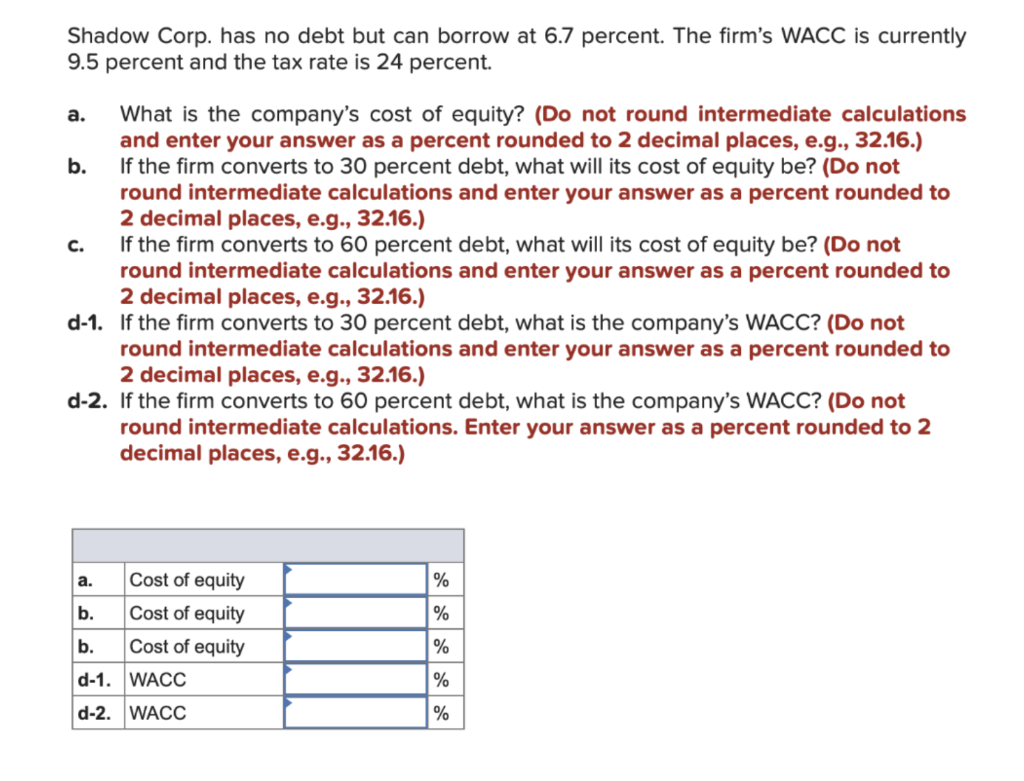

Shadow Corp. has no debt but can borrow at 6.7 percent. The firm's WACC is currently 9.5 percent and the tax rate is 24 percent. a. b. C. If the firm converts to 60 percent debt, what will its cost of equity be? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) d-1. If the firm converts to 30 percent debt, what is the company's WACC? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) d-2. If the firm converts to 60 percent debt, what is the company's WACC? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) What is the company's cost of equity? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) If the firm converts to 30 percent debt, what will its cost of equity be? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Cost of equity Cost of equity Cost of equity b. b. d-1. WACC d-2. WACC % % % % % a) b) c) d-1) Re = WACC = 9.50% converts to 30 percent debt: Re = Ra + (Ra-Rd) (D/E)(1-t) Ra= unlevered cost of equity = 10.41% 0.095+((0.095-0.067)*(0.3/0.7)*(0.76)) converts to 60 percent debt: ReRa + (Ra-Rd) (D/E)(1-t) Ra = unlevered cost of equity = 12.69% Equity Debt 0.095+((0.095-0.067)*(0.6/0.4)*(0.76)) converts to 30 percent debt: WACC: Particulars weight cost 0.7 10.41% 0.3 5.09% weighted cost 0.072884 0.015276 8.82% WACC d-2) converts to 60 percent debt: WACC: Particulars Equity Debt weight cost weighted cost 0.4 12.69% 0.6 5.09% 0.050768 0.030552 8.13% WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts