Question: This assignment comprises of three parts. Your task is; (1) to compute the monthly, the average and the standard deviations of the returns for the

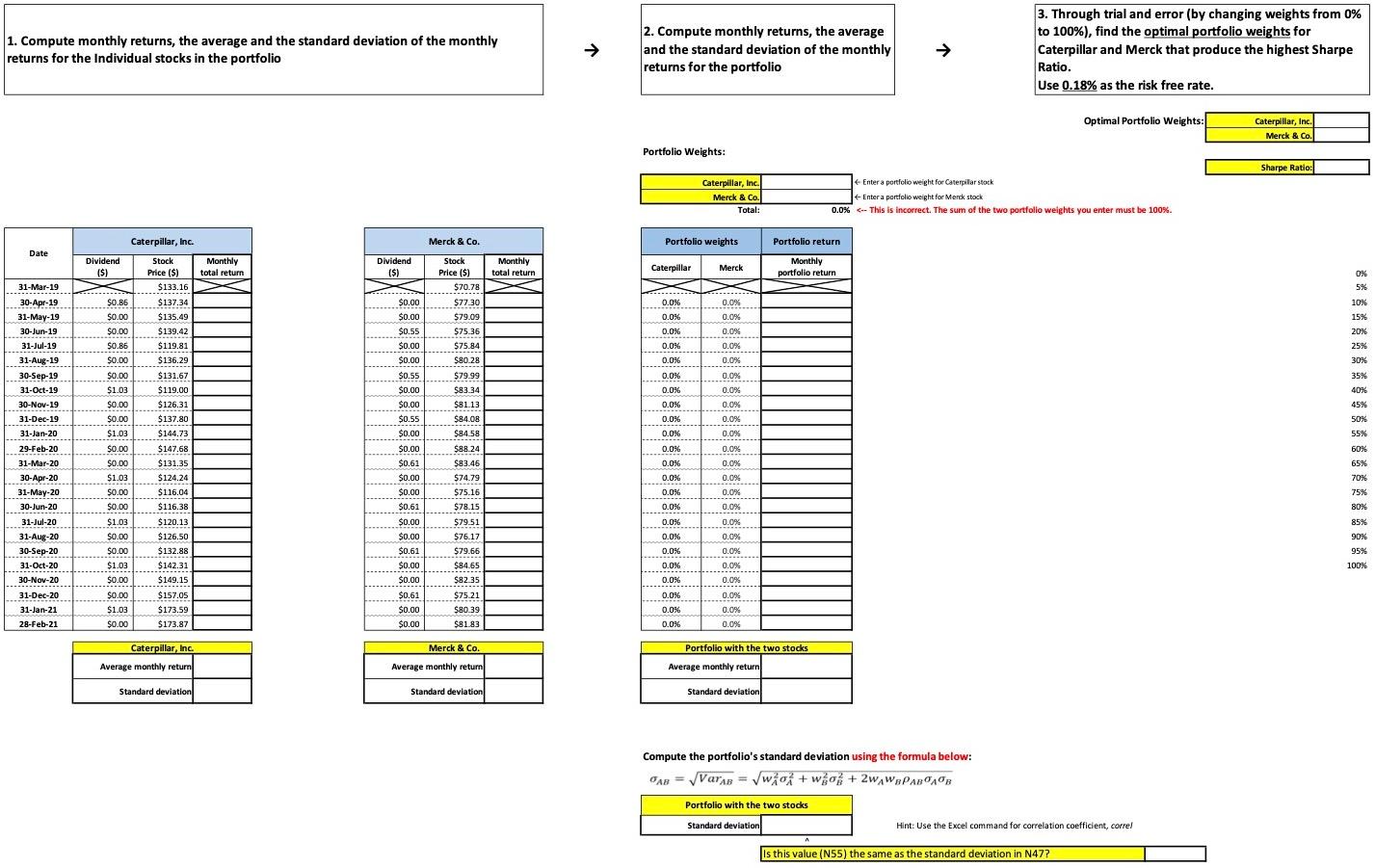

This assignment comprises of three parts. Your task is; (1) to compute the monthly, the average and the standard deviations of the returns for the two stocks (Caterpillar and Merck), (2) compute the monthly, the average and the standard deviation for the portfolio returns consisting of the two stocks, and (3), through manual trial and error, to estimate the optimal portfolio weights that produce the highest Sharpe Ratio, a measure for investment return / risk efficiency.

For a more clear image, right-click the image below and select "Open Image in New Tab."

Thank you!

1. Compute monthly returns, the average and the standard deviation of the monthly returns for the Individual stocks in the portfolio 2. Compute monthly returns, the average and the standard deviation of the monthly returns for the portfolio 3. Through trial and error (by changing weights from 0% to 100%), find the optimal portfolio weights for Caterpillar and Merck that produce the highest Sharpe Ratio. Use 0.18% as the risk free rate. Optimal Portfolio Weights: Caterpillar, Inc. Merck & Co. Portfolio Weights: Sharpe Ratio: Caterpillar, Inc. Merck & Co Total: Enter a portfolio weight for Caterpilar stock +Enter a portfolio weight for Merck stock 0.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts