Question: This assignment is an opportunity to practice the IRAC method of case analysis. First, review the IRAC method if you need a refresher. You can

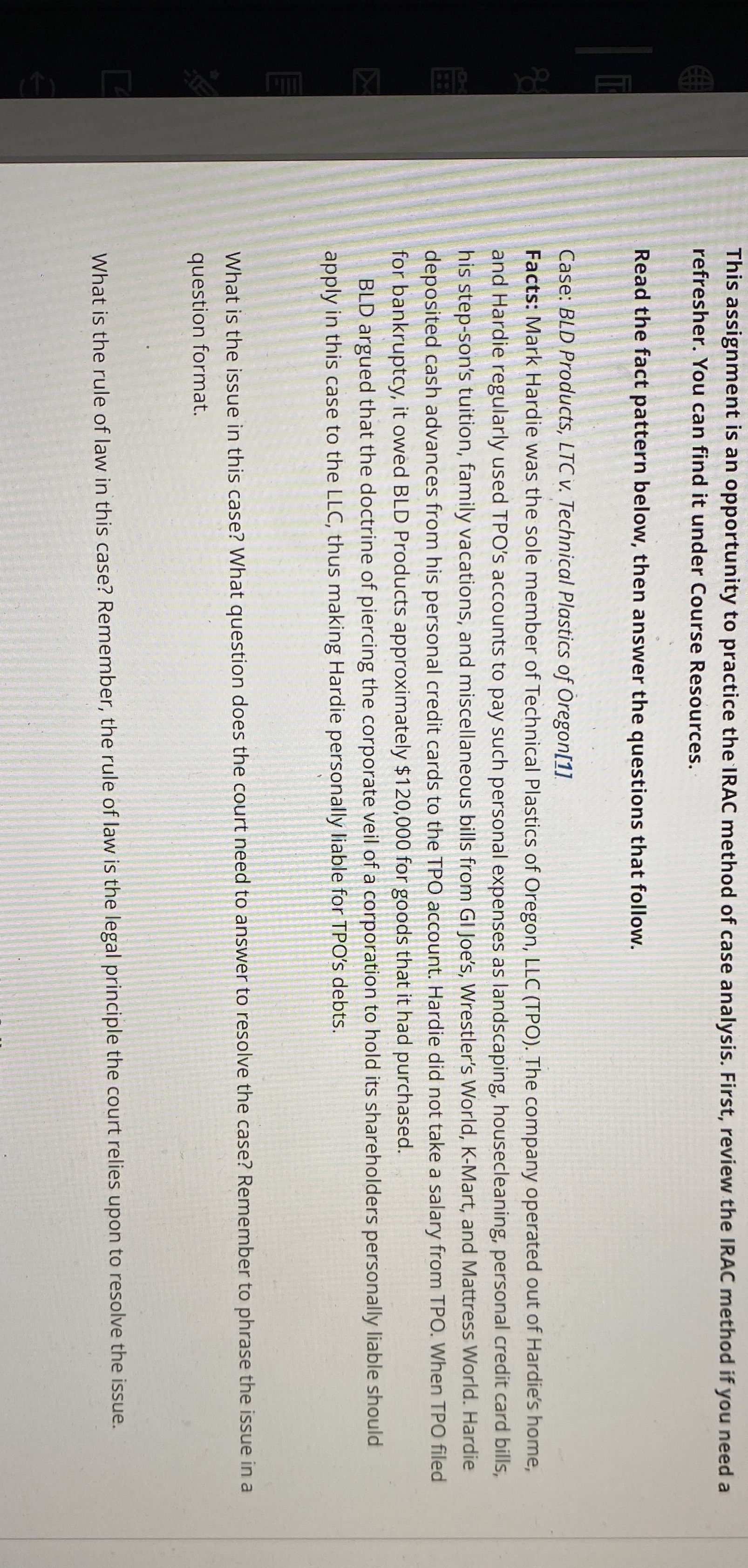

This assignment is an opportunity to practice the IRAC method of case analysis. First, review the IRAC method if you need a refresher. You can find it under Course Resources.

Read the fact pattern below, then answer the questions that follow.

Case: BLD Products, LTC v Technical Plastics of Oregon

Facts: Mark Hardie was the sole member of Technical Plastics of Oregon, LLC TPO The company operated out of Hardie's home, and Hardie regularly used TPO's accounts to pay such personal expenses as landscaping, housecleaning, personal credit card bills, his stepson's tuition, family vacations, and miscellaneous bills from GI Joe's, Wrestler's World, KMart, and Mattress World. Hardie deposited cash advances from his personal credit cards to the TPO account. Hardie did not take a salary from TPO. When TPO filed for bankruptcy, it owed BLD Products approximately $ for goods that it had purchased.

BLD argued that the doctrine of piercing the corporate veil of a corporation to hold its shareholders personally liable should apply in this case to the LLC thus making Hardie personally liable for TPO's debts.

What is the issue in this case? What question does the court need to answer to resolve the case? Remember to phrase the issue in a question format.

What is the rule of law in this case? Remember, the rule of law is the legal principle the court relies upon to resolve the issue.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock