Question: This assignment is due at the beginning of class on Wednesday 10! 10. Please show all work to receive partial credit. 1. Inverse ETFs {Exchange

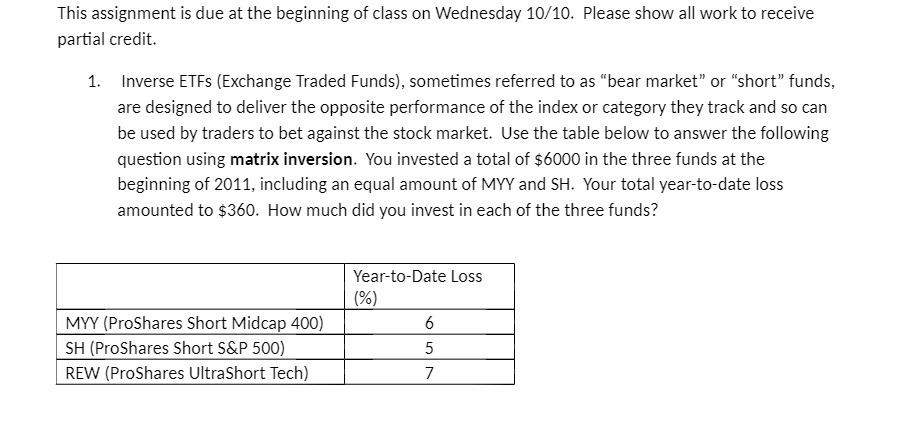

This assignment is due at the beginning of class on Wednesday 10! 10. Please show all work to receive partial credit. 1. Inverse ETFs {Exchange Traded Funds], sometimes referred to as \"bear market\" or "short\" funds, are designed to deliver the opposite performance of the index or category they track and so can be used by traders to bet against the stock market. Use the table below to answer the following question using matrix inversion. You invested a total of $6000 in the three funds at the beginning of 2011, including an equal amount of MW and 5H. Your total vearto-date loss amounted to $360. HOW much did you invest in each of the three funds? YeartoDate Loss {5%) MW [ProShares Short Mid-cap 400} SH {ProShares Short 58.? 500) REW {ProShares UltraShort Tech)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts