Question: This assignment is intended to help you learn to do the following Determine which causes of loss form applies when given a scenario. . Recommend

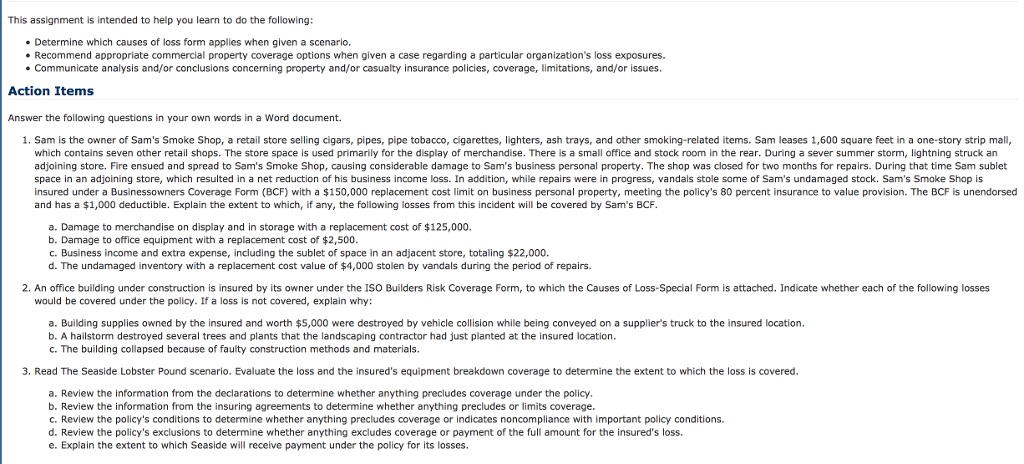

This assignment is intended to help you learn to do the following Determine which causes of loss form applies when given a scenario. . Recommend appropriate commercial property coverage options when given a case regarding a particular organization's loss exposures. . Communicate analysis and/or conclusions concerning property and/or casualty insurance policies, coverage, limitations, and/or issues. Action Items Answer the following questions in your own words in a Word document. 1. Sam is the owner of Sam's Smoke Shop, a retail store selling cigars, pipes, pipe tobacco, cigarettes, lighters, ash trays, and other smoking-related items. Sam leases 1,600 square feet in a one-story strip mall which contains seven other retail shops. The store space is used primarily for the display of merchandise. There is a small office and stock room in the rear. During a sever summer storm, lightning struck an adjoining store. Fire ensued and spread to Sam's Smoke Shop, causing considerable damage to Sam's business personal property. The shop was closed for two months for repairs. During that time Sam sublet space in an adjoining store, which resulted in a net reduction of his business income loss. In addition, while repairs were in progress, vandals stole some of Sam's undamaged stock. Sam's Smoke Shop is insured under a Businessowners Coverage Form BCF) with a $150,000 replacement cost limit on business personal property, meeting the policy's 80 percent insurance to value provision. The BCF is unendorsed and has a $1,000 deductible. Explain the extent to which, if any, the following losses from this incident will be covered by Sam's BCF a. Damage to merchandise on display and in storage with a replacement cost of $125,000. b. Damage to office equipment with a replacement cost of $2,500. C. Business income and extra expense, including the sublet of space in an adjacent store, totaling $22,000. d. The undamaged inventory with a replacement cost value of $4,000 stolen by vandals during the period of repairs 2. An office building under construction is insured by its owner under the ISO Builders Risk Coverage Form, to which the Causes of Loss-Special Form is attached. Indicate whether each of the following losses would be covered under the policy. If a loss is not covered, explain why: a. Building supplies owned by the insured and worth $5,000 were destroyed by vehicle collision while being conveyed on a supplier's truck to the insured location. b. A hailstorm destroyed several trees and plants that the landscaping contractor had just planted at the insured location. C. The building collapsed because of faulty construction methods and materials 3. Read The Seaside Lobster Pound scenario. Evauthe loss and the insured's equipment breakdown coverage to determine the extent to which the loss is covered a. Review the information from the declarations to determine whether anything precludes coverage under the policy b. Review the information from the insuring agreements to determine whether anything precludes or limits coverage c. Review the policy's conditions to determine whether anything precludes coverage or indicates noncompliance with important policy conditions. d. Review the policy's exclusions to determine whether anything excludes coverage or payment of the full amount for the insured's loss. e. Explain the extent to which Seaside will receive payment under the policy for its losses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts