Question: This assignment is the last in the sequence to include Final Project Milestones One and Two. In Milestone One , you introduced the business you

This assignment is the last in the sequence to include Final Project Milestones One and Two. InMilestone One, you introduced the business you chose. You examined its financial statements and financial health and reported its financial values. InMilestone Two, you made calculations based on the information about your company and compared the totals with those of one year ago. You then used those figures to decide whether short-term financing was needed to improve your company's financial health.

In this final stage, you will use the information you've accumulated thus far and make decisions on whether any or all of the following are appropriate directions for your company. Review the assumptions about this company located in the Final Project Financial Assumptions document.

Note: All documents and resources that are needed to complete this assignment are linked in the What to Submit and Supporting Materials sections.

Scenario

The CFO of Chipotle Mexican Grill has asked for your support in preparing a report for the business's board of directors. Many of the board members are new, and some of them have little background in finance. With this in mind, you will need to generate a report that all board members can easily understand.

Directions

Specifically, you must address the following:

- Financial Analysis:In prior assignments, you calculated some of the financial formulas using quarterly financial statements from your chosen business and the Final Project Financial Formulas worksheet. For the financial analysis, edit prior work based on feedback and include it in this final project.

- Financial Calculations:Accurately calculate financial formulas to figure out the business's current financial health. You must calculate the following:

- Working capital

- Current ratio

- Debt ratio

- Earnings per share

- Price and earnings ratio

- Total asset turnover ratio

- Financial leverage

- Net profit margin

- Return on assets

- Return on equity

- Working Capital Management:Explain the impact of working capital management on a typical business's operations. Provide examples to support your claims.

- Why is it important for a business in general to carefully manage its working capital?

- Financing:Explain the options available for a company in general to finance its operations and expansion.

- Short-Term Financing:Explain how potential short-term financing sources could helpany businessraise funds for improving its financial health.

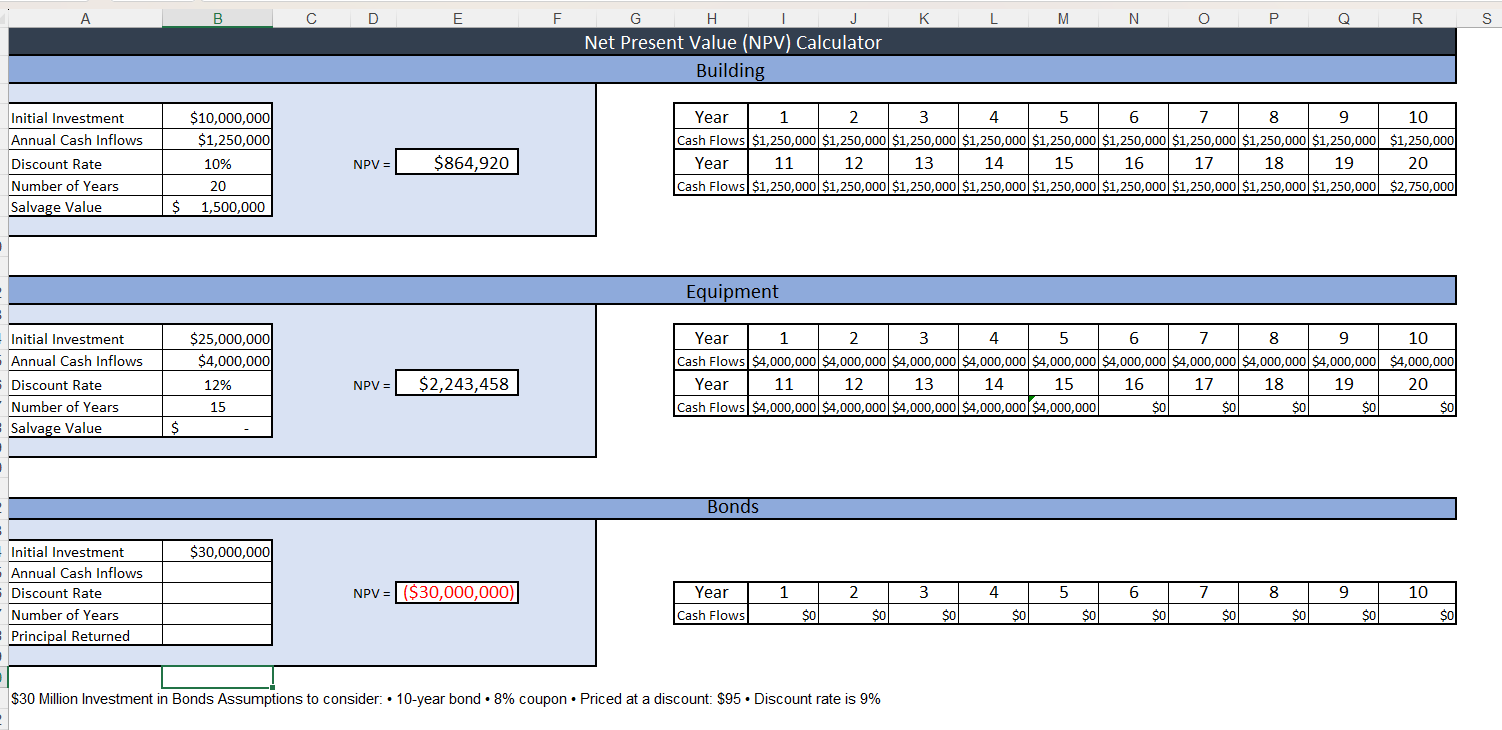

- Bond Investment:Discuss the risks and benefits of any business investing in a corporate bond. Include the necessary ethical factors, appropriate calculations, and examples to support your analysis.

- Capital Equipment:Discuss the risks and benefits of any business investing in capital equipment. Include the necessary ethical factors, appropriate calculations, and examples to support your analysis.

- Building:Discuss the risks and benefits of any business investing in a building, including leasing substantive physical assets like buildings. Include the necessary ethical factors, appropriate calculations, and examples to support your analysis.

- Financial Calculations:Accurately calculate financial formulas to figure out the business's current financial health. You must calculate the following:

- Financial Evaluation:In this step, you will use the knowledge you've accumulated thus far and make decisions on whether any or all of the following are appropriate directions forChipotle Mexican Grill. Assume that the situations located in the Final Project Financial Assumptions document are true of your chosen company. For each of the options below, include the necessary ethical factors, appropriate calculations, and examples from previous milestones to support your analysis. Based on your company's financial health, you should consider:

- Bond Investment:Determine if the bond investment is a good financing option for your chosen business's financial health. Use your financial analysis and other financial information to support your claims.

- Capital Equipment:Determine if the capital equipment investment is a good financing option for your chosen business's financial health. Use your financial analysis and other financial information to support your claims.

- Building:Determine if the building investment is a good financing option for your chosen business's financial health. Use your financial analysis and other financial information to support your claims.

- Future Financial Considerations:Describe your chosen business's likely future financial performance. Base your description on the business's current financial well-being and risk levels. This time,do notconsider the assumptions in the Final Project Financial Assumptions document. Use your chosen company's most current financial information to support your claims.

Milestones

Milestone One: InModule Two, you will submit a short paper that introduces your chosen company and summarizes the results of the company's latest balance statement, income statement, and cash flow statement.This milestone will be graded with the Final Project Milestone One Rubric.

Milestone Two: InModule Five, you will submit a short paper that compares your chosen company's latest status with the values of one year ago. You will use this information to decide whether short-term financing can help improve your company's financial health.This milestone will be graded with the Final Project Milestone Two Rubric.

Final Submission: InModule Seven, you will submit a short paper that describes whether your chosen company should make specific investments based on its financial health. It should be a complete, polished artifact containing all of the critical elements of the final product. It should reflect the incorporation of feedback gained throughout the course. This submission will be graded with theFinal Project Rubric.

This is the first two parts in order

Business Selection

Chipotle Mexican Grill is a fast-casual restaurant known for its focus on offering top-notch, ethically sourced Mexican-inspired dishes. Its strong commitment to providing "Food with Integrity" means that all menu items, such as burritos, bowls, tacos, and salads, are made using high-quality ingredients sourced in a sustainable manner whenever possible. Established in 1993 by Steve Ells Chipotle, it is led by Brian Niccol, who holds the positions of Chairman of the Board of Directors and Chief Executive Officer.

Financial Statements

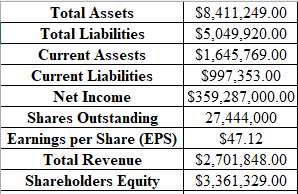

By using Mergent Online, I found the financial statements for Chipotle Mexican Grill, and as of March 31, 2024, Chipotle Mexican Grill's financial position appears strong. The company's total assets of $8.41 million outweigh its total liabilities of $5.05 million, indicating a favorable net equity position. However, its current ratio of 1.65 (current assets of $1.65 million divided by current liabilities of $997,353 suggests it has ample liquidity to meet short-term obligations. Chipotle's net income of $359 million translates to an earnings per share (EPS) of $47.12, a key investor metric. The company generated substantial total revenue of $2.7 million, but its shareholders' equity of $3.36 million reflects its value to owners. Chipotle's financial statements indicate a financially healthy company with strong asset and equity positions, solid profitability, and ample liquidity. As of the reporting date, there were 27,444,000 shares outstanding.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts